The data show that over 70% of the total supply of staked equipment comes from staking services, with the lido being the highest.

Ethereum Staking Service Providers Have Locked In A Total Of 11.4 Million ETH

Last year, ETH successfully completed a transition to a Proof-of-Stake (PoS) consensus mechanism, which meant that miners no longer had a role to play on the network as chain validators called “stakers” filled in their role.

Just like miners, punters earn rewards for acting as network nodes and managing transactions.

Such as juveniles, Punters earn awards to act as network nodes and deal management, It's about becoming a gambler, The only thing an investor has to do is lock a 32-year guarantee in the staking agreement, and contrary to the requirements of the mines, the validator does not need a large amount of computational power to perform the task. The miners do, too, Punters earn awards to act as network nodes and deal management, It's about becoming a gambler, All an investor must do is lock a 32 ETH security in the Ethereum staking contract, and contrary to the requirements of the mines, the validator does not need a large amount of computational power to perform the task.

As per data from the on-chain analytics firm Glassnode, the total value locked into the Ethereum staking contract is now around 16.1 Million ETH in the overall network (that is, including all platforms as well as investors with self-custodial wallets). These services generally operate by grouping locked rooms by the various users, in order for the combined amount to exceed at least 32 eth.related reading: Bitcoin might fall to $15k if fed does not rotate, ex-crypto exchange chief data warnsas of glassnode chain analysis company, the total value locked in the staking contract is now approximately 16.1 million eth in the global network (i.e., including all platforms and investors who have self-service portfolios).

Here is a chart that shows how much of this ETH is coming from the different staking services in the market:

Looks like Lido is the largest player in the market right now | Source: Glassnode on Twitter

As displayed in the above graph, the total amount of Ethereum staked by all these services adds up to 11.4 million ETH, which is just under 71% of the entire staking supply. Lido alone contributes 4.7 million ETH, which is more than 29% of the total coming from these platforms.

Lido alone accounts for 4.7 million eth, or over 29% of the total from these platforms. Lido is a decentralized cash stakeout pool, which is a kind of platform that adds the investors' eth to the staking pool and gives them another token in return that is supported 1:1 with their initial position.

Coinbase, Kraken, and Binance, the next three biggest providers in the sector, combined have locked in about 4.3 million ETH. Read on: is Bitcoin a «fraud» and a «company stone?» Jamie Dimon, CEO of jpmorgan, declares socoinbase, kraken, and binance, Top 3 suppliers in the industry, together have locked into approximately 4.3 million eth. Related reading: Bitcoin is it 'fraud' and 'Pet Rock? ' JPMorgan CEO Jamie Dimon called SoCoinbase, Kraken, and Binance, Top 3 suppliers in the industry, together have locked into approximately 4.3 million ETH.

Their individual dominance is 12.8 per cent for Coinbase, 7.6 per cent for Kraken, and 6.3 per cent for Binance.

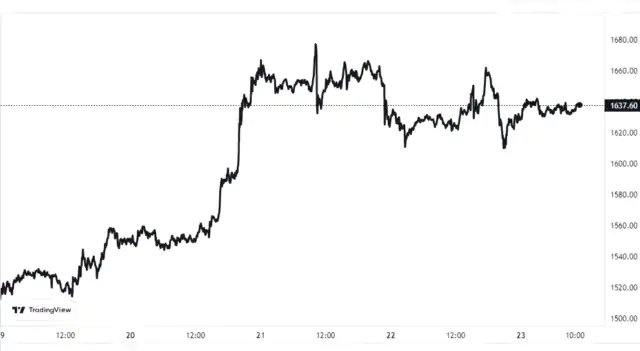

The value of the crypto seems to have been moving sideways since the surge a few days ago | Source: ETHUSD on TradingView

BlocksInform

BlocksInform