Bitcoin saw a pick-up from around $23,900 yesterday. This is what Santiment claims to be the possible reason for this decrease.

Bitcoin sees the biggest profit-loss ratio of transaction in 2 years.

As per data from the on-chain analytics firm Santiment, yesterday was the largest profit-taking day for BTC since February 2021. The relevant indicator here is the “ratio of on-chain transaction volume in profit to loss,” which, as its name already implies, measures the ratio between the daily volume being involved in profit-taking transactions and that involved in loss-taking ones.

The indicator works by examining the chain history of each item in the outstanding supply to see what price it was moved to for the last time. If that previous price for any coin was lower than the present value of Bitcoin, then that coin is considered to have a profit. Now, if the piece is sold when in that condition, its sale transaction would contribute to the volume of profit.

However, the measure would account for the volume under the type of loss if the part is sold when the BTC price is lower than its last transfer value.

When the ratio between these two volumes exceeds 1, this means that there are more profit taking transactions on the network at this time. On the other hand, values below the limit mean that the taking of losses is currently dominant.

Now, here is a chart that shows the trend of this Bitcoin report in recent months:

The value of the metric seems to have been quite high in recent days | Source: Santiment on Twitter

As shown in the above graph, the ratio between profit and loss transactions for Bitcoin was at a very high level during the past day. In that peak, there were over 2.4 times more profit-making transfers occurring on the blockchain compared with the loss of those. This level of profit is the highest seen since February 2021, two years ago or so.

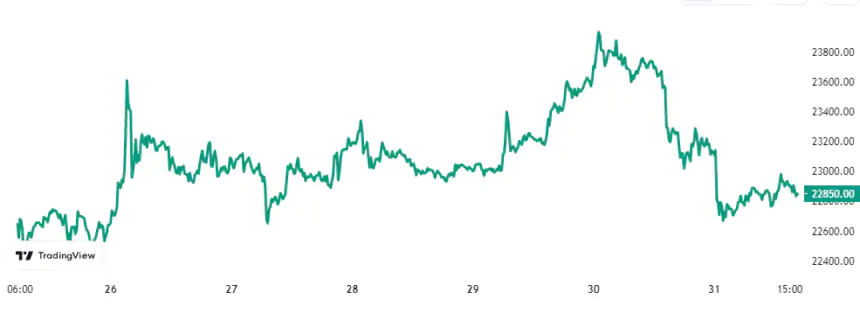

It is interesting that the last increase coincided with the BTC, which peaked yesterday at $23,900. Since that time, however, the Btc has decreased significantly and is now below the $23,000 level. This would suggest that it might have been these profit-taking transactions that have led to the latest pullback in the price of the cryptocurrency.

Today, following the decrease in the BTC value, the value of the indicator has also decreased to less than 1, suggesting that the take-over has stopped and that the transfer of losses is taking over. It could be bullish for the coin, however, as Santiment explains, "If loss deals are accumulating now, prices are more likely to rebound back."

As of writing, Bitcoin trades around $22,800, down by 1% in the past week.

Looks like the value of the asset has taken a hit during the past day or so | Source: BTCUSD on TradingView

BlocksInform

BlocksInform