Bitcoin (BTC) bulls have withstood the selling pressure that pushed the price below $23,000 last week. As BTC holds above the previous trench of $22,000, There’s another concern for the bulls as the days go by.

Mt. Gox payments are approaching, And there are two critical scenarios for the most prominent cryptocurrency on the market as it challenges a fundamental level. Will Mt. Gox’s BTC payments support a persistent bear market, or will the bulls have the strength to break the consolidation and push the price higher to confirm a new bull market cycle?

Mt. Gox Payments To Creditors Will Mark A Before And After For BTC Price?

Mt. Gox creditors are set to receive their payments after a 9-year liquidation process. Launched in 2010 and based in Tokyo, Japan, the defunct Bitcoin exchange handled over 70% of all BTC transactions worldwide until early 2014, when it ceased operations.

In 2014, Mt. Gox suspended its trading services, shut down its website and exchange services, and filed for bankruptcy protection from its creditors after the platform was hacked. The liquidation process began in April 2014. The company declared it lost nearly 750,000 of its customers’ BTC and about 100,000 of its BTC, totaling about 7% of the Bitcoin in circulation at the time, valued at $473 million.

According to an announcement released by Mt. Gox trustee Nobuaki Kobayashi in early January, Mt. Gox’s creditors have until March 10 to choose a payment method, divided into four groups:

-Early Lump-Sum Repayment

– Repayment for a Portion of Cryptocurrency Rehabilitation Claims in Cryptocurrency

– Repayment by Bank Remittance

– Repayment by Remittance through a Fund Transfer Service Provider

As concerns mount following the release of BTC payments to the defunct exchange’s creditors, the question of whether it will affect the price of Bitcoin has emerged. Strategists at financial services firm UBS, James Malcom and Ivan Kachkovski, have stated that “the Mt. Gox payouts are unlikely to destabilize the value of BTC.

Will The Selling Pressure On Bitcoin Continue?

If the bulls can avoid massive selling pressure from Mt. Gox creditors, they can retest the $24,000 resistance level that BTC has been unable to recover from since last week. On the other hand, Bitcoin has a strong floor at the $22,000 level that has held since volatility dropped and selling pressure increased in recent hours.

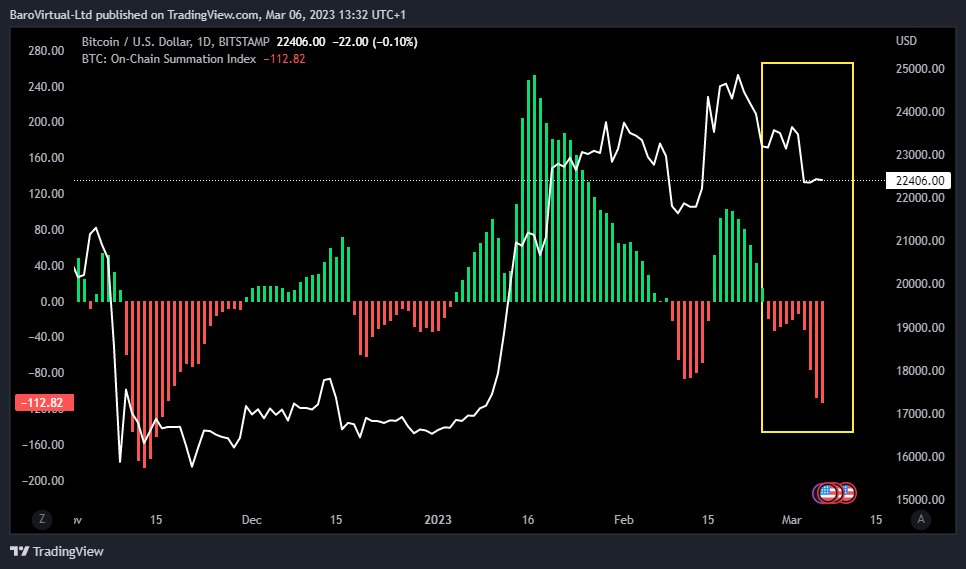

According to a Twitter post by market research and data analysis firm Barovirtual, the bearish pressure intensified, resulting in the price action being trapped in the current range without a significant move higher.

In addition, since the end of February, BTC’s Average Return Index, which monitors the average profitability of exchanges, has suffered a decline in trader productivity, which, according to Barovirtual, could indicate that Bitcoin needs to “cool down” to the lower $21,000 range.

As the bulls run out of steam at this market stage, BTC may see a correction to lower levels and retest its next support lines. However, if the released Bitcoin does not affect BTC’s value, bulls may have a chance to stop the selling pressure and hold the $22,000 support for further continuation of the bull trend that started at the beginning of 2023.

Currently, the largest cryptocurrency on the market is trading at $22,500, well above its support line of $22,000. Despite the recent range between $22,100 and $22,500, Bitcoin has seen a slight gain of 0.2% over the past 24 hours.

BlocksInform

BlocksInform