Data on the chain shows the open interest of Bitcoin has risen sharply recently, a sign that the price of crypto can move towards more volatility.

Bitcoin Open Interest has made an enormous jump of 8.3% during the past day.

As pointed out by an analyst in a CryptoQuant post, this increase in open interest is the largest observed during the past three months. The “open interest” is an indicator that measures the total amount of Bitcoin futures contracts that are currently open on derivative exchanges. Short and long contracts are taken into account.

When the value of this measure increases, it means that users are opening up new futures positions immediately. As leverage usually increases when investors open new contracts, this kind of trend can result in increased volatility in the price of cryptography.

In contrast, the decline in indicator values implies that investors are winding down their positions. Particularly strong declines suggest that massive sell-offs have just occurred on the market.

Naturally, when open interest is reduced to sufficiently low values, the price tends to become more stable because there is no longer a lot of leverage present.

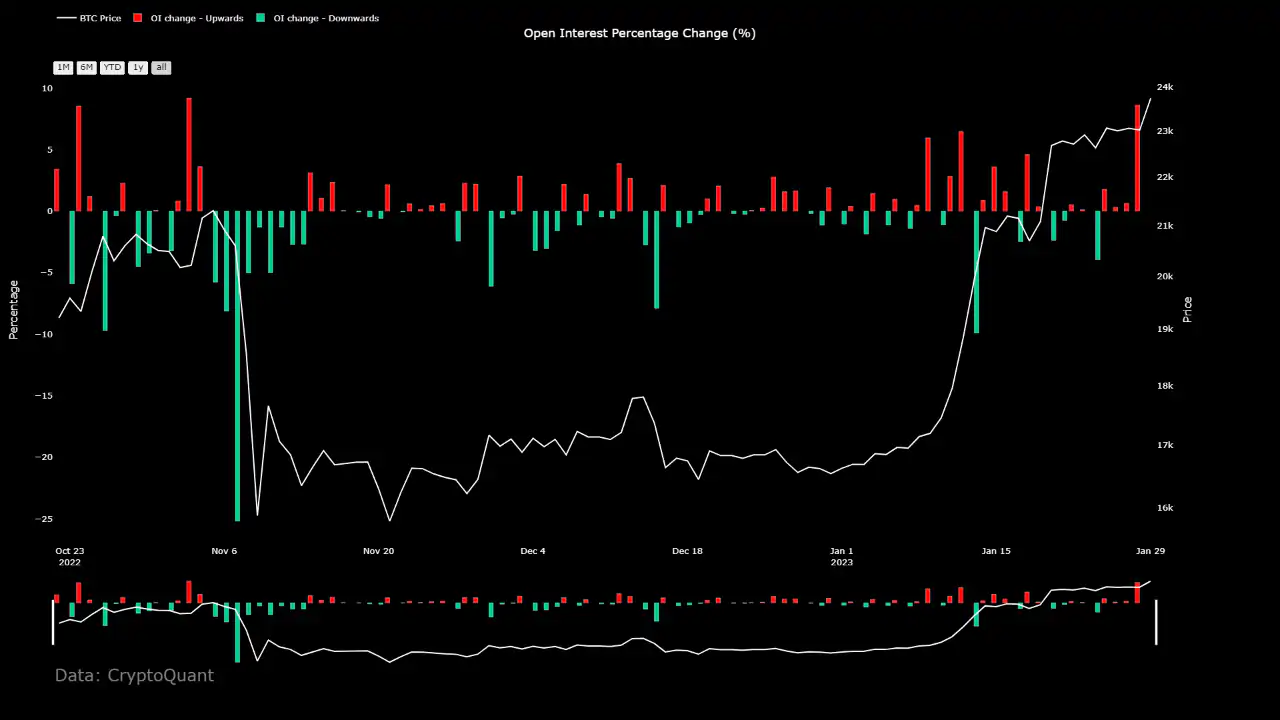

Now, here is a chart that shows the trend in the daily percentage change of the Bitcoin open interest over the last few months:

Looks like the value of the metric has been quite high over the past day | Source: CryptoQuantAs shown in the chart above, open interest in Bitcoin seems to have gone through a very big positive change lately. As a result of this surge, the value of the indicator increased by $700 million, representing a percentage change of 8.3 per cent, the highest observed over the past three months.

This could be an indication that volatility could happen soon for crypto. However, it is currently difficult to know in what direction this new volatility could eventually absorb the price.

From the chart, it’s apparent that earlier during the current Bitcoin rally, the open interest saw a large spike (obviously smaller than the current one), and only a day later, a sharp negative spike was seen as Bitcoin’s price rapidly climbed.

This means that the price increase then was fueled by a short squeeze. A "compression" occurs when mass liquidations occur immediately as a result of a large price change.

Such liquidations only amplify price developments, leading to the liquidation of an even greater number of positions. This way, liquidations can overlap when a compression event occurs. Restrictions are the reason why high open interest periods typically introduce more price volatility.

It would seem that when the recovery began, many investors opened up short positions, believing that the price rise would not last too long. But as their bet failed, the liquidation of their positions did nothing but fuel the rally.

It remains to be seen if a similar event will also follow this increase in open interest, or if a lengthy compression will happen this time instead.

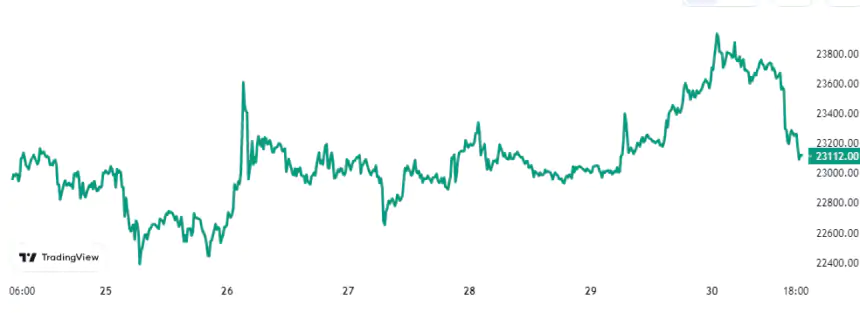

As of writing, Bitcoin trades around $23,100, up by 1% in the past week.

BTC continues to consolidate | Source: BTCUSD on TradingView

BlocksInform

BlocksInform