The market panic that ensued after the collapse of Sam Bankman Fried's FTX exchange in early November seems to be abating.

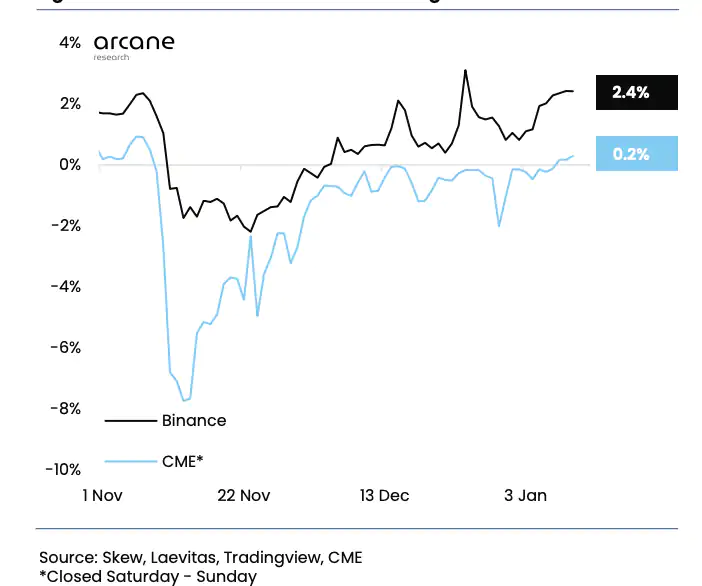

The three-month bitcoin (BTC) futures listed on the Chicago Mercantile Exchange (CME), widely considered a proxy for institutional activity, are drawing a premium over the the cryptocurrency's going spot market price for the first time since FTX went bust.

The renewal of the bonus means that institutional activity is no longer focused on the short side. The CME futures fell into a record discount in mid-November as sophisticated traders took bearish bets to hedge against a deeper FTX-induced slide in the leading cryptocurrency.

Bitcoin, however, has been more resilient than expected in the last couple of months, with the decline capped at about $16,000.

The base denotes the difference between forward and cash prices. (Arcane/TradingView Search) (Arcane, Skew, Laevitas, ECM, TradingView Search)

The three-month CME futures traded at a 0.2% annualized premium, while their BINANCE counterparts received a 2.4% premium.

The forward structure of CME futures – the difference between forward contracts of different maturities at a particular point in time – remains inverted or lagging, according to obscure research.

This means that subsequent-month contracts continue to trade at lower prices than near-month contracts, an anomalous condition, given that prices are generally higher at the end of the curve.

Despite the recovery of the MEC base, The structure of the terms remains late as institutional investors maintain a cautious perspective on Bitcoin and less liquid other expiration dates dated," Bendik Schei of Arcane Research and Vetle Lunde wrote in a note to customers.

BlocksInform

BlocksInform