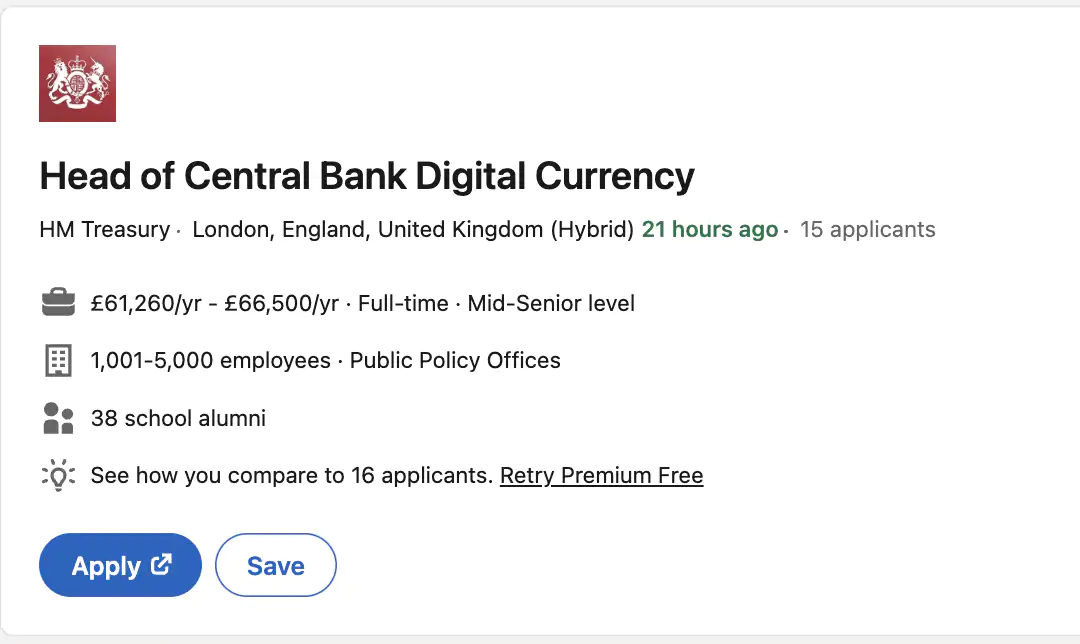

The U.K. government’s economic and finance ministry, His Majesty’s Treasury, is recruiting for a head of central bank digital currency (CBDC) to lead the development of a digital pound. The work is described as "significant, complex and transversal" and "will require extensive engagement within and beyond DM Treasury."

According to the LinkedIn post, the Treasury and the Bank of England are working together through the CBDC Taskforce to explore the case for a digital pound. The role of the CBDC leader could bring the Government of the United Kingdom closer to its objective of deploying a CBDC.

Danny Scott, CEO of the British corporation Bitcoin () CoinCorner, told Cointelegraph that a CBDC might miss "the real use and purpose of the world, which is what we often see.”

"For those who have been in the industry for a couple of cycles, we've seen hypes come and go - altcoins, blockchain, distributed book, ICO, challenge, NTF. You see big business coming and jumping on the latest hype to avoid looking how late they are. It falls under R&D and exploratory for most, which is perfectly understandable.”

Scott, which has worked and built in the Bitcoin space for more than ten years, explained that once in a while, the public could misinterpret and perhaps confuse crypto research and development projects with practical and useful solutions.

'A CBDC [e-book] is just around the corner. There are many countries around the world that are looking at this issue and trying to understand the advantages it has over the present system. It is only right that it should happen."

Indeed, the move toward a digital pound matches the trend among central banks worldwide to explore the potential of CBDCs. In Europe, the European Central Bank (ECB) has been actively studying the future of a digital euro, and several countries, including Sweden and Denmark, are also exploring their own digital currencies.

CBDCs claim to offer a number of benefits, including improved financial inclusion, reduced costs for businesses and consumers, and increased security and efficiency in the payment system.

However, El Salvador banked as much as 70% of its unbanked population with the introduction of Bitcoin as legal tender, while countries such as Nigeria, Ghana and Kenya can now receive money from around the world to a mobile phone or Bitcoin exchange account.

In addition, the introduction of a new digital currency brings with it potential risks. James Dewar, UK partner Bitcoin merchant solution Bridge2Bitcoin and manager of Laser Eyes Cards, said Cointelegraph that "the introduction of a CBDC itself would present various challenges and risks that Bitcoin," which the CBDC demands "third-party trust, central banks and states, not to take advantage of the offer of money.”

This risk applies to the macroeconomic level as it does today. This represents a huge risk for freedom and property rights in our societies.”

This represents an enormous risk to freedom and property rights in our societies." Tony Yates, a former senior adviser to the Bank of England, has spoken out against CBDCs. Tony Yates, a former chief adviser to the Bank of England, denounced CBDCs.

Echoing Dewar's thoughts, he challenged the motives behind the global deployment of CBDCs as "suspects". “It is reasonable that government explore the idea properly. "It makes sense for the government to explore the idea in an appropriate manner.

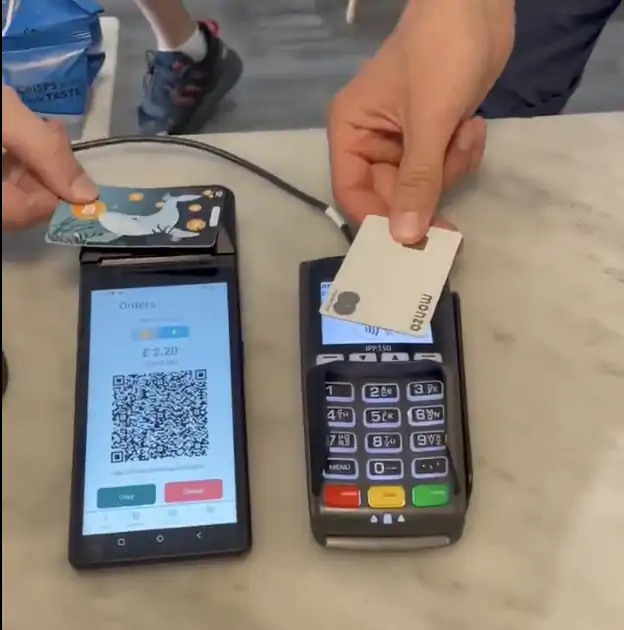

Overall, we are concerned that political pressure may be exerted on the process which largely ignores or minimizes the risks to a CBDC's society." The U.K. is increasingly a digital cash-based society: Less than 15% of payments are made with physical cash according to the Bank of England, and as many as 23 million people — about one-third of the U.K. population — did not use cash at all in 2021.

Scott asks of the treasury, “Don’t we already have a digital pound?”

“From an end-consumer perspective, the pound is mostly digital these days regardless of the mechanism used. Scott asks the Treasury: "Don't we have an eBook already?" From the point of view of the final consumer, books are mostly digital nowadays, no matter what mechanism is used.

Therefore, once they have completed their exploratory phase, I would be interested in seeing a list of the benefits and new features that a CBDC will bring to the public."

Related: Amid crypto winter, central banks rethink in-house digital currencies

Related: In the middle of the crypto winter, central banks are redesigning internal digital currencies. Dewar said there might be hope for bitcoin and the United Kingdom government: The role description indicates that the emergence of private sector money, such as bitcoin, provides interesting opportunities for businesses and consumers in the United Kingdom, and we would totally support that in Bridge2Bitcoin."

BlocksInform

BlocksInform