Crypto lending platform MakerDAO is voting on a new proposal to bring another commercial bank into its ecosystem, strengthening the connection between decentralized finance (DeFi) and traditional finance.

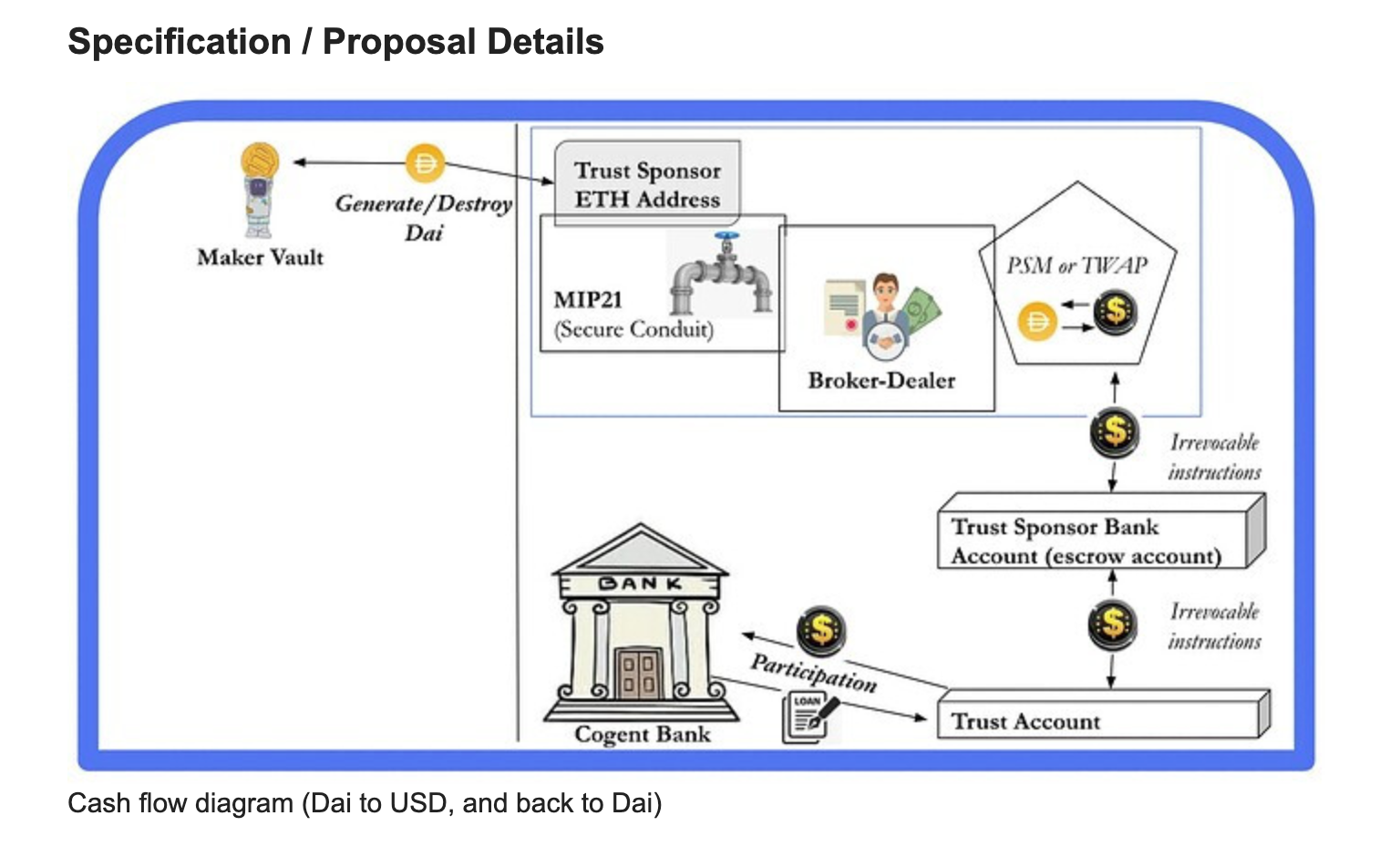

As per MakerDAO’s governance forum, Cogent Bank — a Florida-based commercial bank — is proposing to participate with $100 million in loans to MakerDAO’s RWA Master Participation Trust.

Vote on four governance surveys in the ongoing monthly governance cycle.

What is subject to a vote and what are the consequences?

Recap, here. v pic.twitter.com/YivsBJHpHv

— Maker (@MakerDAO) February 17, 2023

The proposal is part of MakerDAO’s monthly governance cycle and seeks the same terms and conditions applied to Pennsylvania-based bank Huntingdon Valley Bank (HVB), which entered into a collateral integration with the crypto firm in July 2022, allowing the bank to borrow against its assets using DeFi.

Under the same conditions, MakerDAO would use its trust arm to link the capital available at Cogent Bank with MakerDAO’s Dai (DAI) stablecoin. The fiduciary entity would be responsible for producing and destroying dai from the vault, as well as managing the partnership with the bank.

The Challenge Protocol would achieve credit market exposure in at least eight categories, including business real estate, industrial, life insurance, government consumption and financial affairs, with mainly fixed-rate lending.

Among the sources of income for makerdao are the costs associated with the maintenance of the safe, strikes dai, and returns. The benchmark 30-day average secured overnight financing rate stood at 4.15% as of Jan. 5.

Before its acquisition in 2018, Cogent Bank was known as Pinnacle Bank. Florida Bank is responsible for $1.3 billion in assets and is insured by the Federal Deposit Insurance Corporation. According to the company, lending in the first three quarters of 2022 amounted to $602 million, for a total of $873 million in 2021.

In an attempt to withstand the crypto winter of 2022, makerdao unveiled a governance process for its first partnership with a traditional bank, the Huntingdon Valley Bank. At that time, the challenge protocol announced plans for loading other banks based on the results of its integration with hvb.

BlocksInform

BlocksInform