The aether is again deflationary while the market tries to bounce back in 2023.

Data from ultrasound.money shows ether’s net issuance, or the annualized inflation rate, has dropped to -0.07%, meaning the volume of ether being burnt is outpacing the amount that is being minted.

Marcus sotiriou, Digital Asset Broker's market analyst globalblock, attributed the recent flare of burnt ether to a peak in the nonfungible token () sales stimulated by the positive feeling of the crypto market as a whole.

More than 14,700 ethers (), worth around $24 million, have been burnt over the past seven days, according to ultrasound.money. Some 3400 were burned in the course of these exchanges. NTF marketplace OPENSEA is the top seven-day and 30-day gas-guzzler among platforms, ultrasound.money found.

According to data from cryptoslam, NFT sales volume jumped over 5% to $242 million over the past week and 80% of sales volume, or around $195 million, is based on the Ethereum network.

"More sales on ethereum means more deals happen, resulting in more eth being burned," sotiriou said coindesk.

Market participants widely expected that last fall’s Ethereum Merge, which shifted the platform’s protocol from a proof-of-work (PoW) to more energy-efficient proof-of-stake (PoS) protocol, would turn ether deflationary.

The aether inflation rate also depends on a separate mechanism called the aether enhancement (eip) proposition-1559, Charges paid for network transactions are "burned" or removed from traffic. EIP-1559 is related to the amount of ether burned while operating the network: The greater the number of transactions on the blockchain, the greater the burn of the EPF.

ETH became deflationary when the amount of ether being burned rose amid market volatility triggered by crypto exchange FTX’s implosion in November. But ETH subsequently turned inflationary because of slow network usage as the crypto market remained in the doldrums.

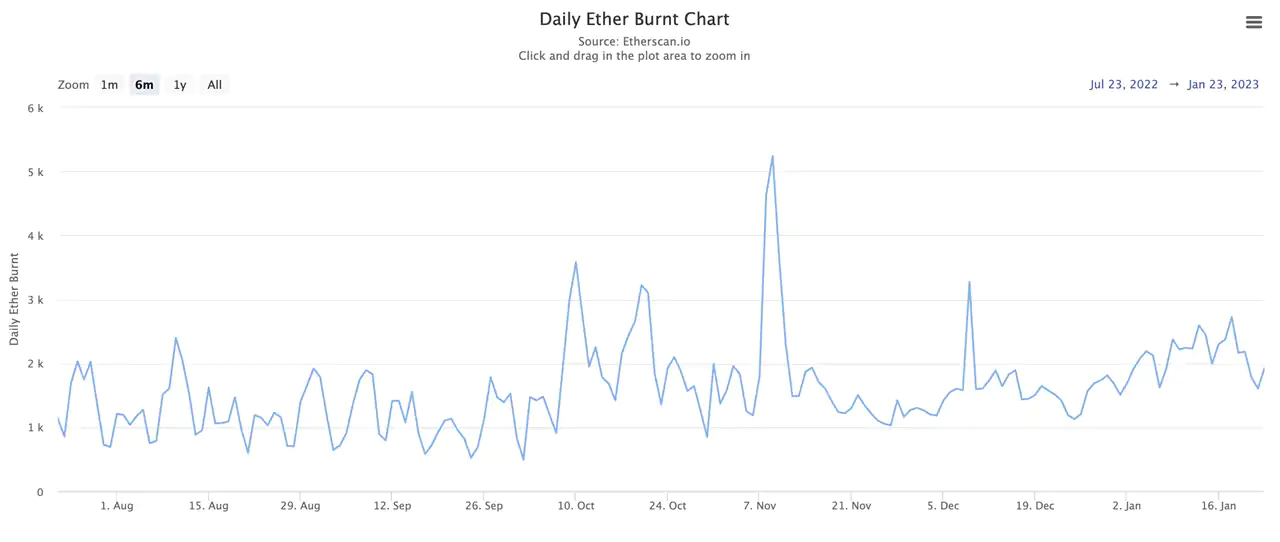

But as the market bounced back, the use of the ethereal platform jumped up and went back to deflationary. Daily combustion has increased from levels almost exclusively between 1,000 and 2,000 EPF in the last six months to a maximum of more than 2,700 EPF on January 18, as measured by .

The daily chart Ether Burnt shows a slight increase in the quantity of ether burned in mid-January. (Etherscan)

At the time of the press, the EPF was trading at $1,625 on Monday, an increase of approximately 4% over the previous seven days.

BlocksInform

BlocksInform