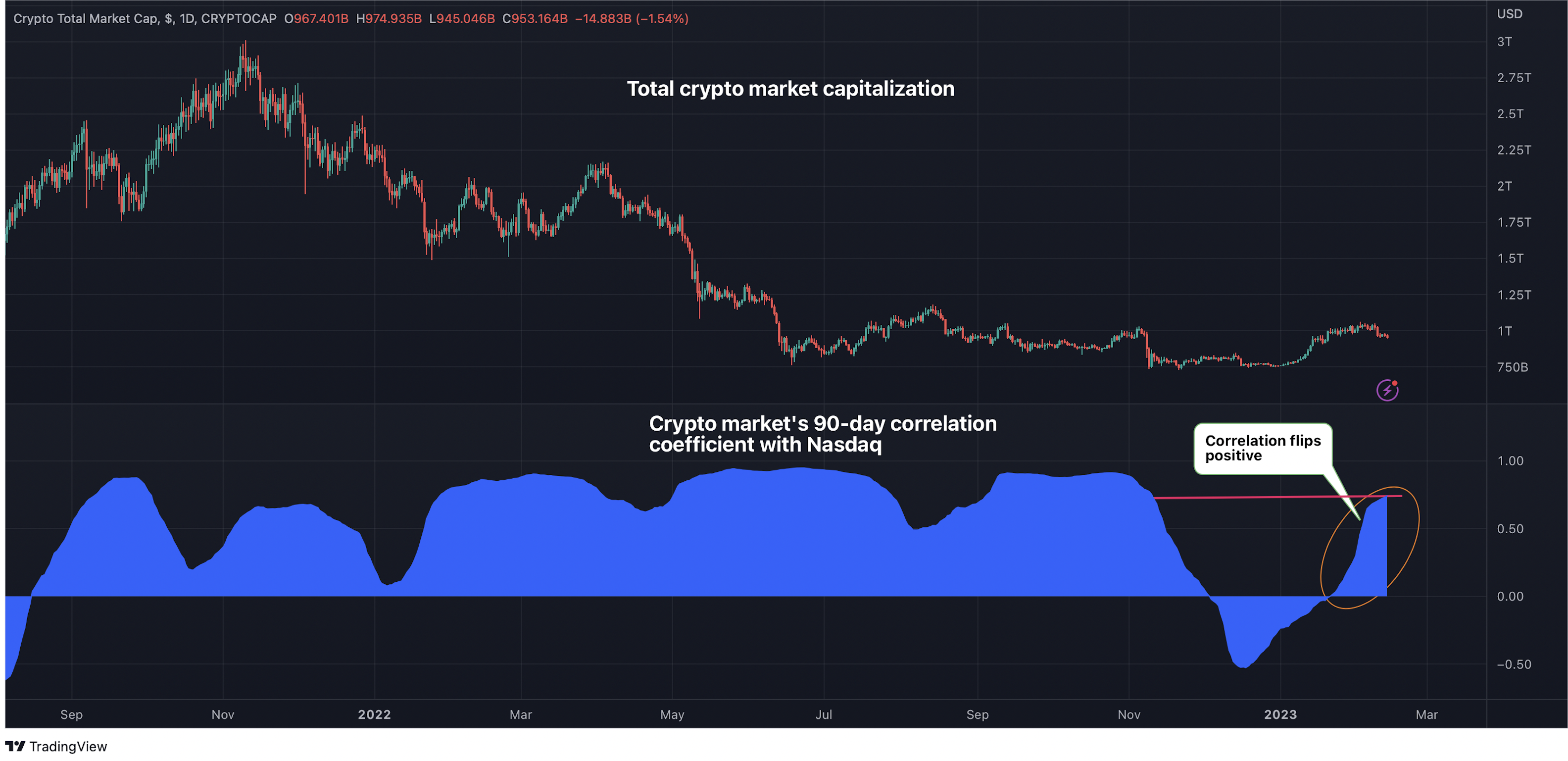

The correlation between the crypto market and the technology-intensive nasdaq equity index has become positive, indicating a renewed focus on Wall Street risk appetite among digital asset investors.

The 90-day correlation coefficient between the total capitalization of the crypto market with nasdaq has increased from -0.12 to 0.74 in 4 weeks, at its highest point since the beginning of November, depending on the data from the tradingview graphical platform.

In other words, the cryptography market is changing again alongside technological actions. On days of higher tech stocks, cryptocurrencies, including bitcoin (btc) and ether (eth), are likely to do the same. Conversely, a drop in technological equities could lead to a drop in the cryptography market.

Speculation that the Federal Reserve (Fed) would use rate cuts later this year may be at the root of the renewed correlation among cash-dependent risk assets. The long-held positive relationship had crumbled in November, thanks to the spectacular collapse of Sam Bankman Fried's FTX exchange that saw crypto investors dump their tokens despite the risk reset on Wall Street.

The correlation is determined by comparing the general returns or movements of two assets or commodities over a period of time. A correlation near 1 suggests that the two assets go hand in hand, in the same sense. At the same time, a negative correlation means that both assets are going in different directions.

Renewing the positive correlation means that cryptocurrencies are more sensitive to factors that influence stock markets, such as the publication of the U.S. CPI. (CoinDesk/TradingView)

The renewed positive correlation implies increased cryptocurrency sensitivity to the release of macroeconomic data such as the US Consumer Price Index (CPI), which injects volatility into equity markets. The CPI days were among the most volatile for U.S. stocks last year, according to MarketWatch.

The Bureau of Labor Statistics report on Tuesday's CPI in the United States is expected to show that annualized inflation fell to 6.2% in January from 6.5% in December, as estimated by Reuters from FXStreet. The basic CPI, which excludes the volatile component of food and energy, is expected to increase from 5.7 per cent to 5.5 per cent.

A better-than-expected figure could wipe out hopes for the Fed's so-called easing pivot, pushing tech stocks and crypto-currencies down.

The release of Tuesday's Consumer Price Index will be a huge figure. It is expected that the CPI will be higher than expected, taking into account the recent massive NFP surprise, it could turn out to be rather bearish for risky assets," wrote gregoire magadini of the crypto service provider amberdata in Sunday's weekly bulletin.

According to andreas steno larsen, founder and CEO of steno research, data on the consumer price index should be lower than anticipated. Which would strengthen hopes that interest rates would be reduced.

'Based on our models and metrics - leader as well as lagging behind - we expect printing to be in the 6.1% and 5.3% ranges for core and securities, Larsen said in a note sent out to subscribers last week.

Salaries have slowed down across all significant forward indicators, housing is at extremes compared to the reality of the consumer price index, This means we are seeing greater downside risk/return in the core segment versus stocks," said Larsen, while providing for the energy component's positive contributions, commodity prices, including pre-owned automobiles, and tiredness at the right price.

The total crypto market capitalization has recently reached a six-month high of $1.06 trillion and was $948 billion at the time of publication, representing a 25% gain since the start of the year. Nasdaq picked up 12 percent this year.

BlocksInform

BlocksInform