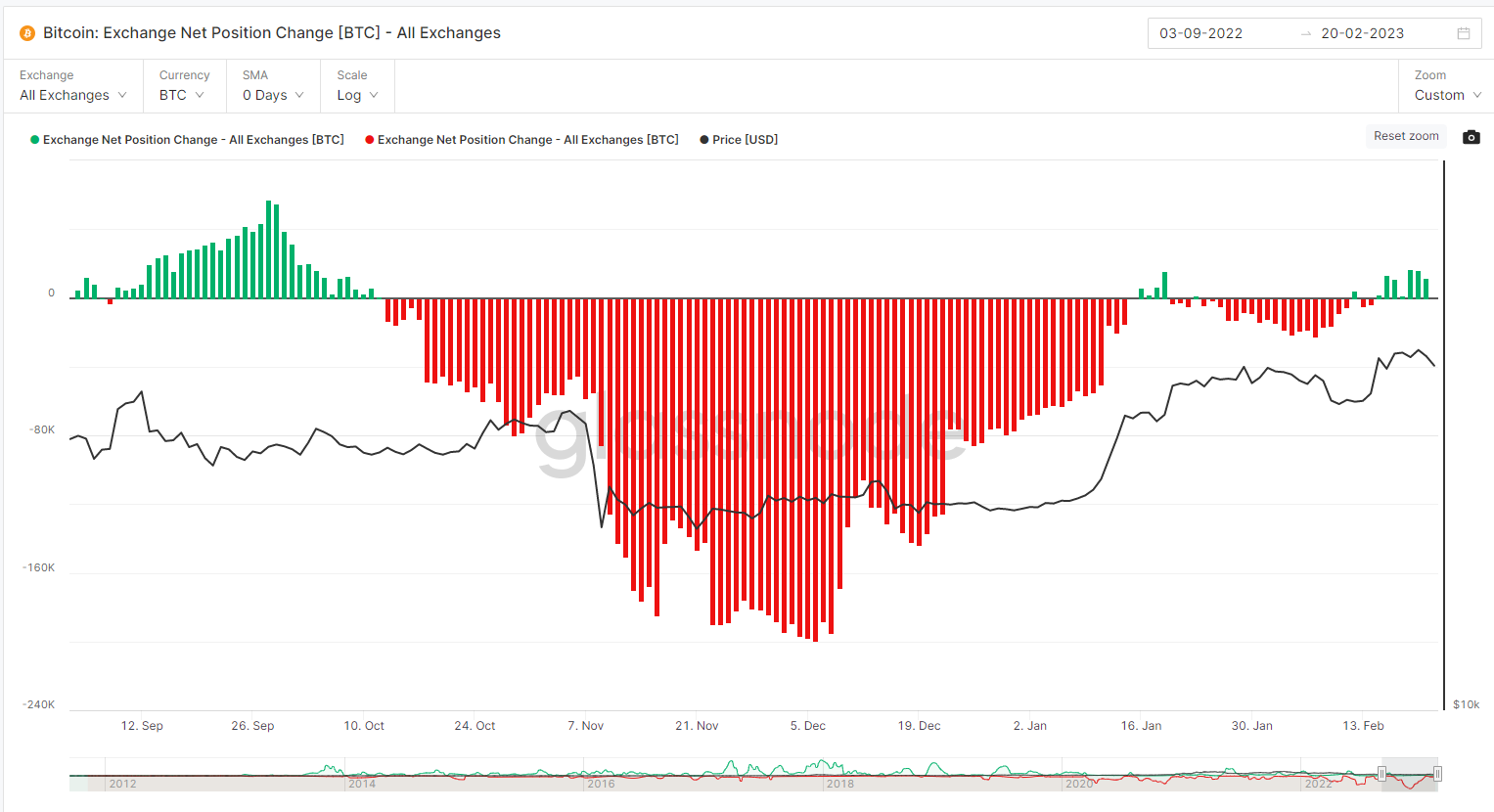

Bitcoin and aether have separate pathways into and out of trade.

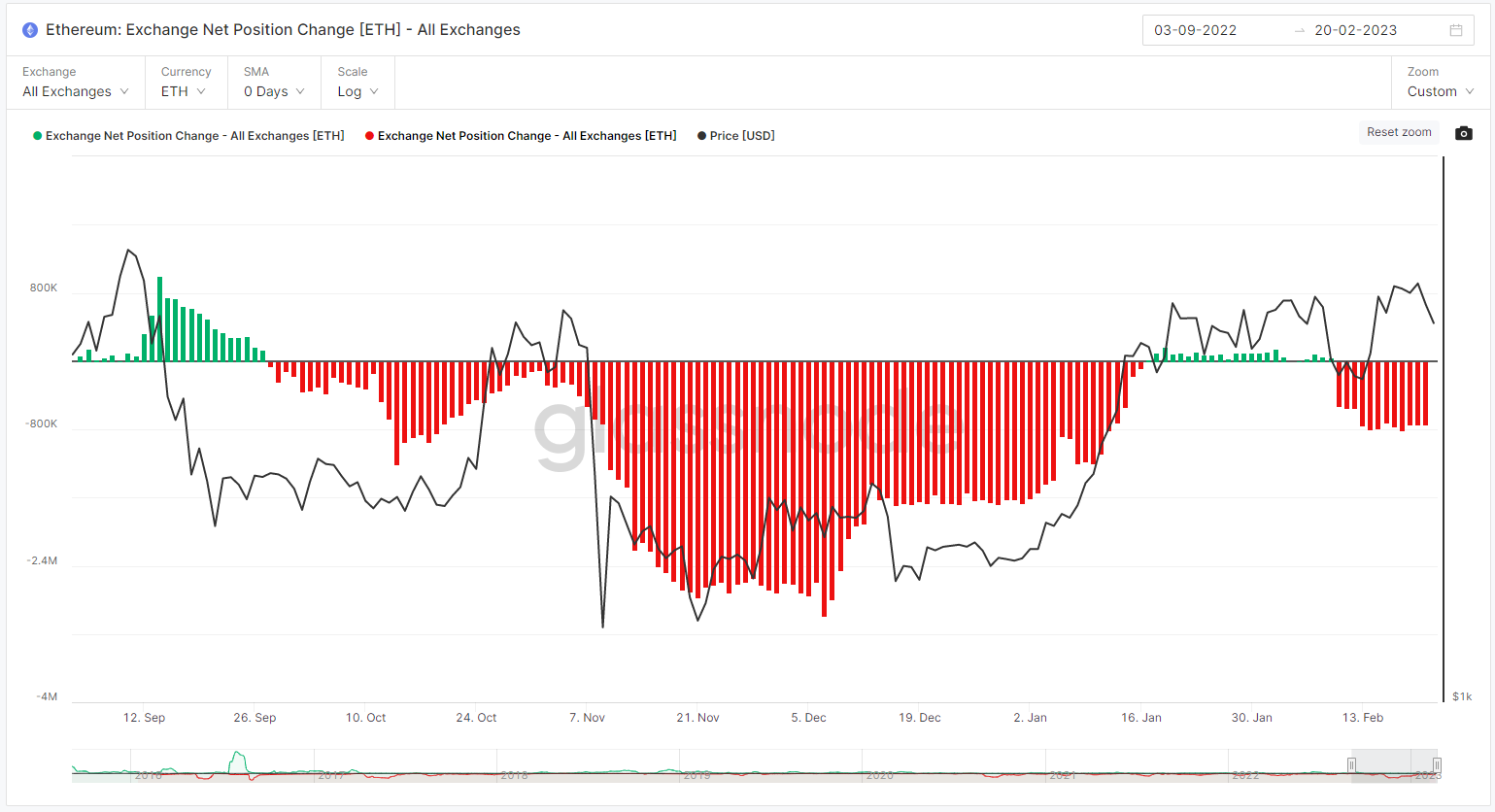

The measures of the net position show that the investors send bitcoins to the exchanges and take away the aether. The net position indicators show that investors send Bitcoin to trade and get the aether out of it.

The moves imply a downward sentiment for the BTC and optimism for the EPF, a deviation from their more typical correlated trajectories.

Exchange balances tend to increase when investors are considering selling an asset, or at least placing themselves in positions to do so quickly. Investors removing assets from exchanges implies that investors are looking to hold the asset.

(Glassnode)

Investors who withdraw stock market assets assume that investors seek to hold the asset (Glassnode). Bitcoin trending bearishly would run opposite its average performance following a "golden cross," such as the one that the asset reached Feb. Bitcoin downtrend would run at the opposite of its average performance as a result of a "gold cross," such as the one that the asset reached in February.

Bitcoin's downtrend would run at the opposite of its average performance following a "gold cross," like the one the asset reaches on February. 18.

The price of Bitcoin has increased on average by 8% following the seven gold crosses since 2015 before the last one.

A gold cross occurs when the 50-day moving average price of an asset exceeds its 200-day moving average.Incentives?

What lies behind the final moves? Carbon prices are still up 42% since the beginning of the year, and investors may not be able to ignore the temptation to make a profit. A key point to keep an eye on is whether the btc movement on the stock markets is increasing.

There has been a moderate increase, more reflective of investors seeking to manage risk as the market appears to be coming out of a period of contraction rather than negativity. Activity was stronger as the change in its net trading position was negative in each of the last 13 days. Exchange rates were eliminated at a time when prices fell by 10 per cent between February and February. 13.

The EPF was more active because the change in its net foreign currency position was negative in each of the last 13 days.

13.Since the beginning of the year, the Btc has outperformed by around 8%, despite a 33,000-point fall in the ether supply since September. Since the beginning of the year, BTC has surpassed the EPF by about 8%, despite a decrease in the ether supply of 33,000 EPF since September.

BlocksInform

BlocksInform