Data about the watch chain Bitcoin broke over those three key levels in a way that recalls the rally in April 2019.

Bitcoin Breakout demonstrates the original similarities. To April 2019 Rally

According to data from the on-chain analytics firm Glassnode, BTC has broken above the three investor cost-basis levels for the first time since the COVID-19 crash and the 2018-2019 bear market. The relevant indicator here is the “realized price,” to understand the concept of the “realized cap” it needs to be looked at first.

The realized cap is a capitalization model for Bitcoin that assumes that every piece in the circulation offer has its real value as the price at which it was last moved instead of the current BTC price (which the normal market capitalization uses to calculate it).

Now, from the realized cap, a “realized price” can be obtained by dividing the metric by the total number of coins in circulation. Since the realised ceiling represented the prices at which investors purchased their coins (i.e., base of costs), the realised price may be considered to be the average purchase price on the market.

This means that if the standard price of bitcoin drops below this indicator, the average holder may be assumed to have entered a loss state. Although this realized price is the average market-wide cost basis, the measure can also be defined for specific groups of investors.

The BTC market can be divided into two primary cohorts: short-term holders (STHs) and long-term holders (LTHs). Investors who have purchased their coins in the past 155 days fall into sths, while those who have held them since prior to this threshold are included in lths.

Here is a graph that shows the trend in the Bitcoin price achieved for the whole market, and for these two groups of holders individually, in the recent past:

BTC seems to have broken above all these levels recently | Source: Glassnode on Twitter

As can be seen from the chart above, Bitcoin had broken over the STH cost base and the realised price of the entire market earlier in the last rally, suggesting that the average STH and the average global investor were returning to earnings.

In the latest pursuit of the rally, cryptography has now jumped over the lth cost base of $22,400. This means the average investor in each segment is now in the green zone.

The last time Bitcoin posted a breakout over all of these levels was after the COVID-19 Black Swan crash, which had briefly taken the coin below those prices.

A similar trend also manifested itself in April 2019, when the bear market in this cycle came to an end, and an uptrend occurred. Although it is still too early to say so, this similarity between the two rallies could point the way the current could also follow.

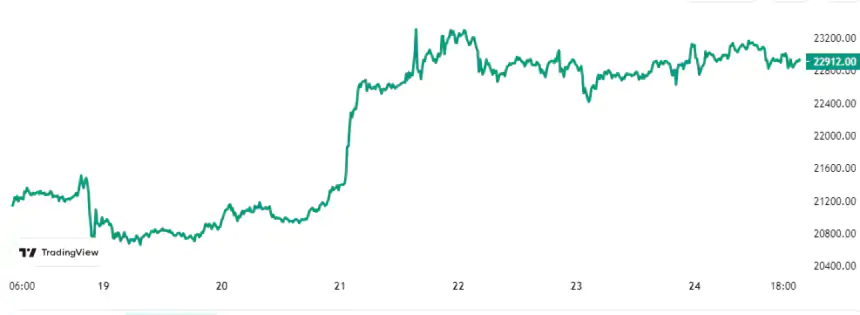

At the time of writing, Bitcoin is trading around $22,900, increasing by 8% in the past week.

Looks like BTC has been moving sideways in the last few days | Source: BTCUSD on TradingView

BlocksInform

BlocksInform