The EU is using the recent Terra Luna situation to push forward the digital euro CBDC.

Many will view the volatility created by the algorithm-supported stablecoin attack, ust, as a reason to increase stablecoins regulation. With $16 billion evaporating within days, it is hard to sustain calls for greater protection for investors.

The identity of the attacker is currently unknown. There are many theories, but no tangible evidence of government or institutional involvement at this time. However, a common thread among the theories is that the goal was to create instability within the stablecoin market to fast-track the adoption of CBDCs.

Janet yellen spoke in front of the treasury committee during the crisis, the treasury of the united kingdom has reiterated its willingness to regulate stabbing, and now the eu puts its cap on the ring. Fabio Panetta of the European Central Bank (ECB) and the person in charge of developing a CBDC for Europe said,

“Recent developments in the market for crypto assets illustrate that it is an illusion to believe that private instruments can act as money when they cannot be converted at par into public money at all times… There is no guarantee that they [stablecoins] can be redeemed at par at any time - just last week, the world's biggest stablecoin temporarily lost its peg to the dollar."

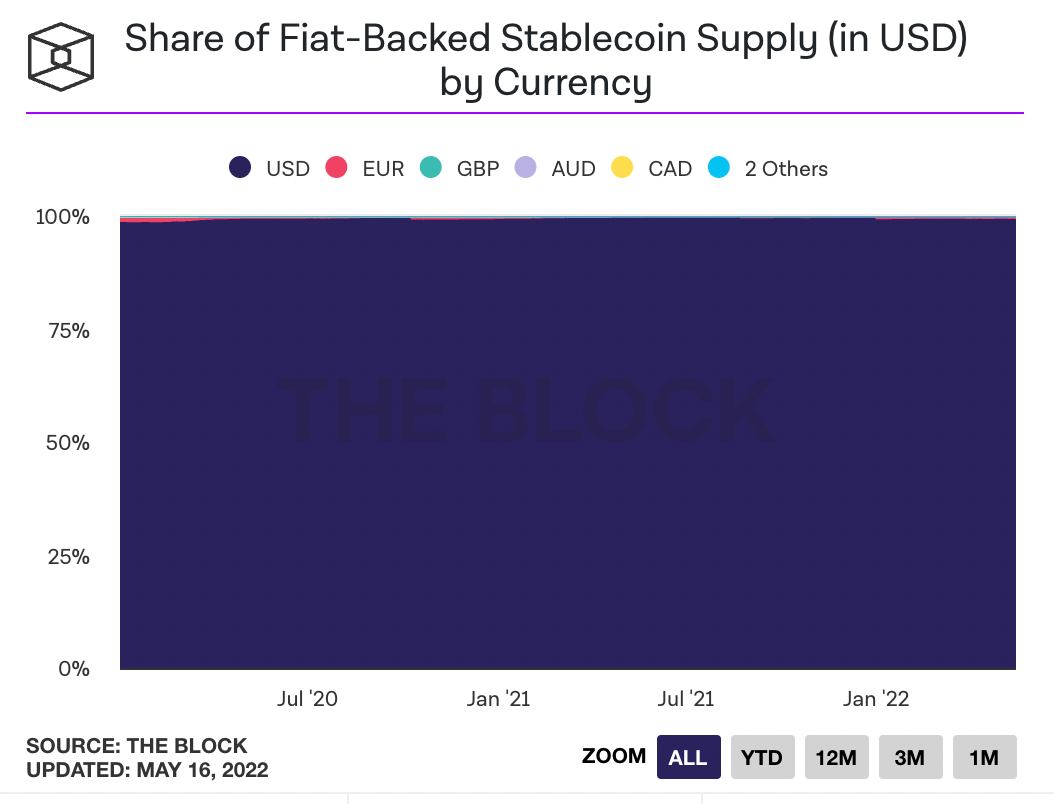

A clear rationale for a glacial approach to crypto-sustained stablecoins is that no other currency has made real progress in space. More than 99% of all stability outstanding is guaranteed by the dollar rather than by the pound sterling, the euro or countless other fiduciary currencies.

The graph below shows the market share of crypto-currencies composed by the high fiat system.

On-going news from traditional media focuses on the environmental impact of Bitcoin and the benefits of proof of participation instead of proof of work.

Every CBDC report that has been published focuses on a demonstration of interest model with minimal energy use. Panetta added “that a digital euro “can only be successful if potential users find that it adds value to current payment options.”

BlocksInform

BlocksInform