The data on the channel shows the annual rate of change in the Bitcoin Puell Multiple has left the bearish market area, a sign that an uptrend rally can be here.

Bitcoin Puell Multiple's 365-day change rate increased.

As pointed out by an analyst in a CryptoQuant post, this could be one of the first indications of the return of the bull market. The “Puell Multiple” is an indicator that measures the ratio between the daily Bitcoin mining revenue (in USD) and the 365-day moving average (MA) of the same.

When the value of this metric is greater than 1, miners are making more income than the yearly average right now. However, values below the threshold imply that the earnings of these chain validators are lower than normal.

As the incomes of minors change, these holders become more or less likely to sell BTC (based on how break-even was achieved), which is a factor in the price of cryptography. Thus, when the multiple puell is higher than 1, btc can be considered as overvalued, while being lower than this value could suggest that the part is undervalued.

The appropriate indicator here is not the multiple of puell itself but its rate of change (rock). The rock shows how quickly a measurement changes its value over a defined period of time.

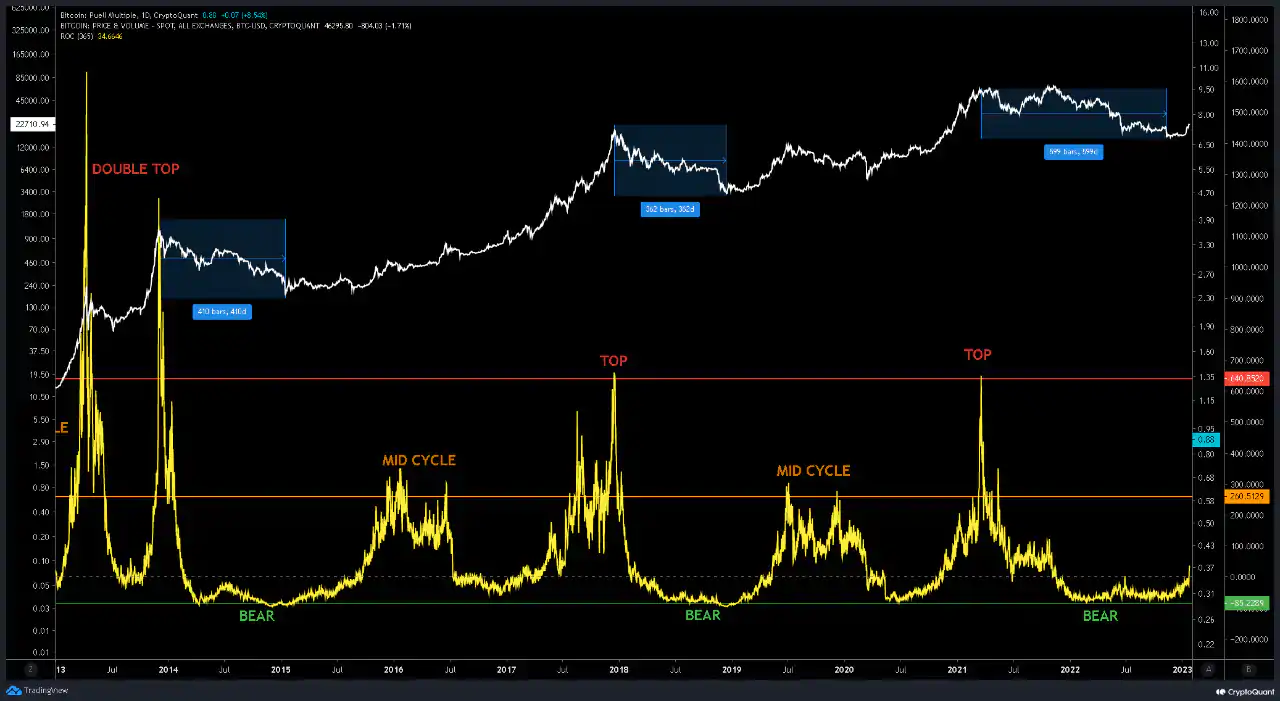

In particular, the 365-day report of the Puell Multiple is of interest in the ongoing debate. Here is a graph which shows the trend of this indicator during the various Bitcoin cycles:

Looks like the value of the metric has spiked in recent days | Source: CryptoQuantIn the chart above, the quant has flagged areas relevant to the Bitcoin Puell Multiple 365-day CR. It appears that the peaks occurred in the crypto price each time the metric hit the red line, while the mid-cycle highs were put around the orange line.

And the bear markets seem to have lasted while the indicator was around the green line. There is also evidence that transitions to and from down markets have generally followed the dashed line in the past.

Recently, as Bitcoin has risen sharply, the incomes of miners have also exploded, leading to multiple puell also seeing an increase. As the graph shows, the 365-day rock of the indicator has naturally increased rapidly over the past few days.

With this spike, the metric has finally crossed above the dotted line, which could mean, if the past pattern is anything to go by, that the bear market may be coming to an end, and the crypto might have started transitioning towards a bullish trend. The analyst notes, however, that a few more courses will be required before this break can be fully confirmed.

As of now, Bitcoin is trading around $22,800, up 9% in the last week.

The value of the crypto seems to have been moving sideways in the last few days | Source: BTCUSD on TradingView

BlocksInform

BlocksInform