Bitcoin () matched six-month highs on Feb. 21 as the last attempt to toggle $25,000 to unsuccessful support.

Bitcoin unsettled before Wall Street open

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $25,250 on Bitstamp.

A firm rejection on the hourly deadlines then saw the pair come back under $24,750, keeping a trading range in place throughout the weekend.

With a rue de mur in February. 20, Bitcoin faced three days of "off time" trading with thinner liquidity and more risk of volatile movements from top to bottom.

These, to some extent, came to pass, with efforts to beat the prior week’s highs being short-lived, resulting in liquidations of both long and short traders, data from Coinglass confirms.

Monitoring resource Material Indicators continued to track the source of flash volatility, coming in the form of whale traders on exchanges attempting to move the market with mass bid and ask liquidity.

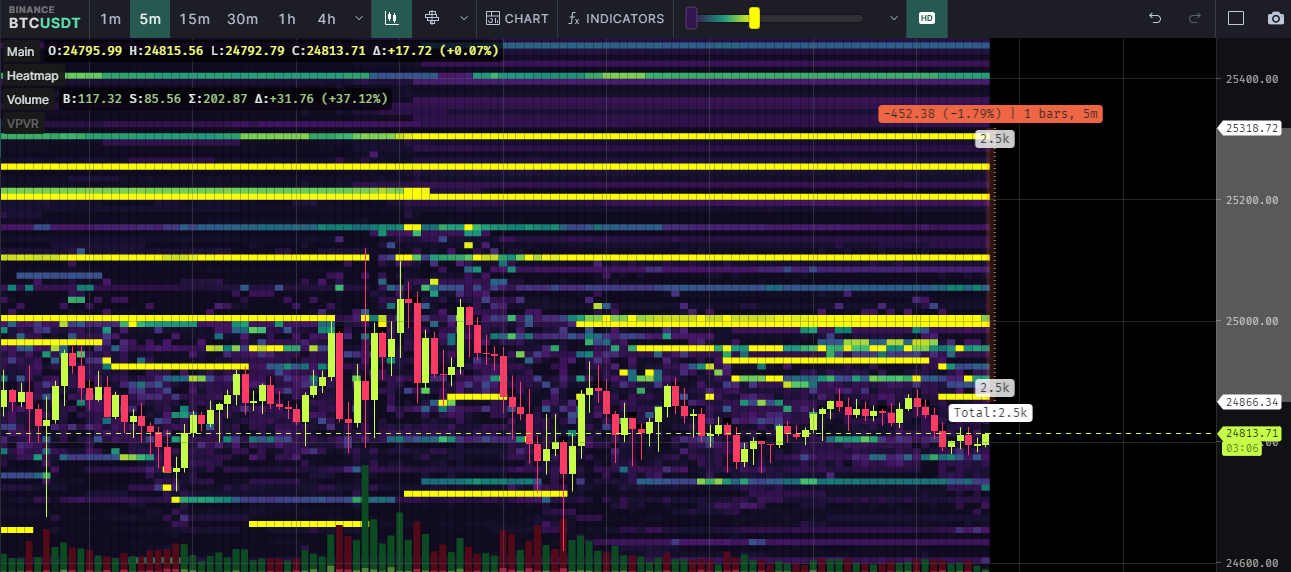

Update on the range set by the Notorious B.I.D.#FireCharts shows ask liquidity laddered up to ~$26.5k and it appears liquidity in that range is getting trickled into the active #trading range and replenishing resistance at $25k. Want to see more bids above $24k to retest $25k. pic.twitter.com/RW0MMxCuIl

— Material Indicators (@MI_Algos) February 20, 2023

“2500 BTC in sell orders stacked between $24.8–25.3K on the BTC/USDT pair,” popular trader Daan Crypto Trades continued.

"might be for three reasons: 1. real sales orders. 2. Price suppression orders to execute orders prior to subsequent withdrawal or purchase. 3. Orders to walk price down.”

Source: Daan Crypto Trade / Facebook.

“We are grinding $25,000 once again here, but the question remains do we stay above that resistance zone, or deviate and come back down,” part of a Twitter commentary stated.

"We are spending $25,000 more here.

In an update on an existing theory, Venturefounder, a contributor to on-chain analytics platform CryptoQuant, predicted a retest of lower levels before upward continuation for Bitcoin.

Related: Bitcoin faces do-or-die weekly, monthly close with macro bull trend at stake

In an update on an existing theory, Venturefounder, a contributor to the CryptoQuant chain analysis platform, predicted a retest of lower levels before Bitcoin's upward pursuit.

“$25k BTC is very alike $31k in July 2021,” he argued.

It was based on market conditions starting in the middle of 2021, when BTC/USD produced a record "double top" in April and November, respectively.“

Venturefounder cautioned that macroeconomic events could weaken Bitcoin and crypto more broadly — part of a complex series of predictions from crypto sources for the upcoming year.

BlocksInform

BlocksInform