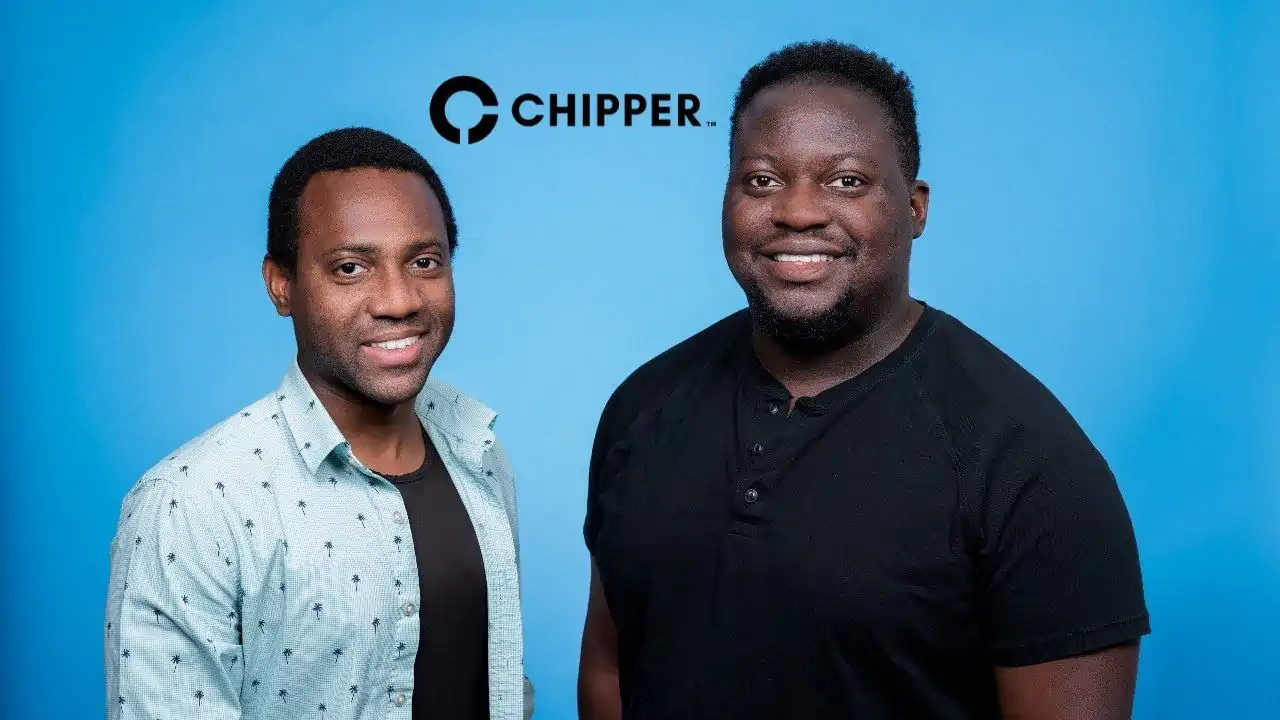

Pan-African payments app, Chipper Cash, has laid off 50 employees across multiple departments, with the engineering department losing 60% of staff.

The pan-African payments application, Chipper Cash, dismissed 50 employees in several departments, with the engineering department losing 60% of its staff.According to Techcrunch, a number of employees have taken Linked.

To reveal this situation that affected 12.5% of employees of the enterprise. While I was away, a lot of my close colleagues and friends were. If you’re looking for talented engineering leadership, engineers, technical program managers, analysts, or IT staff…,” Erin Fusaro, the VP of Engineering at Chipper Cash in her LinkedIn post.

Chipper made headlines when he raised 150 million dollars in a series c extension that estimated the company at 2 billion dollars, making it one of only 5 unicorns in Africa. The round was led by bankrupt crypto platform, FTX, financing about $40 million of the round as the 2 companies also explored how FTX users in Africa could use Chipper Cash to move funds on and off the FTX trading platform

The round was carried out by the crypto platform in bankruptcy, FTX, The funding is approximately $40 million as Both companies also explored how FTX users in Africa could use Chipper Cash to transfer money to and from the FTX trading venue. This was revealed by a recent spreadsheet containing Alameda Research investment portfolio, indicating that Chipper Cash received an additional $See also: Luno strikes 10 million customers – a million added in 6 months, 40% in South Africa kodzillaApril 14, 20220 reviews.5 million in SAFE from FTX at a $1.25 billion valuation.

This was revealed by a recent spreadsheet containing the Alameda Research investment portfolio, indicating that Chipper Cash has received an additional $The company is obviously experiencing problems.5 million in FTX SAFE worth $1.25 billion.

- Ovex ($5 million from FTX at a $122 million valuation)

- AZA Finance ($25 million promissory note/loan)

- African mobile money unicorn, Wave ($10 million in equity)

- South African crypto exchange platform VALR ($4 million equity)

- Nigerian crypto exchange startup, ($500,000 from FTX at a $20 million valuation);

- Nestcoin ($250,000 equity from FTX at a $30 million valuation)

- Congolese-based web3 startup, Jambo ($500,000 in tokens)

Ovex ($5 million FTX at a value of $122 million)AZA Finance ($25 million promissory note/loan) unicorn of African mobile money, Wave (10 million dollars in capital)South African crypto exchange platform VALR (4 million dollars in capital)Nigerian crypto exchange startup, ($500K from FTX to $20M) ; Nestcoin ($250,000 in FTX equity on a $30 million valuation)Startup Web 3 Congolese, Ham ($500K in chips)

In November 2022, another FTX investee, Nestcoin, a startup that builds, operates, and invests in Web3 applications for Africa, said it was forced to release some of its employees following the FTX bankruptcy.

Nestcoin, which leveraged an investment of $6.45 million in February 2022 from multiple participants, including the search on alameda, He said he had a portion of his money frozen on the deceased swap, impacting the company's operations. According to the founder, yele bademosi, part of the money they collected was held in ftx, either as estates or in cash.

The disclosure does not indicate how the Chipper funding was worded or structured.

____________________________________

BlocksInform

BlocksInform