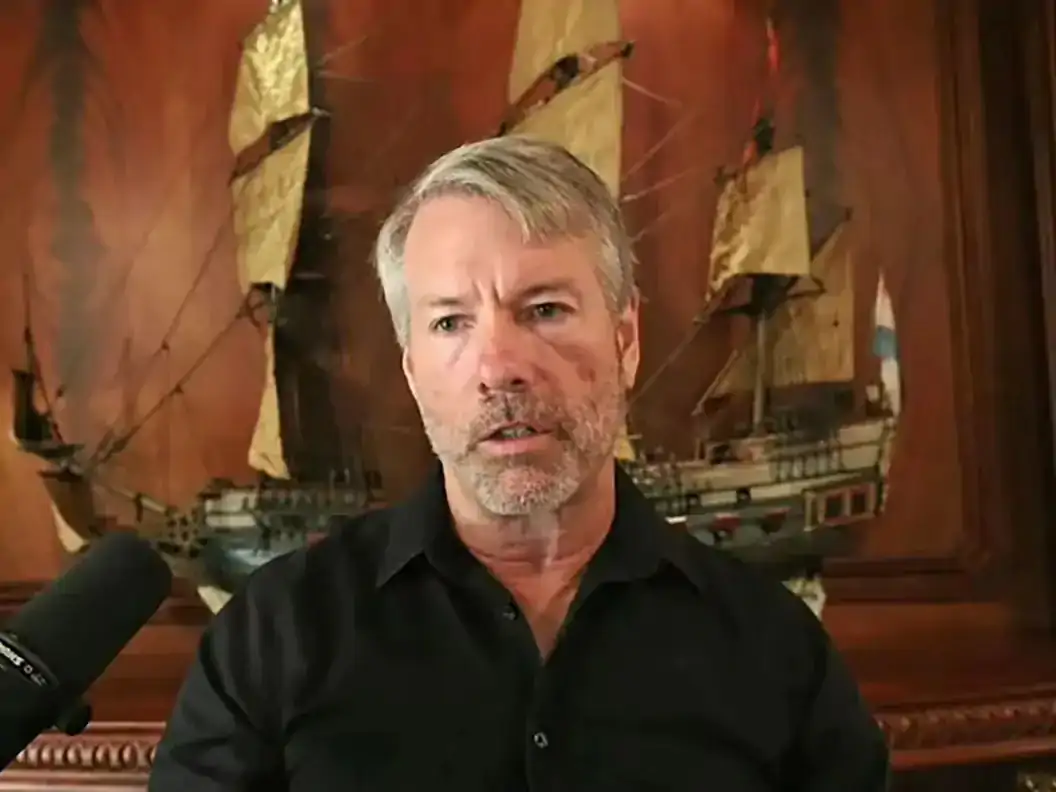

MicroStrategy (MSTR) founder and executive chairman Michael Saylor has lost a bid to dismiss claims that he failed to pay personal income taxes, interest and penalties due for Washington, D.C., according to a ruling on Feb. 28.

The court nonetheless dismissed the claims against Saylor and the company they had conspired to violate the False Claims Act of Washington, D.C.

A status conference in the tax evasion case against Saylor is scheduled to be held on March 10.

$23,264.96

$23,264.96 $1,623.66

$1,623.66 BNB$296.20

BNB$296.20 XRP$0.37473855

XRP$0.37473855 $12.67

$12.67The District of Columbia sued Saylor and his company last August, alleging Saylor never paid any income taxes in the district in the more than 10 years he had lived there, and that MicroStrategy had conspired to help him do so.

The Attorney General's office claimed that Saylor had saved the district over $25 million in taxes and was looking for tax arrears, damages, civil penalties, expenses and expenses.

$23,264.96

$23,264.96 $1,623.66

$1,623.66 BNB$296.20

BNB$296.20 XRP$0.37473855

XRP$0.37473855 $12.67

$12.67DISCLOSURE

Please note that our privacy policyterms of usecookiesdo not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk reporters are not permitted to buy titles on DCG.

BlocksInform

BlocksInform