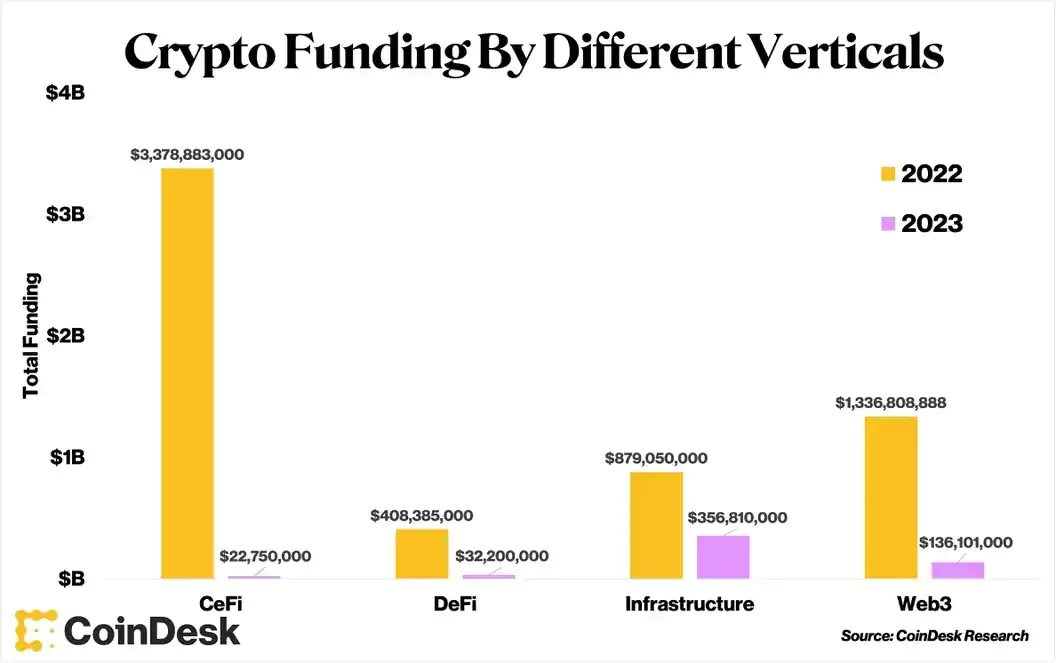

Venture capital and other investments into crypto companies plunged 91% year-over-year in January. Venture capital and other investments in cryptography firms fell by 91 per cent compared to January of the previous year.

This article is part of CoinDesk's BUIDL Week.

In the investment landscape after FTX, the pace of transactions slowed down and start-up valuations returned to normal. However, there is broad agreement among the VC investors surveyed on a number of relevant crypto vertical sectors – and these do not include centralized financial players.

Infrastructure by any name

Infrastructure remained the most stable investment vertical in January, with the broad term referring to multiple facets of the crypto world.This can range from inter-blockchain portals to on-chain wallets – and includes any software innovations that will make static digital identities feasible, non-fungible tokens useful and decentralized autonomous organizations real competitors to corporations and governments.

This can range from cross-blockchain portals to chain portfolios – and includes all the software innovations that will enable static digital identities, nonfungible tokens of autonomous organisations useful and decentralized of real competitors to the societies and the governments.Crypto-concentrated investment firm Multicoin Capital was one of those taken with exposure to FTX when the stock market suspended withdrawals last November.

The collapse only strengthened the company's investment commitment, said Co-Founder and Managing Partner Kyle Samani at CoinDesk in an email, noting that decentralized finance (challenge) Has done very well throughout the volatility. Crypto-concentrated multi-in investment capital investment firm was among those taken with a ftx exposure when the stock exchange suspended withdrawals last November, However, the collapse only reinforced the company's determination to invest, Co-founder and CEO Kyle Samani sent an e-mail to coindesk, noting that decentralized finance (defi) "has done wonders all through volatility." we are especially interested in evidence networks for physical work," said Samani, Reference projects such as Multi-In Wallet Enterprise Helium, that encourages people to build physical telecom networks.”

See also: Crypto Winter Led to 91% Plunge in VC and Other Investments

Generalist Web3 fund Shima Capital, an active firm that has the backing of hedge fund billionaire Bill Ackman, is particularly interested in consumer and infrastructure projects, general partner Yida Gao told CoinDesk in an email.

"See also: the crypto winter resulted in a 91% drop in vc and other investmentsgeneralist web3 fund shima capital, an active business with support from a billionaire hedge fund bill ackman, focuses on consumption and infrastructure projects, The general partner yida gao said to Coindesk in a mail. Web 3 Shima Capital general purpose fund, An operating company backed by billionaire Bill Ackman, focuses on consumption and infrastructure projects, Associate General Yida Gao said to CoinDesk in an e-mail.

"We have a solid thesis about how the game is going to put forward the next wave of crypto users," he said.This includes the construction of floors to support this large number of new arrivals, For example, industry-specific channels, that can put heavy data sets on the chain and drive savings to the assets at stake, and new network protocols such as account abstracts, a proposed way to rewrite the operation of smart contracts to allow for new capabilities such as asset collections, secure user IDs and systems to protect against fraud. This includes the construction of floors to support this important influx of newcomers, For example, industry-specific channels, that can put heavy data sets on the chain and drive savings to the assets at stake, and new network protocols such as account abstracts, a proposed way to rewrite the operation of smart contracts to allow for new capabilities such as asset collections, stable user identities and fraud protection systems.“[t]here are currently promising opportunities to back founders building for this massive market both at the consumer and infrastructure levels of the web3 stack,” said gao.

T]here are currently promising opportunities to support the founders to build for this massive market both in terms of consumers and infrastructure of the Web3 pile,' said Gao.

The misdeeds of FTX founder Sam Bankman-Fried and other executives have increased the calls for stricter crypto regulation in the United States, which puts many startups in murky legal territory. Investments resistant to regulationThe harms of FTX founder Sam Bankman-Fried and other leaders have increased calls for stricter crypto regulation in the US, This places many start-ups on a troubled legal field.

“Government regulations are a form of censorship, whether they’re valid or not,” explained Tribe managing partner Boris Revsin, who joined the firm last July. For this reason, Tribe Capital, another active investor last month, prefers to focus on so-called decentralized protocols that resist censorship.

See also: Crypto Redundancies: This is the sinister count since April"Government regulations are a form of censorship, if they are valid or not," says Boris Revsin, the tribe's managing partner, Joined the firm in July of this year.

BlocksInform

BlocksInform