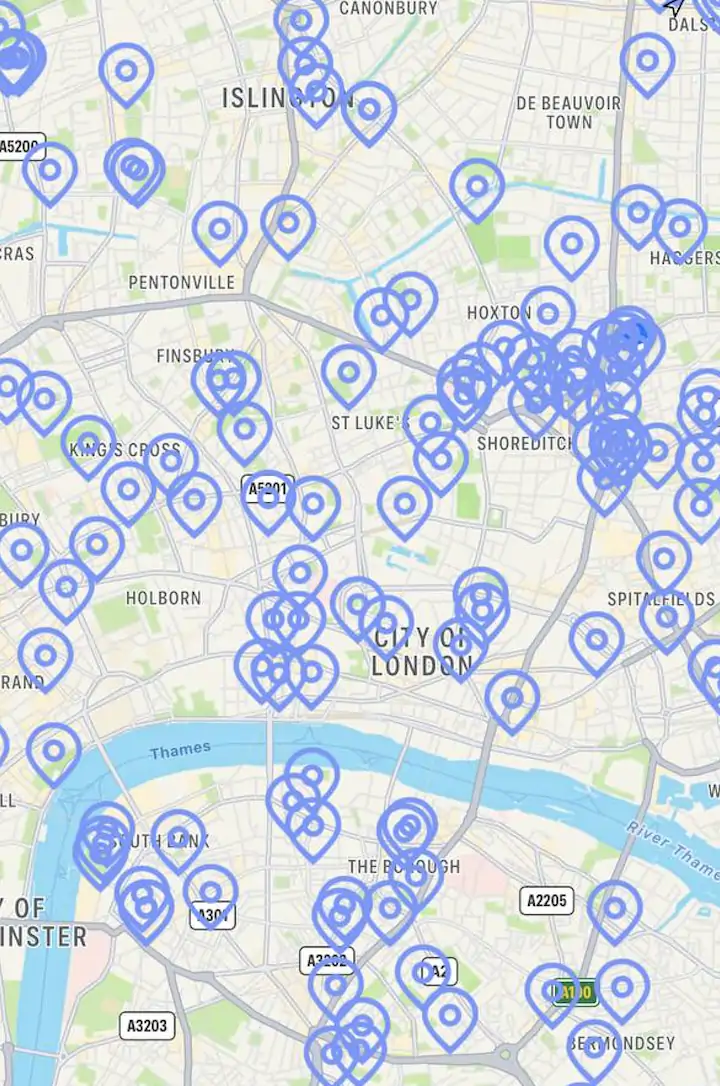

A partnership between Poundtoken and BitcoinPoint will make the country's first 100% backed GBP stablecoin ($GBPT) accessible to retail consumers via a network of 18,000 ATMs across the United Kingdom. The movement marks another step towards the United Kingdom becoming a "crypto hub" and is consistent with government pressure to use stablecoins for wholesale regulations.

Bitcoin Point is a Lightning Network-enabled Bitcoin (), and cryptocurrency exchange, licensed and registered in the U.K. Poundtoken is the sole issuer of the GBPT ($GBPT) stablecoin. Poundtoken claims that its gbpt stability is fully supported in GBP at all times, with monthly certifications provided by the kpmg auditor.

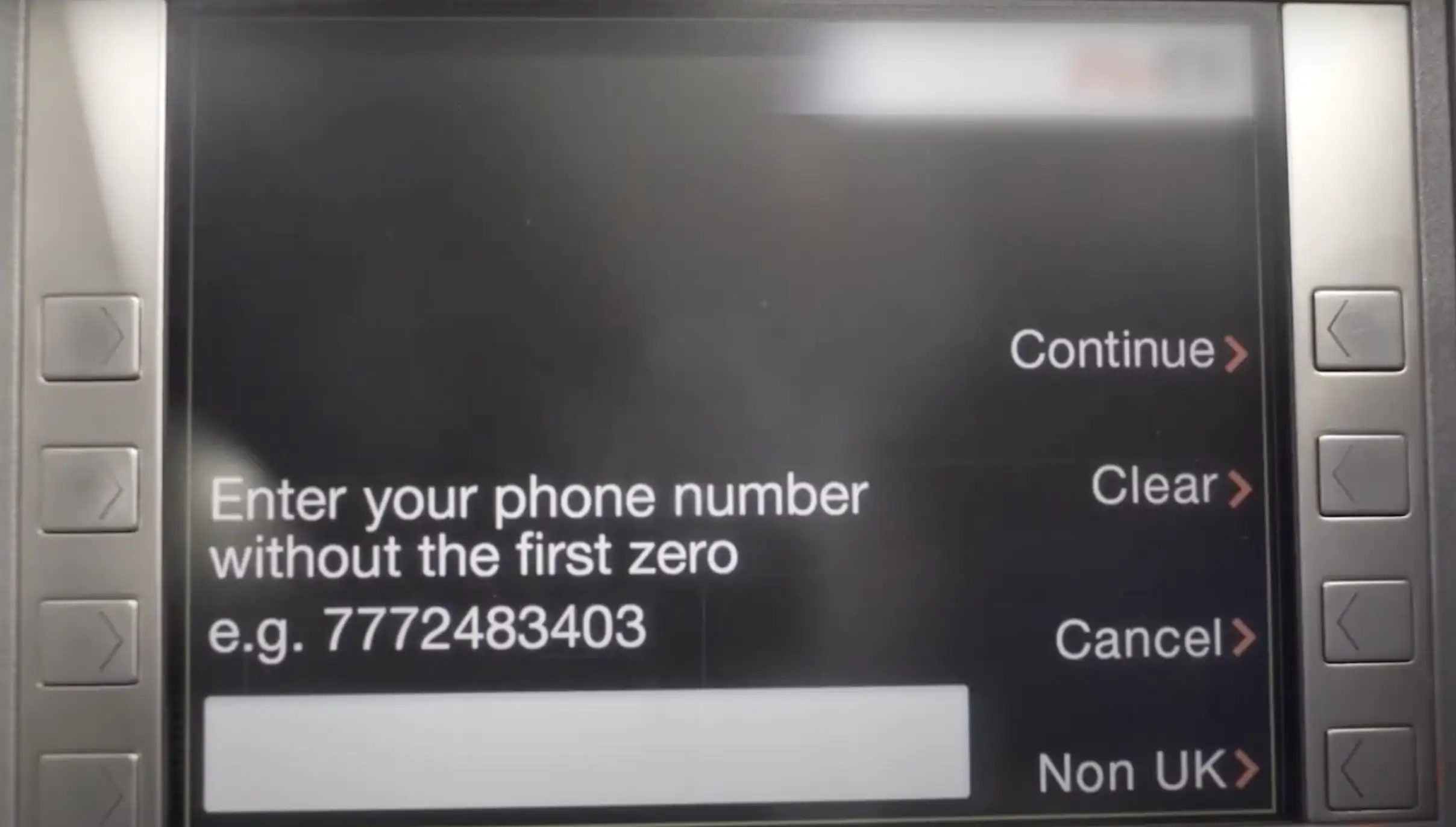

Tokens including bitcoin, ether () and can already be exchanged for money at ATMs throughout the UK. However, gbpt registration on the bitcoinpoint platform means users can now access both retail and wholesale payments using gbp stablecoin, and use a currency familiar to Englishmen like a crypto ramp.

Benoit Marzouk, CEO at BitcoinPoint, told Cointelegraph that the move could democratize “access to crypto for non-tech savvy people in the U.K.” He described the following:

It is also entirely consistent with the government's idea of integrating stabilizers into the United Kingdom economy."

The United Kingdom is the second most important European economy. Its government is recruiting for senior roles in Central Bank Digital Currencies (CBDCs) as well as a digital pound rollout, while Prime Minister Rish Sunak has been vocal in his support for Digital Settlement Assets, the new and preferred terminology for crypto.

Crobie told Cointelegraph that Poundtoken arrived following the "increase in USD stablecoins," such as Tether () and Circle (), However, there is no alternative in the United Kingdom.

“GBPT's real goal is to bring blockchain and cryptography to the UK and facilitate its adoption in the UK [...] It is time for the UK to start realizing its potential to lead the world in cryptography."

The partnership is working to standardize the use of health care facilities to carry out day-to-day financial practices. Marzouk explained, "we are bitcoiners to the point of Bitcoin and we really see value in stablecoin projects - it's really logical.”

Stablecoin use has proliferated around the world, from inflation-ridden Argentina to European financial hub Switzerland. However, the scars of the Terra (LUNA) algorithmic stablecoin crash are still fresh for the crypto industry, forcing some jurisdictions, such as Hong Kong, to outlaw use entirely.

Scoring systems from traditional finance risk assessors such as Moody’s may give credibility to the burgeoning stablecoin ecosystem while efforts from Bitcoin-advocate groups such as the Bitcoin Policy Institute may pave the way towards a crypto and stablecoin-based future.

Related: United Kingdom banks are a threat to crypto, and that's bad news for everyone

Within the United Kingdom, Marzouk said Cointelegraph that cashing through an offering ATM using Bitcoin Point continues to be weak, less than five percent, and there is not likely to be a dramatic increase in the number of users who use GBCF to hold physical money. However, he is 'completely confident about onramp [in crypto].”

"We see Bitcoiners pulling out of banking and becoming Bitcoin only; you could also have people who don't want a bank account, so they could use the GBCF. This means that when they need money, they can offer money to the GBCF."

The movement could make it possible for more and more crypto enthusiasts to take part without a bank. Integration is now online through the UK's 18,000 automatic teller machines.

BlocksInform

BlocksInform