Throughout the market brutally defeated crypto, altcoins are starting to show their first signs of a potential recovery after a withdrawal of almost 90% in most assets. But could the recovery be due to a phenomenon based on the schedule known as the January effect?

Crypto Altcoins is booming to begin with. The New Year

Take a look at CoinMarketCap’s top crypto gainers and losers over the last seven days, and the returns from many top altcoins are reminiscent of the previous bull market in Bitcoin and other coins.

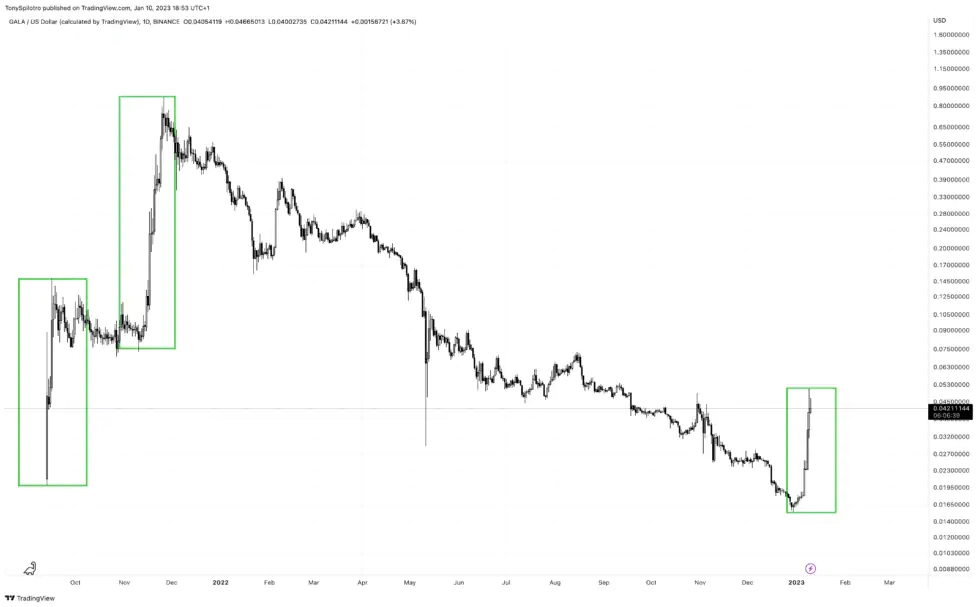

GALA, for example, tops the list with 138% growth in the last week. Lido dao has fallen 61% behind in one week. Tens of spare parts jumped by 20% or more in the same period. Even specific altcoins caught up in the FTX-related fallout, such as Solana, have posted the largest monthly bullish candle since August 2021.

January, 2023, are far from the beginning for anyone who dares to buy a dip. But why exactly altcoins knows such a strong performance compared to Bitcoin or Ethereum, which have climbed by about 5 and 10% over the same period?

The answer could be what we call the "January effect", a calendar effect that occurs during January. Other calendar effects on capital markets include "selling in May and disappearing", the Halloween effect, the July effect and Santa's gathering.

Gala produces one of the largest altcoin rallies from bullfighting | galausd on tradingview.com

What does January have to do with that?

According to Wikipedia’s entry on the subject, the January effect is a “hypothesis that there is a seasonal anomaly in the financial market where securities’ prices increase in the month of January more than in any other month.” In plain language, some assets may outperform the rest of the year in January.

It was first observed in 1942 by the investment banker sidney b. wachtel. Watchel noted that small capitalization stocks outperformed the rest of the market in January, with most returns coming in before mid-month. Watchel also noted that, for some reason, the third year of a president's term in a presidential round would yield the highest returns of all.

Investopedia asserts that the increase in buying activity is due to investors buying small cap assets back after performing year-end tax-loss harvesting following a price drop. This is a common practice for wealthy investors looking to maximize all possible tax advantages. Even Bitcoin bull and MicroStrategy front man took advantage of some tax-loss harvesting due to his BTC holdings sitting at a loss.

Smaller spares, given the low volume and liquidity profile, respond much more effectively to the shift from year-end selling to buying excitement in the new year. Another potential reason is that investors first deploy a new investment plan from a new year.

Whatever the reason, given the rise of many altcoins, this January now leans in favour of proof of this precise phenomenon. It remains to be seen whether this is predictable or whether it is due to the downward trend combined with the third year of President Biden Us.

Considering that most of the data suggests that the game ends a bit early in the middle of the month, altcoins might still have a few days to shine. How do cryptocurrencies end in January?

In my telegraph chain, I launched an experiment called "the January effect" where I purchased a handful of altcoins. Since December 31, 2022, we have seen spectacular results. Fet & sol are top performers, and the average achievement is an increase of 37%. Past 7 days in crypto: pic.twitter.com/1NEOlXTpV7

— Tony "The Bull" Spilotro (@tonyspilotroBTC) January 10, 2023

BlocksInform

BlocksInform