Anthony scaramucci predicts the 2023 recovery and crypto-driven resurgence of venture assets. But will he fulfill his prophecies?

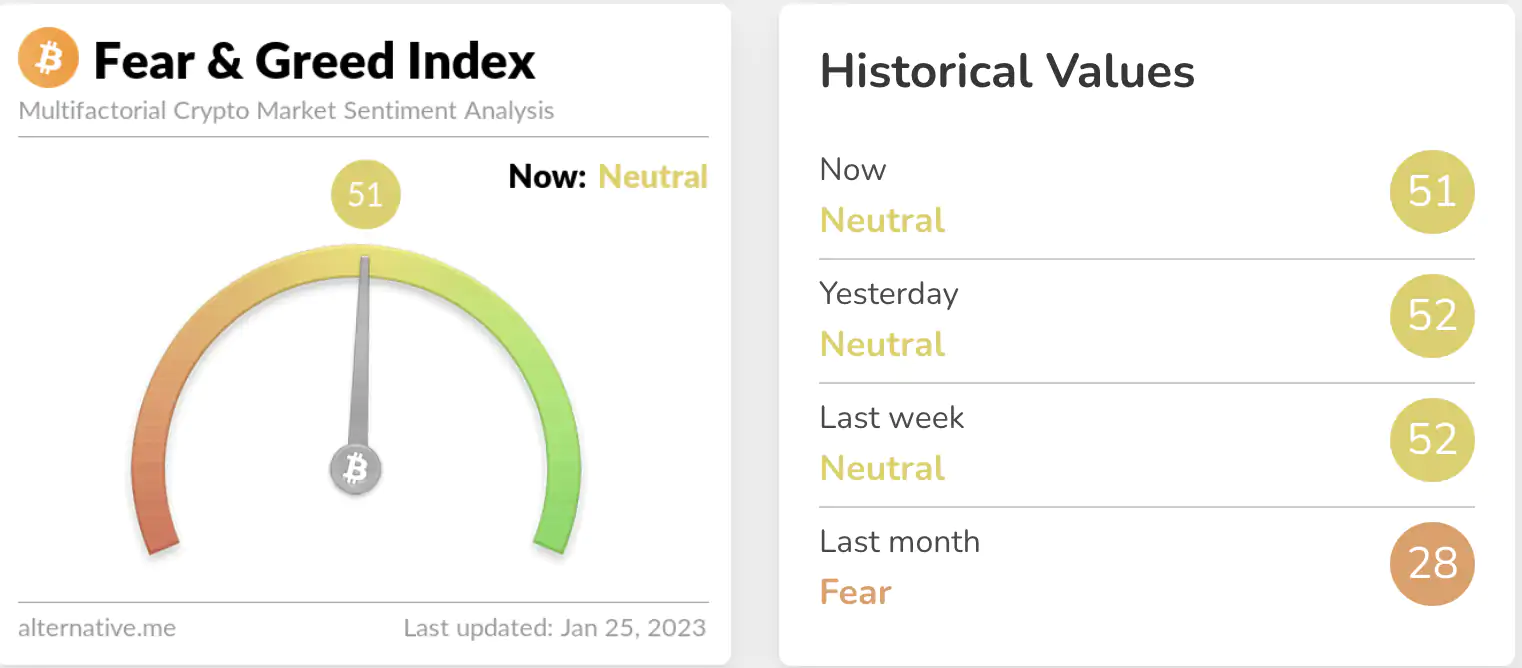

Investor feelings have become positive as the price of Bitcoin has recovered by more than 40% in 2023. The Fear and Greed Index has returned above 50 for the first time since April 2022.

The Fear and Covetousness Index is back above 50 for the first time since April 2022. SkyBridge Capital, the SEC-registered investment advisory firm, has over $2.2 billion in assets under management.

Scaramucci Predicts Rebirth of Risk Assets

According to a Bloomberg article, Scaramucci believes that the Federal Reserve (Fed) will declare victory over inflation once it reaches the 4% to 5% mark rather than waiting for 2%. The Fed aggressively increased interest rates in 2022 from 0% to 4.5%. According to a Bloomberg article, Scaramucci is predicting a resurgence of risky assets, Scaramucci thinks that the Federal Reserve (Fed) will declare a victory over inflation once it reaches 4-5% instead of waiting for 2%.

Anthony Scaramucci said, "If I'm right, the market will re-emerge. If inflation drops to the target range, the Federal Reserve could re-orient itself.

According to a CNBC article, the founder of SkyBridge Capital believes that 2023 will be a recovery year for Bitcoin. It anticipates that the OBT will trade between $50,000 and $100,000 in the next two or three years. Like many industry experts, Scaramucci too predicted Bitcoin to hit $100,000 by the end of 2021, but the asset peaked at $69,000.

SkyBridge’s FTT bet Incurred a Loss of 96%

FTX Ventures acquired a 30% stake in SkyBridge Capital in a $40 million deal around two months before it filed for bankruptcy. Skybridge ftt bet suffered a loss of 96% ftx businesses acquired a 30% stake in skybridge capital in a transaction of 40 million dollars approximately two months before filing for bankruptcy.

Skybridge purchased $10 million worth of tokens from this funding. The FTT stake in SkyBridge suffered a 96% loss FTX Ventures acquired a 30% interest in SkyBridge Capital in a $40 million transaction about two months prior to filing for bankruptcy.

SkyBridge purchased $10 million worth of FTT chips as a result of this funding. Write to us or join the discussion on our Telegram channel. You can also catch us on FacebookTwitter

BlocksInform

BlocksInform