Yes, the title is correct. Bitcoin (btc) futures are truly, exceptionally, trading at a higher premium on the Chicago mercantile swap (cme) than on binance.

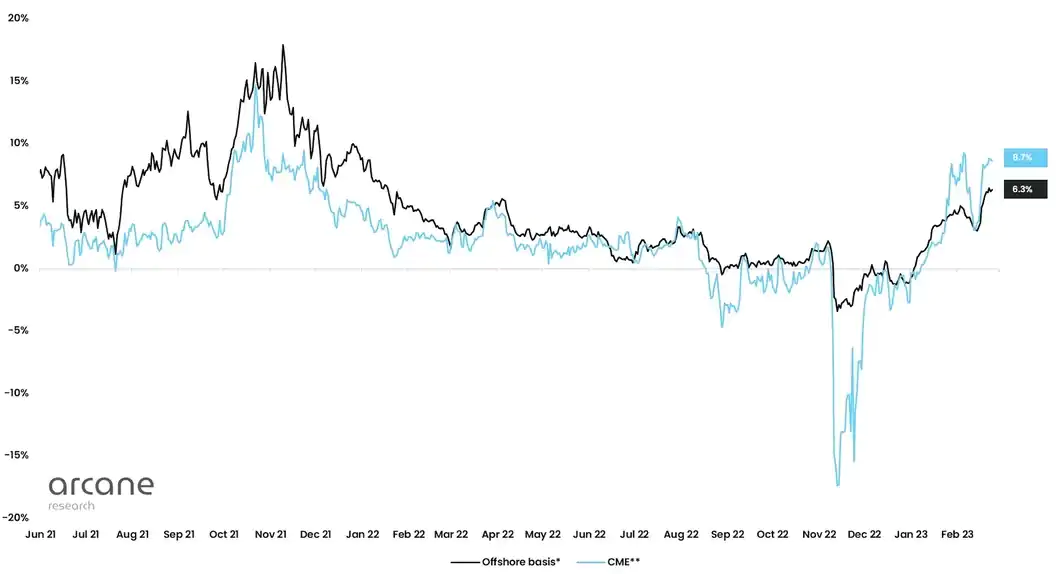

Three-month bitcoin futures listed on CME, widely considered a proxy for institutional activity, are trading at an annualized premium of around 8.7% to the underlying reference index. The corresponding premium on offshore exchanges, mostly Binance, jumped to 6.3%, the highest since January 2022.

On CME, the premium is the highest positive basis since November 2021, according to data tracked by Arcane Research. Back then, bitcoin traded at record highs near $69,000 – almost three times the current $24,850, CoinDesk data show. (We are talking of premiums in standard futures market here, not perpetuals, which are futures-like derivatives with no expiry.)

Bitcoin has surged by more than 45 percent so far this year, outperforming traditional venture assets, including the Wall Street Technology Nasdaq Index, by a significant margin. Forward contracts generally trade at a premium as a sign of biased leverage on the bull side when the underlying asset is up. On the other hand, in bearish markets, rebates are often observed.

Bitcoin has surged by more than 45 percent so far this year, outperforming traditional venture assets, including the Wall Street Technology Nasdaq Index, by a significant margin. Forward contracts generally trade at a premium as a sign of biased leverage on the bull side when the underlying asset is up. On the other hand, in bearish markets, rebates are often observed.

"The bull has returned," said Arcane analyst Vetle Lunde to Coindesk.

CME takes the lead

Historically, futures on the CME have traded at a relatively lower premium than those on BINANCE and other unregulated offshore entities, predominantly because these latter avenues offered higher leverage. This means that traders on offshore exchanges have been able to take larger bull bets while depositing a relatively small amount of cash, known as margin.

However, offshore exchanges have cut back on leverage since the second half of 2021, and they now account for just 30% of the global futures activity, while the rest comes from the CME.

Another reason the cme has reversed offshore trades is that Bitcoin-linked ETFs only invest in regulated futures cme.

'Term trading at a [higher] premium is rarely seen,' said Lunde. 'In this spirit, cme is a great deal of the activity of future btc as a whole. The offshore futures market is trivially small now, with all business concentrated in perpetual."

According to Arcane Research, open interest, or the number of open futures contracts on the CME, currently sits at 80,586 BTC – or 70% of the global open interest. This is well above 28% at the peak of the April 2021 bullish race.

'Term trading at a [higher] premium is rarely seen,' said Lunde. 'In this spirit, cme is a great deal of the activity of future btc as a whole. The offshore futures market is trivially small now, with all business concentrated in perpetual."

Looking forward, a continued move higher in the premium may see carry traders return to the market. Cash and carry arbitrage implies the purchase of bitcoin on the spot market and the simultaneous sale of forward contracts in an attempt to pocket the bonus. Carry trading was quite popular during the bull run when premiums reached as high as 40% on offshore exchanges.

$23,794.07

$23,794.07 $1,637.76

$1,637.76 BNB$308.53

BNB$308.53 XRP$0.38673478

XRP$0.38673478 $13.20

$13.20DISCLOSURE

Please note that our privacy policyterms of usecookiesdo not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk reporters are not permitted to buy titles on DCG.

BlocksInform

BlocksInform