Celsius, the now deceased crypto creditor and borrower, sold bitcoin and eth deposited by clients to purchase this, one's own chip, the auditor of bankruptcy shoba pillay declared in a document of the court.

“Celsius did not earn sufficient yield on its crypto asset deployments to fully fund its CEL buybacks,” Pillay said, adding:

“As a result, it began using customer-deposited Bitcoin (BTC) and Ether (ETH) to fund its CEL purchases.

But because Celsius did not have adequate reporting systems in place to ensure the tracking and reconciliation of client assets, piece by piece, celsius was not able to follow up on missing parts to meet customer obligations.

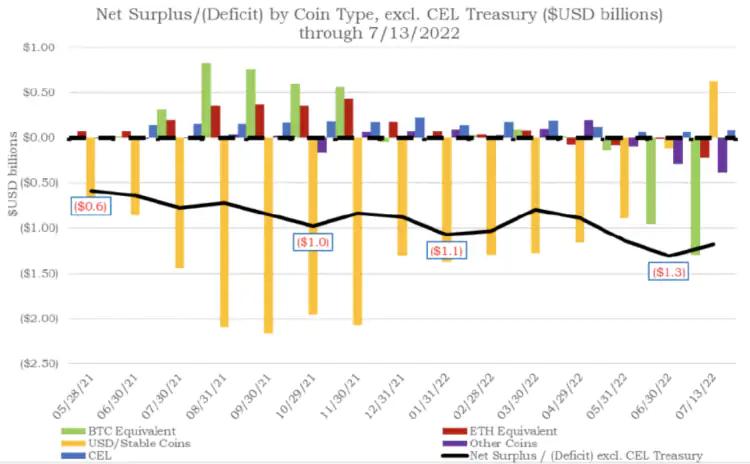

Celsius was caught off guard at the beginning of 2021 when he discovered a deficit in BTC and eth (which he had used to finance buyouts of cel).

As BTC and EPF prices increased at that time, the dollar amount it cost at Celsius to purchase the required number of BTC and EPF also increased."

Celsius then used the customer’s stablecoins to buy bitcoin and eth in May at the cost of $300 million, but:

“As customers began withdrawing BTC and ETH from Celsius in May and June 2022, Celsius had to unwind its borrowings to recover the BTC and ETH it had pledged. As clients began withdrawing BTC and ETH from Celsius in May and June 2022, Celsius had to repay its borrowings to recover the BTC and ETH it had promised.

As a result, its stabilization deficit has been replaced by a BTC and BFS deficit."

There has been speculation in the crypto space since the FTX collapse that some of these now bankrupt entities were selling bitcoin and eth to prop up their own tokens or invest in other assets because FTX curiously had a very low amount of bitcoin or eth.

Some suggest that this practice has led to pressure on the price of Bitcoin, and may explain why it hasn't seen a hit above it.

Some suggest that this practice has led to pressure on the price of Bitcoin, and may explain why it has not seen an off top move.

BlocksInform

BlocksInform