Cryptocurrencies are decentralized forms of electronic money, yet for the most part, the places where you obtain cryptoassets — exchanges — are thoroughly centralized. This centralization has a practical and a political downside, since not only does it introduce single points of failure in which precious funds might be lost, but it’s likely to lead to concentrations of power and influence.

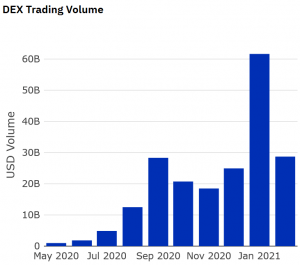

Decentralized exchanges (DEXes) are a solution to this quandary, and while they remain relatively niche compared to centralized exchanges (CEXes) (in terms of volumes), much of the industry seems to be confident that they’ll witness significant growth in 2021. This will be helped by the introduction of new innovations, from layer two scaling solutions, improved automated market maker (AMM) models, and atomic swaps.

Despite the market desire for faster improvements and growth, even major centralized crypto exchanges are improving. Binance told Cryptonews.com that it expects DEXes to ultimately overtake their centralized equivalents somewhere down the line.

It is a niche market, but one that is growing

While industry figures are generally in agreement that DEXes will witness growth in 2021, opinion is mixed as to how strong and fast such growth will be.

“It's a pretty high entry threshold and pricey to transact on DEXs. Until this changes we can't expect true mass adoption, and the shift to decentralized domination,” said Alexi Lane, the project spokesman at Ethplorer, an Ethereum (ETH) tokens explorer.

This is also the view at Binance, which runs a centralized exchange and is developing a DEX of its own.

“Centralized exchanges provide the convenience needed for mass adoption […] DEXes are a niche segment for a niche market, there’s a thick layer of awareness that needs to be penetrated via consumer-friendly interfaces,” a spokesperson for the company told Cryptonews.com.

It becomes clear from trading volumes that DEXes have still yet to overtake CEXes in terms of market share. The biggest DEX — Uniswap — currently has a daily volume of USD 1.25bn (according to CoinGecko), while Binance’s daily volume is USD 27bn.

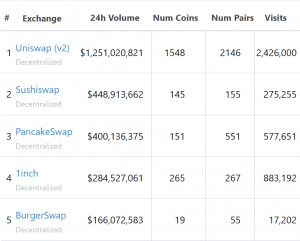

Here are the top 5 DEXes in terms of trading volume:

In fact, at the time of writing, 74 centralized exchanges boast bigger daily volumes than Uniswap, which is the only DEX in the top 75 exchanges by trading volume. However, even though trading is concentrated mostly around CExes, many individuals in the DEX sector claim this is changing dramatically.

“I certainly think decentralized exchanges will gain significant traction in 2021,” said Kadan Stadelmann, Komodo (KMD) Chief Technology Officer (CTO) and lead developer at Komodo’s decentralized exchange solution, AtomicDEX.

Currently, the DEX volumes don’t compare to CEX volumes. However, despite that, he added that DEXes need to be viewed with respect to the way people value them and their role in the market.

“One indicator of this is the recent rise of DEX tokens in the market cap rankings. UNI, 1INCH, and CAKE are all currently inside the top 100 market cap, and none of them even existed just 6 months ago,” the CTO said.

With the aid of innovation

For Stadelmann, a number of technological developments and innovation will facilitate the rise of DEXes in 2021.

“There are a few projects in the space like Komodo focused on creating interoperable solutions that support not only ETH and ERC-20 tokens but also BTC, LTC, and other assets on decentralized exchanges,” he said, referring to the fact that most DEXes today currently limit trading to the Ethereum blockchain and ERC tokens.

Likewise, Martin Koppelmann, CEO of Gnosis (GNO), a developer of market mechanisms for decentralized finance, also said that technology will help DEXes grow this year.

“I think 2021 will bring a lot of surprises in terms of how much decentralized exchanges grow in comparison to centralized exchanges,” he told Cryptonews.com.

One area that is estimated to receive considerable attention is automated market maker (AMM) algorithms, which DEXes use to price assets instead of the kind of traditional order books used by CEXes.

“According to Binance's spokesperson, “DAXes will continue to innovate on AMM models for increasing the efficiency of the market and come up with new ways to generate yields for liquidity providers in 2021.”

As BINANCE starts to expand, they expect to see a rise in the number of sophisticated derivative products and traditional finance instruments (such as options, futures, and contracts for difference). “One emerging trend is the popularity of synthetics that represent assets in traditional finance,” they stated.

According to Martin Koppelmann, scalability will be the most important aspect of improvement, with Gnosis expecting 2021 to be the year that DEXes start rolling out solutions on Layer 2.

“This means applications that build on Ethereum that improve upon lower level technical features, such as lowering the currently high transaction costs. The current transaction costs (‘gas prices’) are a big barrier for many people that want to use these types of services,” he said.

This company aims, through introducing new solutions and products, to make gasoline more affordable and accessible, so as to gain retail investors who cannot afford current prices.

“We have already deployed several of our products to one such solution, the Ethereum sidechain xDai, which is already proving a popular and effective antidote,” he said.

As noted above, most DEXes limit trading to ERC tokens, even though CEXes allow for easy trading for assets from any chain via an IOU-like system. Kadan Stadelmann said that this weakness will be increasingly addressed after this year.

“ERC20 DEXes use wrapped tokens for representing value across chains, which ultimately requires trust in a centralized third-party custodian […] For DEXes to surpass CEXes, solutions like atomic swap technology are crucial for providing trustless cross-protocol trading where users are always in control of their funds,” he said.

A secure and free society

Another trend we might see in 2021 is that security and custody concerns could be what drive more traders to trading on DEXs, as these naturally involve holding your own crypto. This transition may be sped new cases of large exchange hacks, thereby underlining the risks of trusting a centralized party with your funds.

“DEXes are more secure than CEXes for the most part. They are generally safer because the user has sole access to their private keys, but that doesn’t mean there aren’t security challenges to consider,” said Stadelmann.

It was his opinion that liquidity pools that carry AMM protocols allow for centralization of the trading on DEX's, while insecure smart contracts expose DEX to additional risks.

In order to gain broader adoption, DEXes have to either improve upon AMM technology or eliminate them from their models completely. “As new solutions emerge that deliver better overall security along with liquidity provider incentives, we will see market share shift from CEXs to DEXs”, he added.

Another, recently emerging issue relates to the whole GameStop saga, which resulted in various trading platforms suspending trading in shares of the game retailer, other companies, and even cryptocurrencies.

“As more and more people try DEXes as an alternative to centralized options, we have found that DEXes are becoming more and more popular. This trend seems poised to continue with the events unfolding around Robinhood and stocks like GME and AMC, which have demonstrated to retail investors that using centralized providers comes with the price of being at the mercy of their policies,” said Koppelmann.

Regardless, he added such fears are mostly taken care of when trading on DEXes.

“This recent incident and the wave of public opinion following it has already begun to open more people's eyes to the ethos and potential of decentralization: fair marketplaces for a free market,” he said.

Can you describe how big it is?

While decentralized exchanges are certainly going to gain traction in the next few years, it will take a long time before they can really rival the big centralized exchanges. For Binance though, it will be even bigger.

“LIKE any emerging technology, DEXes will take some time to completely dominate the market. We don’t expect this to happen in 2021, but DEXes are bound to take over CEXes a few years down the line.”

___

Learn more:

Crypto Exchanges to Spend 2021 Focusing on DeFi, UX, and New Services

Decentralized Exchange on Ethereum Is Not Sustainable - FTX CEO

Regulators May ‘Disallow Trading on DEXs Entirely,’ Investor Warns

Don’t Have a Fast Bot? Beware of Initial DEX Offerings, Researchers Warn

A Reddit Army Blurs The Line Between Crypto and Traditional Finance

___

Find more insights about the crypto trends in our special series Crypto 2021.

BlocksInform

BlocksInform