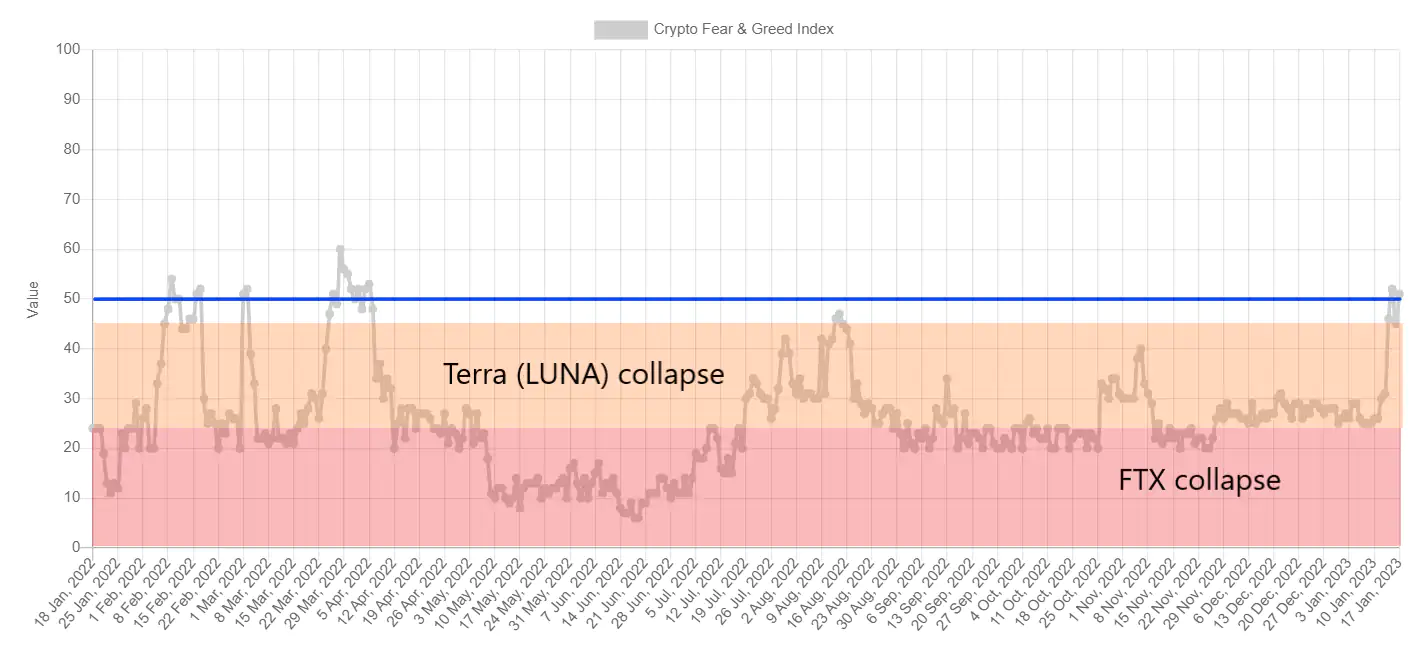

In today's analysis, beincrypto focuses on the famous index of fear and greed, which reverted to neutral levels after 9 months. The end of a long period of extremely negative market sentiment is another argument in favour of completing the cycle down on the cryptocurrency market.

The fear and greed index was within a range of fear (orange, 26-45) and extreme fear (red, 0-25) for most of 2022. The day before the index was higher than level 50 (blue line) was April 5. at that time, the price was $45,000.

Then a sharp drop started in the BTC price and the correlated graph of the index of fear and greed. The index fell particularly sharply after the crash of the ) ecosystem in May-June 2022. During this time, the November ftx collapse dropped the index to 20.

Evidence of Fear and Covetousness c. Bitcoin price

Today, the index gives a reading of 51. In the last few days, he went back to neutral territory (46-54) for the first time in 9 months. The bitcoin price is strengthening around $21,000.

Bitcoin Fear and Greed Index is 51 — Neutral

Current price: $21,166 pic.twitter.com/MqHmP6Y9oT

— Bitcoin Fear and Greed Index (@BitcoinFear) January 17, 2023

If we look at the long-term graph of Bitcoin encoded in colour according to the readings of the Index of Fear and Greed, The first signs of a potential reversal of trend are visible. First, we see an uptrend between the period of the collapse of the terra (luna) ecosystem and the ftx swap. This latest event brought down the BTC price to lower levels. However, the index of fear and greed did not record levels as low as when the first crash occurred.

Second, the index now provides neutral readings for the first time since the collapse of the previous bull market macrostructure. The possible decrease in the price of bitcoin below the 2021 summer low to $29,000 (red circle) confirmed a reversal of the long-term downward trend. Now there's a chance of a signal going the other way. This will happen if the BTC price succeeds in coming out over November's "high swing" to $21,500 (blue circle).

Thirdly, in the two preceding cases of extreme troughs in the price of bitcoin in 2019 and 2020, the indicator's return to the neutral zone was a sign that the accumulation period had ended. The beginning of an upward trend followed approximately one to two months after this event (green zones).

Moving averages and EMO cross

Cryptocurrency investor and market analyst wyInvestor has tweeted an update to his moving averages (SMA) chart of the Fear and Greed Index. 3 curves are considered: quarterly (91d sma, yellow), semi-annual (182d sma, red) and annual (365d sma, green).

According to him, the key moments in this graph occur when the yellow (quarterly) moving average exceeds the two longer (red and green) averages. The analyst calls this event an "emo cross".

On the graph above, we see two situations where an emo cross took place. The first took place at the beginning of 2019, after the end of the previous bearish market. The second was in June 2020, after Bitcoin recovered from the March 2022 COVID-19 accident. In both cases, the emo crossing was a sign that the price of the btc was about to rise.

Today, we are witnessing a third potential case of an emo cross. Several days ago, the yellow (quarterly) exceeded the green (annual) curve. However, it is always under the red (six months), therefore the signal is not confirmed. The analyst stated:

“I do not see the demand and strong euphoria that was typical in previous EMO crosses.”

In conclusion, we must say that the analysis of the Fear and Greed Index provides the first signals of a reversal of an upward trend in the cryptocurrency market. However, they are still early signals that indicate a phase of continuous accumulation rather than the beginning of an upward trend. If the neutral sentiment remains on the market for a few more weeks, there is a chance that the bull market will return soon.

BlocksInform

BlocksInform