In December, when btc/usd was trading for the last time over $18,000, philip swift, co-founder of subsequent trading decentrader, was nevertheless already watching a movement from surrender to accumulation..

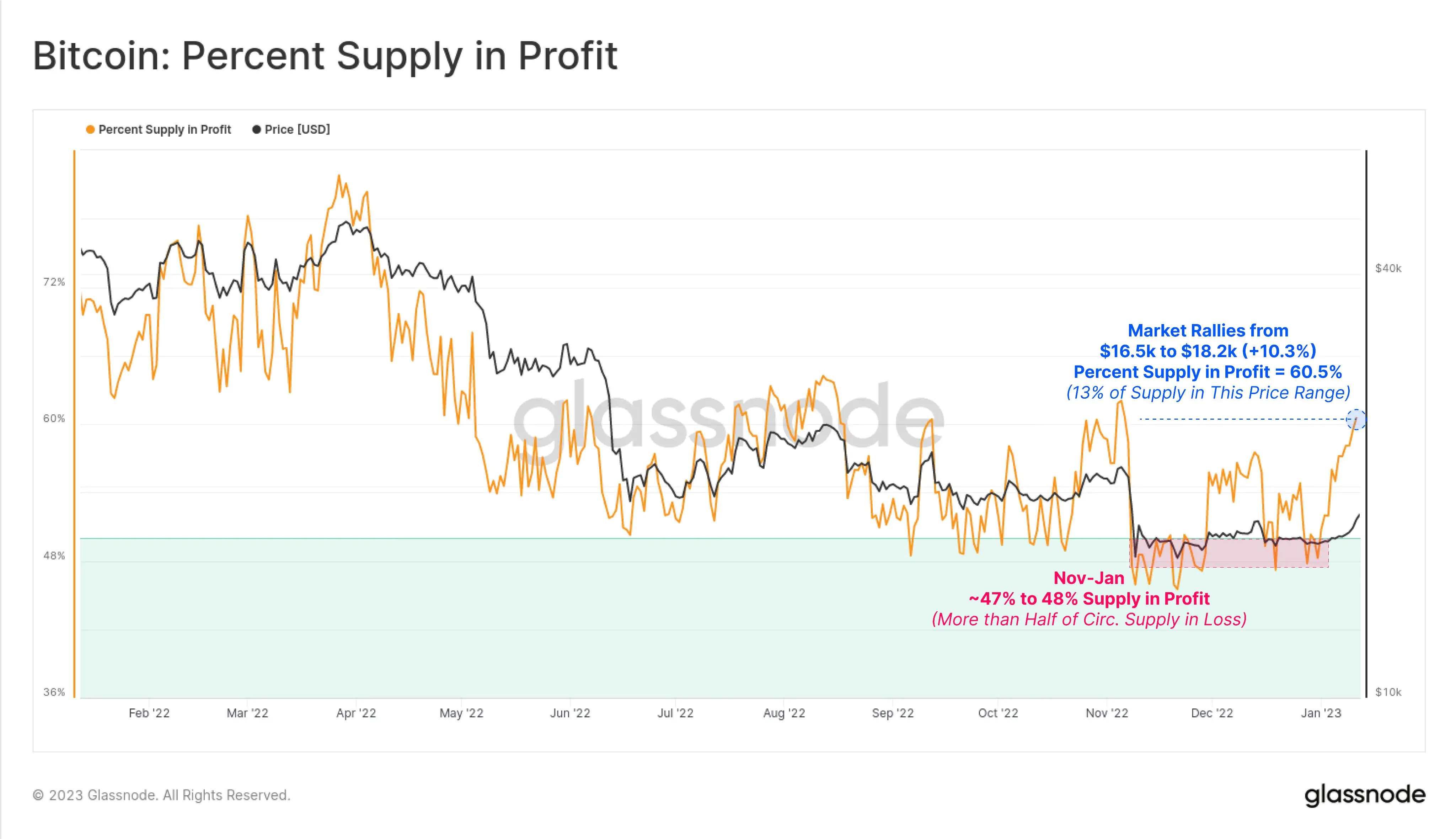

The latest figures from on-chain analytics firm Glassnode shows a large swathe of the BTC supply heading “into the black” as BTC/USD passed $18,000.

The latest figures from the analysis company on the Glassnode chain shows a large portion of the BTC offering cap "in the dark" as BTC/USD spent $18,000.

After gaining nearly 5% in 24 hours, Bitcoin is back on bulls’ radar ahead of a crunch United States inflation data release.

The impact will remain uncertain.

The chain analysis reveals a more important phenomenon already present on the market.

The last price rise saw a considerable number of bitcoins swing from unrealized loss to unrealized profit - it is now worth more than the last time it moved.

If this means that investors who have purchased below the current cash price are benefitting, it suggests that a significant portion of BTC's supply has shifted hands in a region between that region and recent multi-year lows.

“Simple Bitcoin tools like Supply in Profit return massive edge for those who pay attention,” Checkmate, Glassnode’s lead on-chain analyst, commented about the data.

That has an impact on price performance, because the investors who are buying are doing a great deal of price support. "Simple Bitcoin tools such as Supply in Profit return massive edge for those who are careful," Checkmate, Glassnode's chief analyst on the chain, commented the data.

It means a foundation of massive surrender --> buildup."

Bitcoin % offers in graphically annotated earnings.

“"Surrender" and "accumulation" correspond to the classical cycles of the market, One in particular is Wyckoff, This requires a period of accumulation after a macro depression, This is expected to lead to the next bullish phase of the market in the future.

In terms of numbers, at $18,200, 13% of BTC's outstanding offer had returned to profit, Glassnode said.

Bitcoin at one-month highs meanwhile provides a stark contrast to post-FTX chaos in terms of profitability.

Related: Bitcoin gained 300% in year before last halving — The mood resonates with the peaks of December.

As Cointelegraph reported, in the aftermath of the FTX meltdown, hodlers were sitting on more than half of the supply in unrealized loss.

The picture barely improved in subsequent weeks, with Bitcoin's realized cap drawdown nearing bear market bottom territory.

In December, at the time when BTC/USD last traded above $18,000, Philip Swift, co-founder of trading suite Decentrader, was nonetheless already eyeing a move from capitulation to accumulation.

BlocksInform

BlocksInform