Mark Lurie

Mark Lurie, CEO & co-founThis law sets out a global framework for the fight against money laundering and the financing of terrorism – Anti-Money Laundering and Anti-Terrorist Financing – based on KYC.r of Shipyard Software, a provider of crypto trading software.

Secure your seatback. Don't expect to scan new crypto regulations anytime soon.

As much as Washington, D.C., bigwigs might want to put crypto in a box, regulators would have to first get their priorities straight. The primary regulatory approach of the federal organizations involved is the establishment of rules, or how organizations such as the Securities and Exchange Commission, examine and, finally, approve and set legal limits.

The main regulatory approach of the federal organizations involved is to establish rules, or the process whereby organizations such as the United States Securities and Exchange Commission (SEC) are formed, examine and, finally, approve and set legal limits. But this would probably be unsuccessful with cryptography for two reasons.

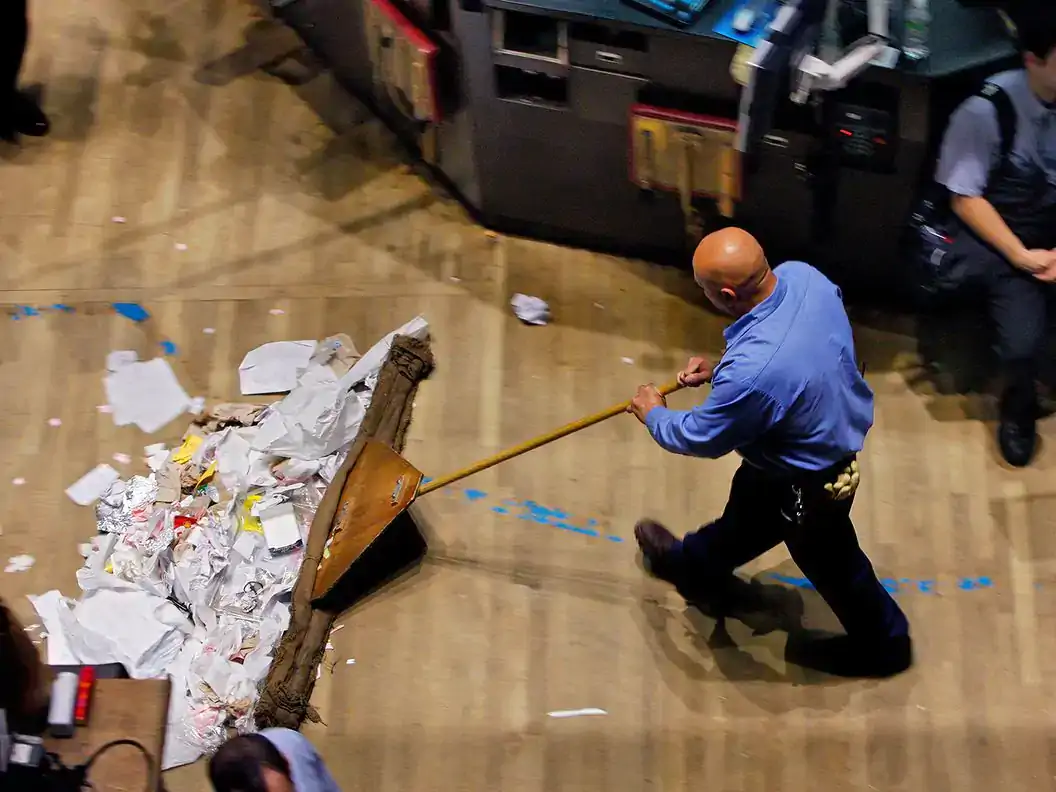

Look in the background

First, the statutory process – which includes the writing of the rule, the publication of the rule, and the consideration of public input before a judicial review – takes years. Because of the speed at which cryptography travels, it is likely that, when a new set of rules comes into force, the industry will have evolved or adapted its products to avoid it.

Second, regulatory bodies must operate under the Bank Secrecy Act (CBA).

DeBut a thorough knowledge of the customer within decentralized finance (challenge) is not only useless, but everything is impossible. Sure, these protocols oversee and approve users’ financial transactions, but DeFi’s non-custodial nature makes it all but impossible to implement effective and responsible KYC policies. Fi platforms do not in fact hold user funds, making it unclear to what extent KYC information is relevant.

Regulators would soon end up playing whack-a-mole with DeFi – a quixotic exercise that would echo efforts to end file-sharing by suing college students for downloading music. The non-custodial nature of freedom of challenge makes it practically impossible to implement effective and accountable KYC policies.

For example, if the SEC closed Uniswap, a popular decentralised trading system, 1,000 developers worldwide would simply roll out pitchforks without blinking. See also: How FinCEN has developed into a honey pot for sensitive personal data – an exercise in fantasy that would echo efforts to end file sharing by prosecuting students for downloading music. The most likely outcome would be for the regulatory agencies to have eggs on their faces.

Another option is enforcement regulation, with legislation so broad that it could apply to almost any transaction, but at the end of the day, it's pretty selective.

Role of regulation

Enacted after the Sept. 11, 2001, attacks, the BSA is a compilation of several acts, including the Patriot Act. This path has the potential to further disorient and frustrate many honest crypto actors.

This seems to be the only practical route for regulators.

Financial institutions filed more than 3 million SARs in 2022 alone. Role of the regulationAfter the attacks of September 11, 2001, the BSA is a compilation of several pieces of legislation, including the Patriot Act. Describing a thorough AML/CTF framework, BSA basically requires all financial institutions to have rigorous KYC policies and to oversee all transactions, including increased due diligence as transactions become more significant and suspicious. Whether the risk is considered material, Banks and financial institutions must submit a Suspicious Activity Report (SAR) to the Financial Crimes Enforcement Network (FinCEN) at the Treasury Department, examining reports for illicit activities. Financial institutions filed over 3 million tax returns just in 2022.

That's a lot of search and rescue. However, the application of the BSA is delegated to a number of organizations. The SEC applies it to stock exchanges, for example, while the OCC applies it to banks.

FinCen applies it to all players that are not explicitly assigned to another federal regulator, like fund issuers. The fundamental problem with BSA is that when it was written, a lot of money could only come through intermediaries. In addition, transaction databases were compartmentalised within each intermediary, which made them easy to monitor.

Within this framework, BSA makes sense and works. But blockchain and challenge have changed the game, allowing the lawful exchange of large amounts of money without intermediary.

Such transactions are also without authorization, that is to say they do not require any administrative supervision and are largely anonymous. This contradicts the BSA's core assumptions, making it largely unfeasible. However, the BSA client knowledge framework is so rooted in the compliance culture of U.S. regulators that it has become good news.

Exposing the wisdom received about the client's knowledge is blasphemous, like siding with crooks and crooks. But in the real world, culpability to the contrary has never been an effective regulatory tool.

Knowledge of the client is not an end in itself, but a means of achieving an end.

The prevention of money laundering and terrorist financing does not necessarily require a general brush-up that undermines new business models and cascades of harmless user activity. The reality is that crypto comes with its own instrument of regulation: the blockchain.

Rather than compartmentalizing transaction databases among multiple financial watchdogs, the blockchain LEDGER provides a single consolidated database for all relevant transactions. Be aware of your deal.

Rather than Know Your Client, regulators should move to Know Your Client or Know Your Transaction. Taking into account the open-source nature of the blockchain, non-private design for most challenging platforms, and the ability of users to easily display more than one address, the only way to regulate space efficiently is through the individual transaction.

KYT would set up blockchain review mechanisms to track money and ban unauthorized transactions.

From a technology point of view, requiring platforms to verify the source of funds before approving transactions would be relatively simple with existing tools and technology.

Every time we discover that the portfolios and the funds were soiled by a bad actor, as an approved address or a portfolio of known hackers, The protocol could just dismiss the deal. See also:Protection of Digital Privacy Rights: Congress urges that human rights be upheld.

BlocksInform

BlocksInform