Risky assets like bitcoin (BTC) and the tech-heavy Nasdaq index unexpectedly put in a positive performance on Tuesday even as U.S. consumer price index (CPI) data revived hawkish Federal Reserve (Fed) concerns and sent Treasury yields higher.

A rise in bond yields makes borrowing more expensive and typically has traders ditching risky assets in favor of fixed-income securities, as observed in 2022. Higher bond yields make borrowing more costly and generally force traders to shift from risky assets to fixed income, as seen in 2022.

U.S. CPI data showed January inflation slowed slightly from the previous month, but the cooling trend moderated. The data also lifted the two-year yield to a two-month high of 4.64% and prompted traders to ramp up bets of a quarter-point (25 basis point) The cooling tendency has moderated.

US CPI data show that January inflation slowed slightly compared to the previous month. fed rate increase in june while assuming similar moves in march and may. The central bank raised rates by 25 basis points last month, after rising by half a point in December and four increases of 75 basis points at the beginning of 2022.

"Last year's rapid tightening cycle impacted risk assets, including cryptocurrencies. "[We] guess the thinking is as long as the Fed doesn't panic and go back to 50 basis points, we are in for a slow ride, which equities can stomach, especially if its a period of strong growth with high prices which will still benefit equities through higher earnings."

"Risk assets are following implied volatility, which sold off heavily following the CPI release," QCP Capital's market insights team told CoinDesk. "[We] guess the thinking is as long as the Fed doesn't panic and go back to 50 basis points, we are in for a slow ride, which equities can stomach, especially if its a period of strong growth with high prices which will still benefit equities through higher earnings."

[We] believe that until the Fed panics and returns to 50 basis points, Let's take a walk, that the actions may bear, especially if it's a period of strong growth with high prices that will always benefit stocks with higher profits. (Amberdata)

Implied volatility refers to the options market's forecast for price turbulence over a specific period and is often equated with uncertainty.

"amberdata" implicit volatility refers to market forecasts of options regarding price turbulence over a given period of time and is often referred to as uncertainty.

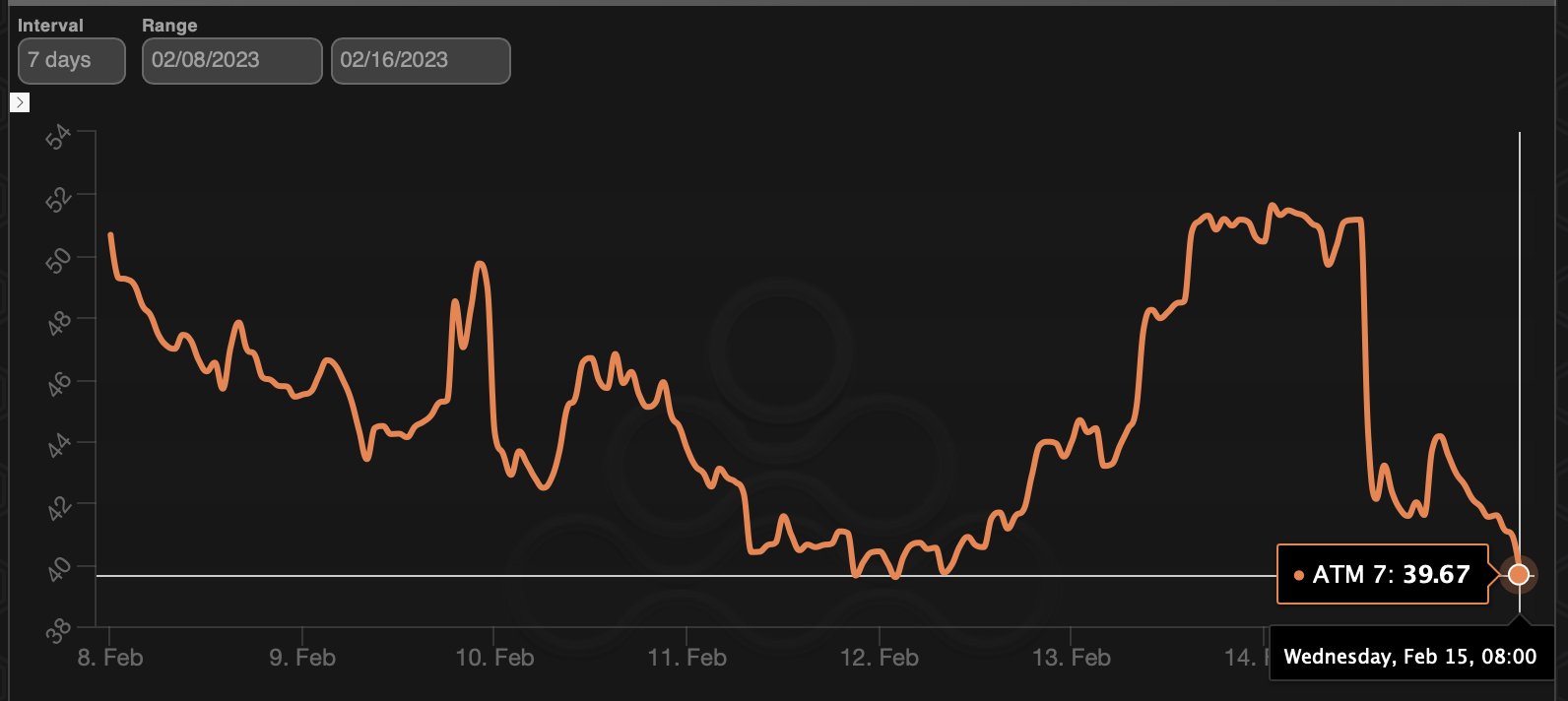

Amberdata's data shows that Bitcoin's implied seven-day volatility plummeted to an annualized rate of 40% from 50% after the publication of the Consumer Price Index, pave the way for cryptocurrency to keep pace with higher tech inventories. Goldman Sachs CEO David Solomon on Tuesday said the prospect of a softer landing for U.S. economy has improved. David Solomon, chairman of goldman sachs, said on Tuesday that the outlook for a milder landing for the American economy has improved.

Goldman Sachs Chief Executive Officer David Solomon said on Tuesday that the outlook for a milder landing for the US economy has improved. In December, the median dot projected a year-end 2023 rate of 5.125%.

Based out of Singapore, the resilience of bitcoin can be transitory, especially if "it starts to look like the Fed is going to increase the graphic point median at the March meeting." in December, the midpoint was an end-of-year rate of 5.125% in 2023.

Noelle acheson, the author of the popular crypto is macro now newsletter, Bitcoin says resilience arises from the decline in wider market volatility and its positive impact on liquidity conditions. "Liquidity is not just dependent on lower rates, it is also influenced by factors such as volatility (lower volatility tends to reduce collateral requirements, and both the VIX and the MOVE bond volatility index are heading down) and the oil price (a lower spend on energy releases more liquidity)."

Liquidity depends not only on lower interest rates, it is also influenced by factors like volatility (lower volatility tends to reduce warranty requirements, and the volatility index of VIX and MOVE bonds is falling) and the price of oil (a decrease in energy spending frees up more liquidity).

'Unlike equities, cryptocurrencies do not have to worry about earnings cuts, nor will they be hit by a wave of bond issues and resulting higher yields,' said Acheson.

Griffin ardern, a crypto asset management company's volatility trader blofin, said shares of market makers raised bitcoin higher after the price index data. Marketers are natural or legal persons with a contractual obligation to maintain a sound level of liquidity on a stock exchange.

They are generally in contrast to investor transactions and maintain a delta-neutral (management-neutral) portfolio which requires active management. In Ardern's opinion, investors had purchased btc put alternatives, or down gambling, during the period preceding the publication of the CPI, which means that market makers have sold bitcoin puts and sold on the spot/future market to protect themselves from the risk of falling prices.

Ardern says, investors had purchased BTC put alternatives, or down gambling, during the period preceding the publication of the CPI, which means that market makers have sold bitcoin puts and sold on the spot/future market to protect themselves from the risk of falling prices.

So after the prices started to go up after the CPI, the market makers had to buy the bitcoin sold.

BlocksInform

BlocksInform