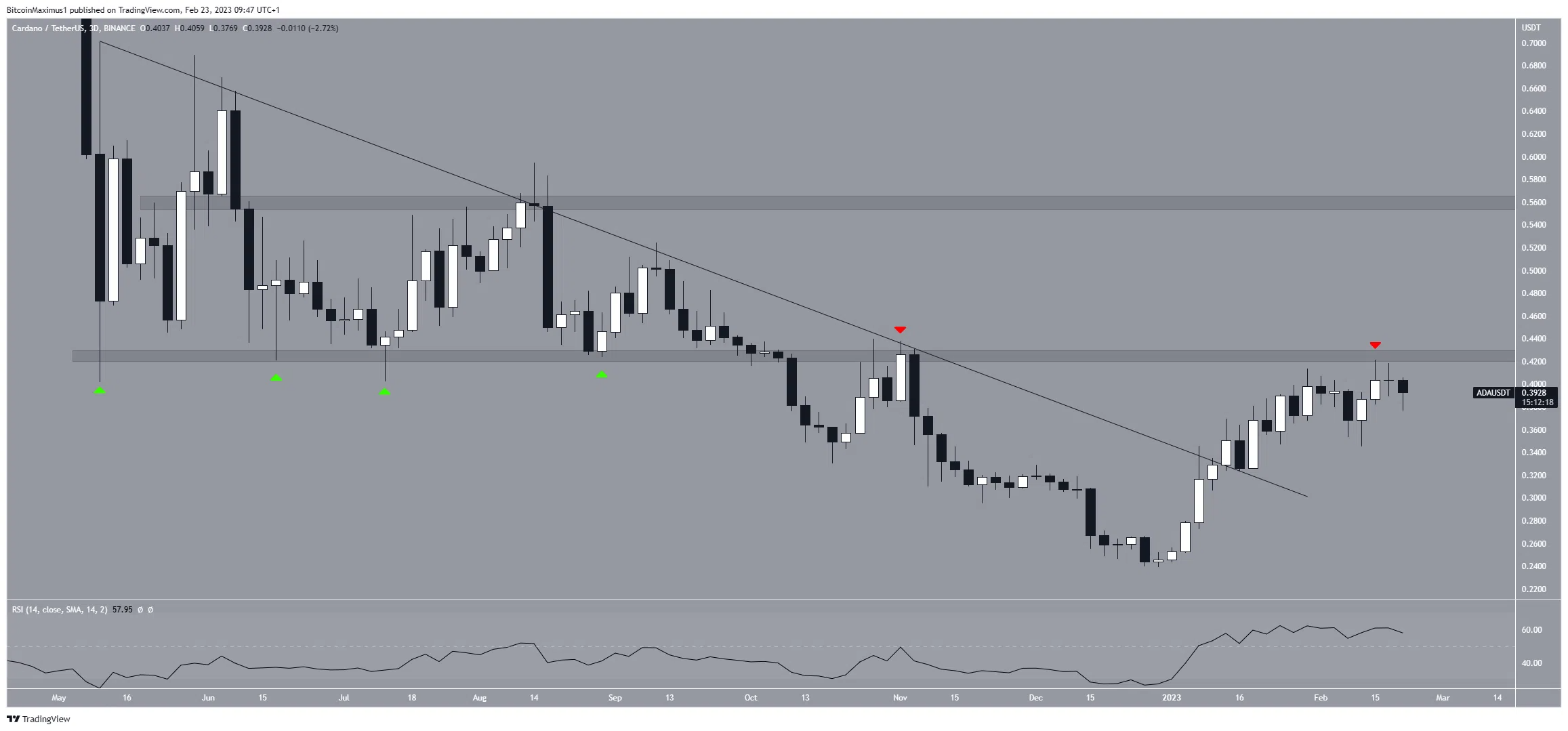

Cardano (ADA) price regained its footing on Feb. 13 and is currently attempting to break out above the $0.425 resistance area.

ADA is the indigenous piece of the Cardano blockchain platform, designed by Charles Hoskinson. Cardano burst down a line of resistance in the second week of January. After validating the line as a medium (green icon), it continued the increase which is still in progress.

On Feb. 1, ada hit a new high of $0.421 annually. But in spite of the rise, it has not yet exploded from the resistance zone of $0.425. This is a critical area as it has been acting intermittently as support and resilience since May 2021.

The fact that the price of cardano explodes or is discarded may determine the direction of the future trend. A successful breakout could act as a catalyst for a subsequent increase in resistance to $0.56.

Since the weekly is greater than 50, a break is slightly more probable.

Has the Cardano Price Adjustment (ADA) been finalized?

technical analysis from the short-term six-hour chart supports the continuation of the upward movement. While Ada was on a downhill climb in February. 9, he bounced back to 0.382 supportive fibered retracement four days later.

Then Ada started what looks like an impulse movement upwards.

Continuing the increase is thus the most probable scenario. If there is a breakout, the ada price could rise to $0.58.

However, if a drop below the 0.382 Fib retracement support level occurs, ADA could fall to the 0.5 Fib support at $0.326 could follow.

In closing, Cardano's most likely price forecast is a breakout in excess of $0.425, which could lead to a jump to $0.580. However, a decrease of less than $0.346 would invalidate this possibility and could result in a decrease to $0.326 and potentially a decrease.

BlocksInform

BlocksInform