Virtual World Sandbag Token is witnessing a price spike over the month prior to its scheduled token unlock in Feb. 14.

Token unlocks, which are generally regarded as bearish events, seem to have little effect on the price of the Sandbox SAND token prior to the release of a larger offering. The project will be releasing 12% of the token’s supply, equivalent to around $273 million worth of SAND, to seed and strategic investors, according to Token Unlock, with half of the 12% going to investors, according to a report from Kaiko Research.

SAND is the utility token used on The Sandbox’s ecosystem as the basis for transactions and interactions. Its price has gone up by 90% since the beginning of the year and is trading today at 74 cents, according to messari data. This is 90% lower than the historical high of $8 in November 2021.

Token Unlocking is the process for unlocking frozen tokens during project funding rounds or fundraising activities. They have often been seen as bearish events, since they free up more asset supply in the marketplace. However, more recently, unlocks seem to have undergone a change in narrative, with tokens that have upcoming unlocks rallying ahead of them. Token rallies like aptos (APT) and axie infinity (AXS) before recent releases are two examples of this.

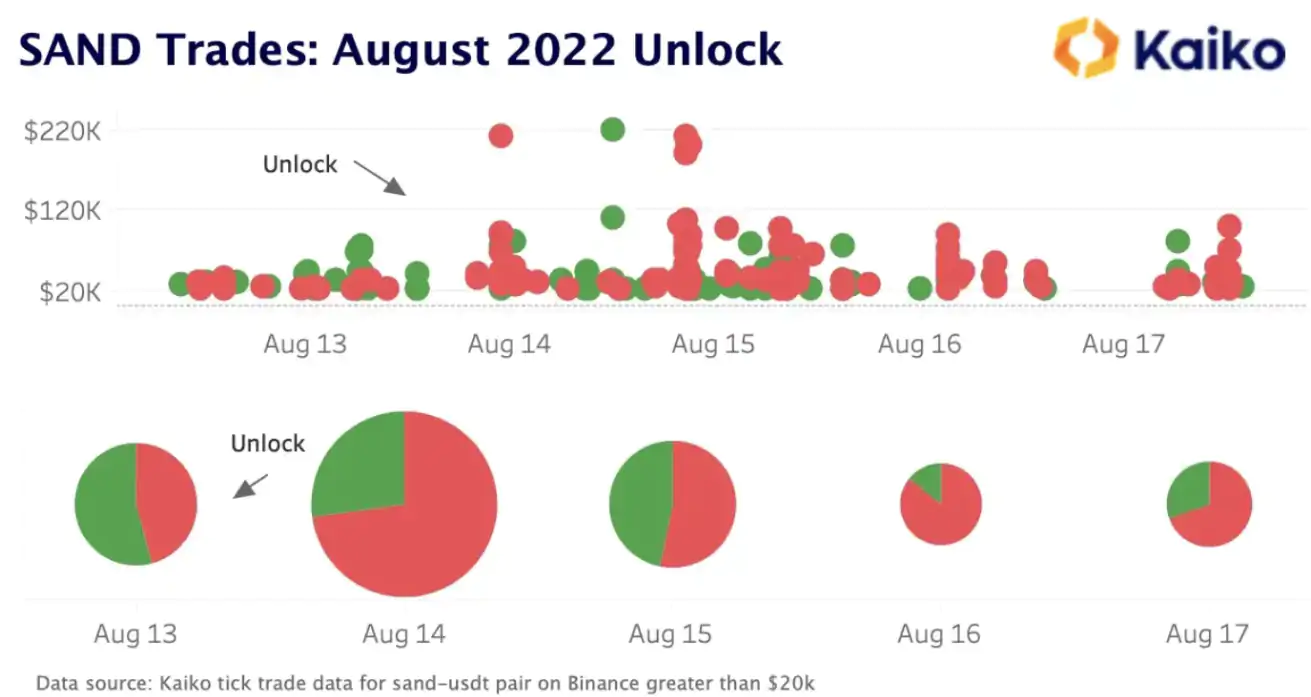

“The thing to watch with unlocks is [percentage] to investors: if [around] 50% expect heavy sell pressure,” wrote Conor Ryder, a research analyst at Kaiko Research. In a report examining previous Sandbox token releases and price developments, Ryder concluded that the chip allocation for this upcoming release is similar to that of August 14, There will therefore be a similar under-performance for SAND as the selling pressure increases.

(Kaiko)

“Following the release of August 14, close to 75% of all major transactions were sales orders as investors were seeking to withdraw money from SAND. That sales pressure continued in the days following the unlocking, with sales orders dominating purchases," Ryder wrote.

“SAND's unblocking allocation is investor-oriented and the symbolic performance has suffered from it," he added.

The sandbox has an unlocking calendar that is due every six months until 2025 with the same investor allowance. Consequently, SAND carriers could consider dealing with serious headwinds so far, according to Ryder.

BlocksInform

BlocksInform