Decentralized exchange GMX has evolved as a serious competitor to established industry players like Uniswap in the wake of FTX's collapse.

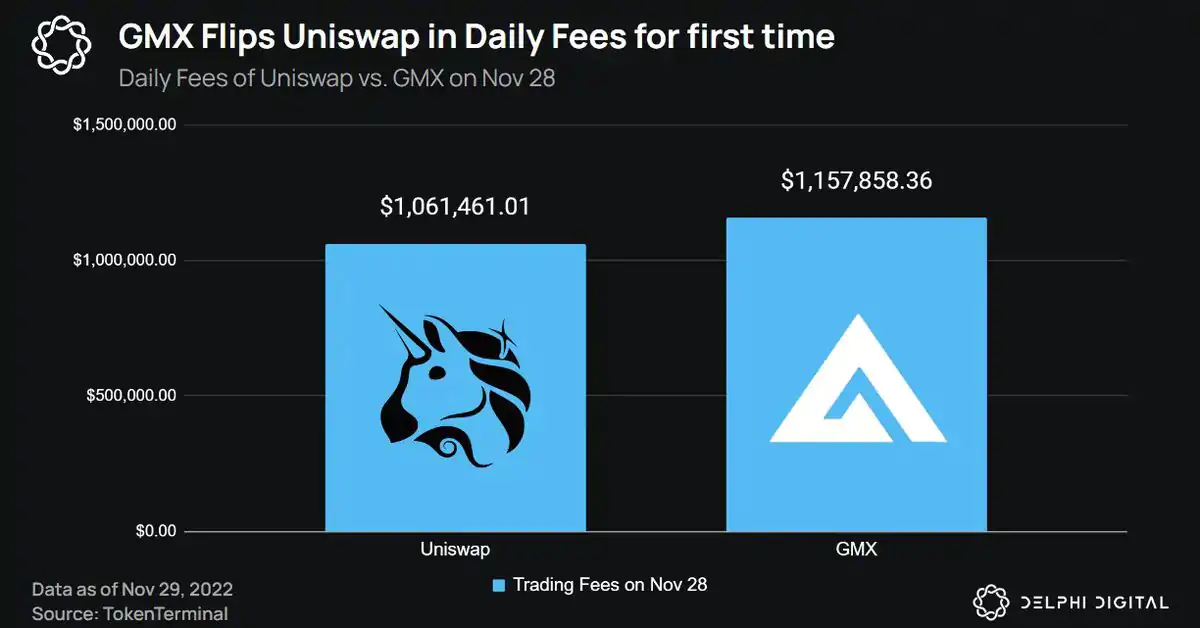

On Monday, GMX earned $1.15 million in trading fees, surpassing Uniswap's $1.06 million for the first time on record, according to data tracked by Delphi Digital.

The decentralized exchange, which allows users to trade perpetuals or futures with no expiry without an intermediary using smart contracts, is perhaps benefitting from a broader shift toward perpetual-focused decentralized platforms triggered by the recent fall of centralized giant FTX.

GMX went live on Ethereum layer 2 solution Arbitrum in September 2021 and debuted on Ethereum-competitor Avalanche early this year. The platform offers relatively low transaction fees and zero price impact or the influence of a single trade over the market price.

Sam Bankman Fried's exchange FTX filed for Chapter 11 bankruptcy protection on Nov. 11, denting investor confidence in centralized exchanges.

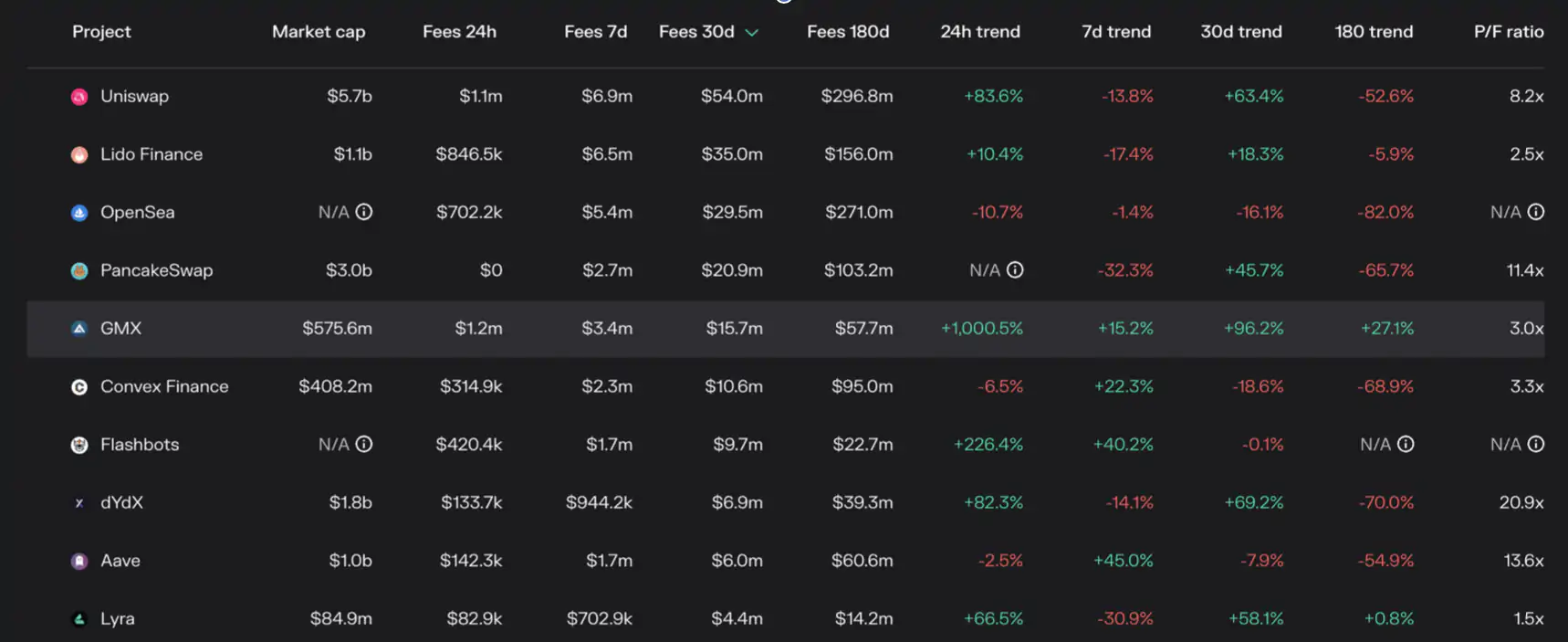

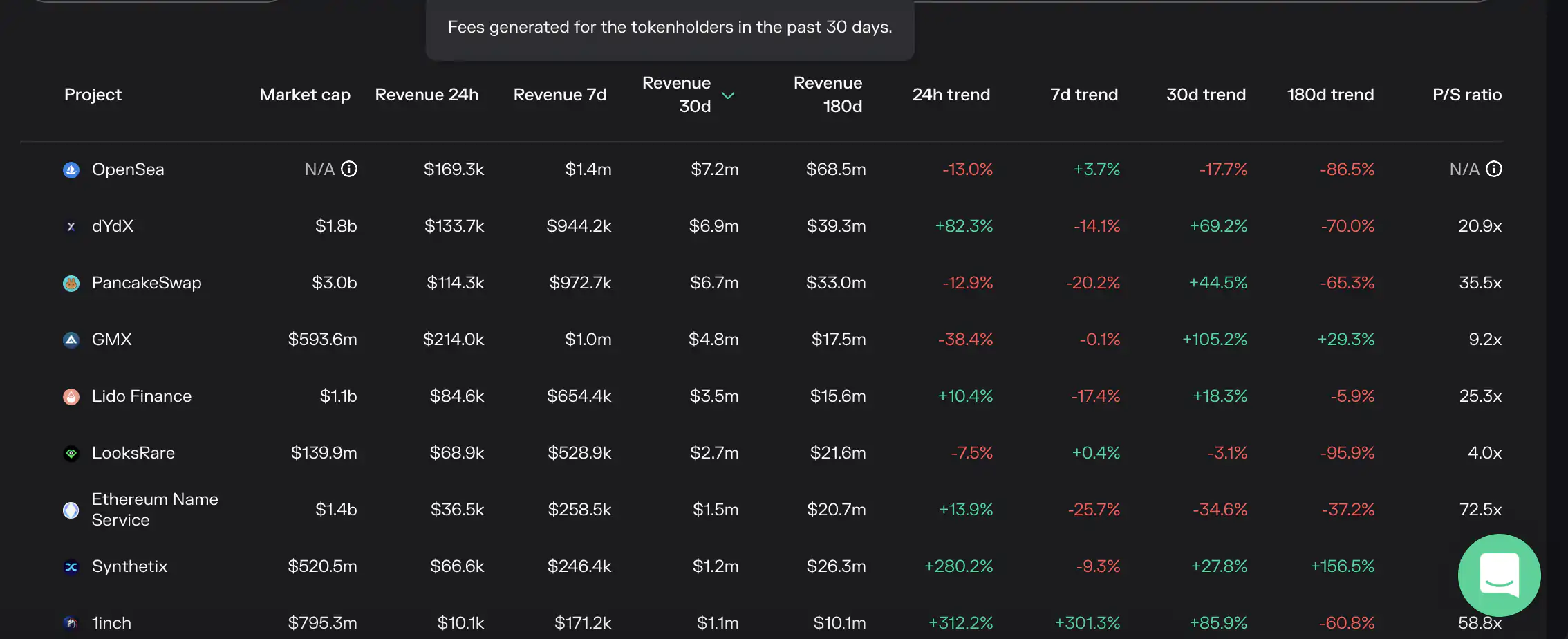

GMX is the fifth largest decentralized application in terms of fees earned in the past 30 days. (Token Terminal)

GMX has pocketed $15.7 million in trading fees in four weeks, becoming the fifth-largest decentralized application, ahead of prominent players like dYdX and AAVE, according to data source Token Terminal.

GMX's hosts, Arbitrum and Avalanche, have earned $985,600 and $540,500 in trading fees in 30 days. Uniswap has collected $54 million in trading fees, retaining the industry leadership.

Yet, Uniswap's UNI token has declined by 16% this month, while GMX has gained by 4%.

GMX's outperformance probably stems from the fact that the GMX token holders receive 30% of all the trading fees, while the UNI token holders do not receive a share in trading fees.

GMX has distributed $4.7 million to its token holders in 30 days. (Token Terminal) (Token Terminal)

GMX has distributed $4.7 million to the token holders in the past 30 days, the fourth-largest payout among all decentralized applications.

$16,857.28

$16,857.28 $1,265.20

$1,265.20 BNB$299.55

BNB$299.55 XRP$0.39939362

XRP$0.39939362 BUSD$0.99990460

BUSD$0.99990460DISCLOSURE

Please note that our privacy policyterms of usecookiesdo not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. Coindesk journalists are not allowed to purchase stock outright in dcg.

$16,857.28

$16,857.28 $1,265.20

$1,265.20 BNB$299.55

BNB$299.55 XRP$0.39939362

XRP$0.39939362 BUSD$0.99990460

BUSD$0.99990460

BlocksInform

BlocksInform