Sanctions aimed at decentralised crypto blender Tornado Cash have not been able to completely shut down its use, although it has paralyzed the service, a blockchain analysis company has shared.

On Aug. 8, the Office of Foreign Assets Control (OFAC) announced sanctions against the crypto mixer for its role in the laundering of crime proceeds.

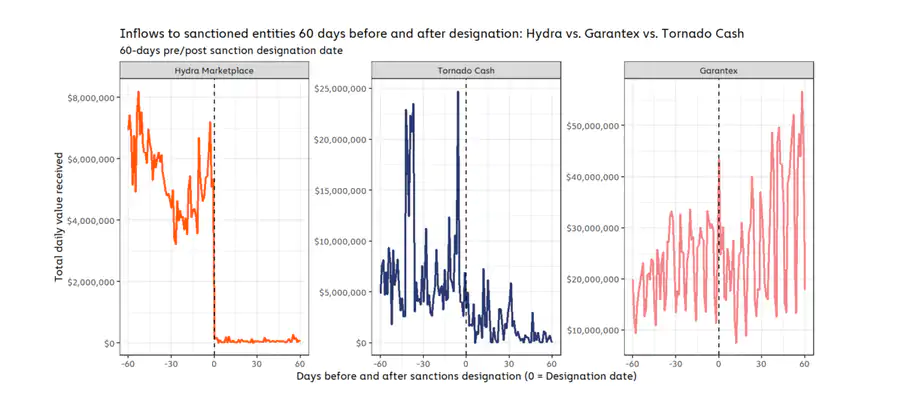

In a report published on Jan. 9, chainalysis stated that the sanctions had some effect, bringing down the total entries in the blender by 68% within 30 days after the sanctions came into force.

1/ The first section of our 2023 report on crypto-criminality is here, and it all comes down to penalties.

In this we look at how the US’ crypto-related sanctions strategy has evolved over time and 3 of OFAC’s biggest #crypto service designations to date.https://t.co/gOp1rHOQgx

— Chainalysis (@chainalysis) January 9, 2023

However, the company has also pointed out that because Tornado Cash is a decentralised platform based on intelligent contracts, "No individual or agency can "unplug" Tornado Cash as easily as with a centralized service."

Chainalysis gave the example of darknet market Hydra, which, on the other hand, saw its crypto-currency entries fall to zero after the German police seized its servers following sanctions.

Chainalysis explained that, while the penalties applied to Tornado Cash has seen its "front-end site deleted, their smart contracts can work forever, This means that anyone can still technically use it at any time."

"This suggests that sanctions against decentralised services act more as a tool to discourage use of the service rather than completely cutting off use."

OFAC came down hard on Tornado Cash in Aug. 2022 due to concerns that individuals and groups had allegedly used the mixer to launder billions worth of crypto since 2019 including the $455 million stolen by the north korea-affiliated lazarus group.

The agency then amended those sanctions in November as it cracked down on the platform even further for: “enabling malicious cyber activities, which ultimately support the DPRK’s [weapons of mass destruction] program.“

The last time he reported, chainalsis research indicated that the illegal use of tornado money was mainly linked to hacks and crypto scams, with an average of approximately 34% of the total entries being assigned to the origin of such.

When penalties could not shut down the blender completely, he was successful in discouraging people from using this platform, with total entries down 68% the month after.

No specific numbers are provided, however, the chart shows that daily cash receipts have sometimes reached close to $25 million a day in the 30 days preceding the penalties, After that, it went down by less than $5 million a day.

These incentives seem to have been powerful because its entries dropped by 68% within 30 days of its designation. This is particularly important here because the cash tornado is a blender, and blenders become less efficient at laundering money the less money they get overall,' reads the report.

Related: DeFi security losses rose 47.4% in 2022 to hit $3.64B: Report

This week, a separate report from the SlowMist blockchain security company also provided some insight into the type of money Tornado Cash has been circulating in 2022. The company's research indicates that 1,233,129 ethers () worth $1.62 billion were deposited on the rig last year, and 1,283,186 ethers ($1.7 billion) were removed.

3/ tornadocash: in 2022, users submitted a total of 1.233.129 eth and removed 1.283.186 eth.

Chipmixer: in 2022, users filed a total of 40.065.33 btc at him and removed 22.582.44 btc from him.

See the complete pdf report for more information. pic.twitter.com/ib2KnnpN9b

— SlowMist (@SlowMist_Team) January 9, 2023

BlocksInform

BlocksInform