Tesla released its fourth-quarter financial report, outperforming profit and income forecasts. However, the company's investments are still at a loss.

Tesla's bitcoin investments are still under water, according to its fourth quarter January earnings report. 25. Nevertheless, the overall profit and turnover of the company exceeded expectations.

The stock of tsla is on the rise today and has increased by more than 13% in the last five days. The company's shares also went up when CEO Musk said it could produce two million teslas this year.

total revenue that Tesla earned was $24.32 billion, which was about 200 million more than the projected value of $24.16 billion. Profit per share was $1.19 versus the $1.13 forecast. Whereas the company pointed out that the average selling price was on a downtrend, She responded by saying that more affordable rates were needed to help businesses sell to more people.

It also stated that its automotive revenues were up 33% from the previous year. Q4 total receipts were $21.3 billion.

Tesla's Bitcoin holdings brought in $34 million in depreciation expenses. He also failed to purchase or sell bitcoin in the final quarter, with total assets valued at $184 million.

Tesla’s Bitcoin Investment

Tesla first shook the crypto and investment world when it purchased $1.5 billion worth of Bitcoin in February 2021. The sizable investment has seen its value fluctuate tremendously with the market, and in March 2021, Tesla allowed payments in Bitcoin.

However, he must make his payments shortly thereafter, which results in a decrease in the asset price. Since then, with Bitcoin’s price dropping, it reported impairment losses in consecutive quarters.

MicroStrategy Not Backing Down From Bitcoin Bet

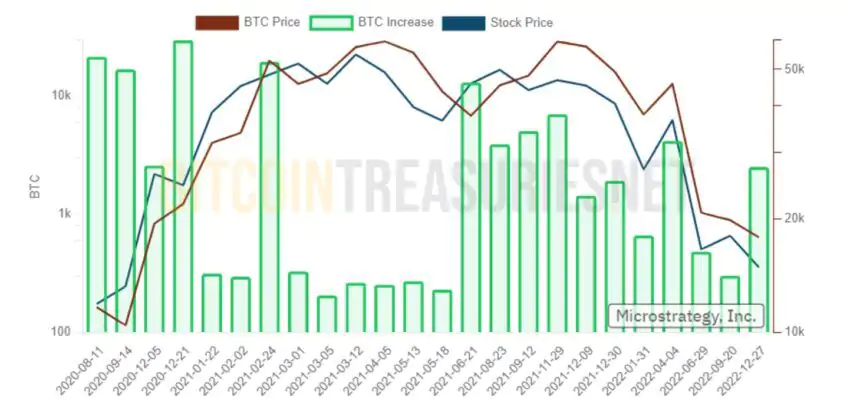

Tesla’s investments in Bitcoin are often compared to MicroStrategy, as both are established firms that are among the top investors in Bitcoin. In contrast to tesla, however, microstrategy is much more optimistic about Bitcoin, with CEO michael saylor among the strongest promoters of Bitcoin.

The firm has consistently bought BTC over the years, most recently purchasing 2,501 BTC in December 2022. The total shareholdings of the society are now 132500 btc, with a value of approximately 3 billion dollars at current prices.

The company had $1.8 billion in unreported losses from its Bitcoin investment because of the crypto winter

BlocksInform

BlocksInform