Despite crypto’s rise to prominence, decentralized applications or dapps and their user onboarding mechanics lack behind the quality user experience provided by more traditional apps. To achieve mass adoption for dapps, Mirror World proposes a World Store that serves all blockchain networks, while providing a seamless experience for all end users buying or investing into dapps, ecosystems and assets.

World Store is an asset platform powered by AI Asset Agents. This decentralized open asset delivery network means to serve users in lowering the trading and exchange costs of assets across all chains. The AI Asset Agent identifies the best personalized asset recommendation while helping users settle transactions from any currency, to any asset, on any chain.

Industry Snapshot

Growth in decentralized apps

A brief history of our crusade

How users find suitable assets in Web3 now?

For Web3 to reach hundreds of millions of users, facilitating transactions and payments is the top priority. Currently, many traditional financial institutions connect fiat to cryptocurrencies, overcoming regulatory issues. From a product experience perspective, reducing high-friction UI interactions while improving usability is a direction wallet partners strive towards.

It’s fair to say a gap exists between Web2 payment rails to Web3 trading. Moreover, shifting from fiat to crypto, asset selection ambiguity plagues new users due to indistinct Web3 ecosystem offerings. The relationship between L2/L1 ETH perplexes newcomers, as does optimal asset allocation for their trading profiles.

For different trading strategies and user types, asset distribution and liquidity remain static and independent today, lacking tailored recommendations. Sudden cheerleading and hype for certain assets by influencers often accelerate liquidity due to sentiment, prompting rash, emotional trades for users.

It’s fair to say users currently face certain challenges in crypto.

The crypto challenges for users

Difficulties in Discovery Assets:

- Unsure which assets match investing behavior and preferences

- Hard to find appealing projects (gaming/apps) from project updates

- Over-reliance on influencers instead of proprietary research

Difficulties in Settling Assets:

- Issues depositing and withdrawing funds

- Confusing fee structures – platforms/protocols charge repeatedly, increasing costs

- Assets scattered across chains/VMs, struggling to consolidate and manage wallet/holdings

How might users discover assets better-suited to them in Web3?

The Tug-of-War between apps and platforms in decentralization evolution

Beyond crypto, the broader landscape of decentralized apps today mainly comprises web or mobile applications reliant on existing platforms for launch and distribution – facing impediments from traditional outlets.

For crypto application builders, onboarding, content, asset distribution, and traffic supply are a final unreachable mile outside Web3 boundaries. In crypto, trading displaces content as the focal point. Here, projects aim to offer digital assets – meaning users do not merely play games or consume content, but actively discover, engage, and purchase accompanying assets.

Distribution methods

- Traditional model prioritizes content to drive asset adoption

- Decentralized model centers around asset distribution

As previous distribution channels heavily rely on content, impeding asset velocity, apps pay recurrent taxes and advertising fees to Google and Apple. Breaking Web2’s stranglehold on content and reshaping core Web3 asset distribution is the logic for crypto asset dissemination – the problem World Store looks to resolve.

Core challenges for decentralized application builders

Reviewing the crypto infrastructure layer, the “ghost town” effect plagues many blockchain ecosystems that fail to attract users to their application offerings – creating mismatched ecosystem content and user fit. As the Web3 infrastructure backbone, public chains function as asset issuers and definers. They employ associated ecosystem offerings and asset properties to attract users. However, Web2 platforms and app stores have restricted the Web2 populace from entering Web3 through throttling and limited traffic allocation.

Construction of a symbiotic relationship

- Asset distribution directly correlates to public chain utility and activity. Effective dissemination draws greater participation, quality traffic improves stickiness, collectively increasing chain vigor in a virtuous cycle.

- Asset distribution impacts the richness of a blockchain’s application ecosystem.

- Broad asset distribution can alleviate public chain “ghost towns”.

Reliance on centralized platforms

However, blockchain projects lack independent application distribution conduits. Despite enabling direct on-chain asset transfers and liquidity, ecosystem offerings rely on centralized platforms for traffic and exposure – causing issues like:

- Rent-seeking by centralized platforms stifles ecosystem maturation as application quantity/quality plateaus.

- Limited traditional user acquisition funnels restrict audience stickiness, hindering public chain mainstream adoption.

- The significance of being decentralized cannot reach end-users, risking the fading relevance of public chains.

The dawn of mass adoption: art of decentralized applications

Considering the inherent limitations we’ve identified, what’s the formula for achieving widespread adoption with a decentralized application?

Mythical Games: The power of integrated marketplace activities and advertising flow pool

Mythical stands out with its unique deposit center, marketplace, and growth driven by Web2 advertising.

Their marquee product, NFL Rivals, leveraged familiar advertising avenues like Google Ads and Apple’s suggestions, capturing a vast US audience. This strategy propelled it to the U.S. iOS Sports Chart’s top 3. NFL Rivals was highlighted as a standout independent property, especially with the absence of fierce rivals in the mobile football arena.

Wondering about their crypto integration?

Their marketplace activity and token liquidity attest to the rising use of their tokens as the primary ecosystem currency. Launches of their individual games further spike the demand for the MYTH token. Mythical’s purchase of DMarket, one of the world’s premier CSGO skin marketplaces, underscores a pivotal Web3 design tenet: “Traders are more readily converted than gamers.” This move directly accesses the substantial liquidity of virtual asset trading. People accustomed to trading easily grasp the concept of digital asset value, making their transition to Web3 smoother than that of typical users. Mythical’s method mirrors Valve’s secondary markets; and given the right momentum and in-game consumption, their token’s value is anticipated to grow steadily.

Friend.Tech: A new way of distributing social relationships

Friend.Tech, or simply FT, with its avant-garde approach, is impeccably crafted for the “degen” audience. Racer envisioned FT as a PWA (Progressive Web App), associating each user with a deposit ID and a native bridge directly in-app. This bypasses traditional control mechanisms (Apple engineers even eased the PWA addition to Home Screen, perhaps upholding Steve Jobs’s visions against Carmack’s skepticism). By entirely overseeing the PWA’s distribution, they sidestepped risks like those faced by StepN’s marketplace on the App Store. While prioritizing crypto native users and skillfully dodging traditional app stores, the approach has some drawbacks:

- It’s tough for newcomers to adopt FT until it reaches significant scale.

- It’s more challenging (albeit achievable) to take this route for comprehensive gaming apps.

While part of FT’s genius lies in recognizing the Product-Market Fit for crypto’s long-standing Alpha Groups, melding it with social utilities, we applaud them for their clever use of bridges and PWA to bypass traditional barriers.

Mahjong Meta: A dedicated deposit center

Mahjong Meta is our third notable contender. Initially launched on the Web, plans for its Android and iOS debut are underway. While they recognize the importance of easing user entry, they are constrained by App Store policies, making them adhere to Apple and Google Pay systems. Drawing parallels with traditional SLG games, where big spenders often flock to official websites for better rates, it’s probable that Mahjong will soon introduce its deposit center.

Envision a scenario where games thrive on iOS and Android, yet a considerable chunk of users prefer a direct portal offering assets at prices at least 10% lower than those of Apple or Google. Companies like Mihoyo, with annual revenues of 3.85 billion USD, can greatly boost their profit margins by initiating their deposit centers. Savings between 5-10% could translate to profit enhancements ranging from 200 to 400 million USD.

By exploring alternative payment and deposit methods, they can potentially offer more competitive pricing to their users.

The overarching theme among these successful entities is their ability to identify market gaps, adapt to challenges, and fully leverage the strengths of both traditional and decentralized platforms. As we delved into these concepts, we realized that we are in the perfect position to unify these concepts into a new paradigm of Asset-first Distribution.

New Paradigm: An open asset delivery network

If we say Uniswap opened the door to DeFi, on-chain swaps can smoothly complete distribution and transactions. Uniswap achieved an on-chain distribution model, allowing users to freely control the liquidity of on-chain assets. On the other hand, World Store is an application marketplace that unveils strong control over asset liquidity in decentralized asset delivery networks.

Mirror World proposes World Store: An Open Asset Delivery Network for Block-based Worlds

Envision a centralized hub, the World Store, where all users – be they gamers, traders, or gamblers – have the ability to seamlessly deposit any fiat currency from any blockchain. In return, they can acquire stable coins, game-specific tokens from other chains, or even snag NFTs using simple methods like QR codes or credit cards, and all at prices substantially lower than what mainstream platforms like Apple or Google offer. The primary allure for users, especially those familiar with Web3, would be the economic advantage.

Upon making a deposit through the World Store’s asset settlement layer, users’ transactions are recorded. This isn’t merely for keeping tabs on financial activities; it forms the bedrock of a sophisticated recommendation system. Using this, users can discover similar assets launched through these Progressive Web Apps (PWAs) or portals.

Drawing inspiration from successful case studies, consider the amalgamation of various models:

- NFL Rival’s Marketplace: An integrated marketplace within the game.

- Web2 Advertisement Model: Utilizing controlled Customer Acquisition Cost (CAC) through mainstream ad platforms.

- Friend.Tech’s Token System: An efficient in-app token bridge (Multi-chain in our case)

- Mahjong Meta’s Deposit Center: A dedicated center to facilitate deposits.

When these elements are harmoniously blended, the result is a powerful blueprint for success, forming a universal template to serve a global community of users, irrespective of their preferred currency.

While the blueprint for integrating the best practices from multiple models presents immense promise, there lies a pivotal challenge: the practical execution across diverse games and platforms. Addressing this challenge requires a paradigm shift, a solution that embodies both innovation and universality.

Enter the concept of World Store: The first open asset delivery network.

World Store dissect

Combine user traffic with on-chain settlements

World Store is Mirror World’s answer, committed to simplifying global asset settlement for the entire Web3 user base and recommending appropriate assets to targeted addresses. It spotlights the most fundamental asset offerings and supplies traffic assistance across leading blockchain ecosystems and projects.

World Store is the world’s first Open Asset Delivery Platform.

In crypto, every user action interconnects with an address /wallet. Addresses interacting with World Store furnish comprehensive transaction histories since their inception, covering transfers, listings, trades, signatures, and more. Via its Recommendation Engine algorithm, relevant assets are highlighted for each transaction (e.g. what other trades might be related) to optimize associated asset purchases and expand settlement dimensions.

World Store has three core components:

The global asset settlement currently supports 10+ chains and multi-VM ecosystems, enables global payments in 150+ countries, and has enabled 50+ local payment methods. Our Asset Delivery Network, by utilizing user ID/address mapping and transaction records as the basis for an asset recommendation engine, has achieved permissionless asset delivery. The Asset Delivery Network currently hosts 20+ client nodes and has accumulated over 10 million transactions.

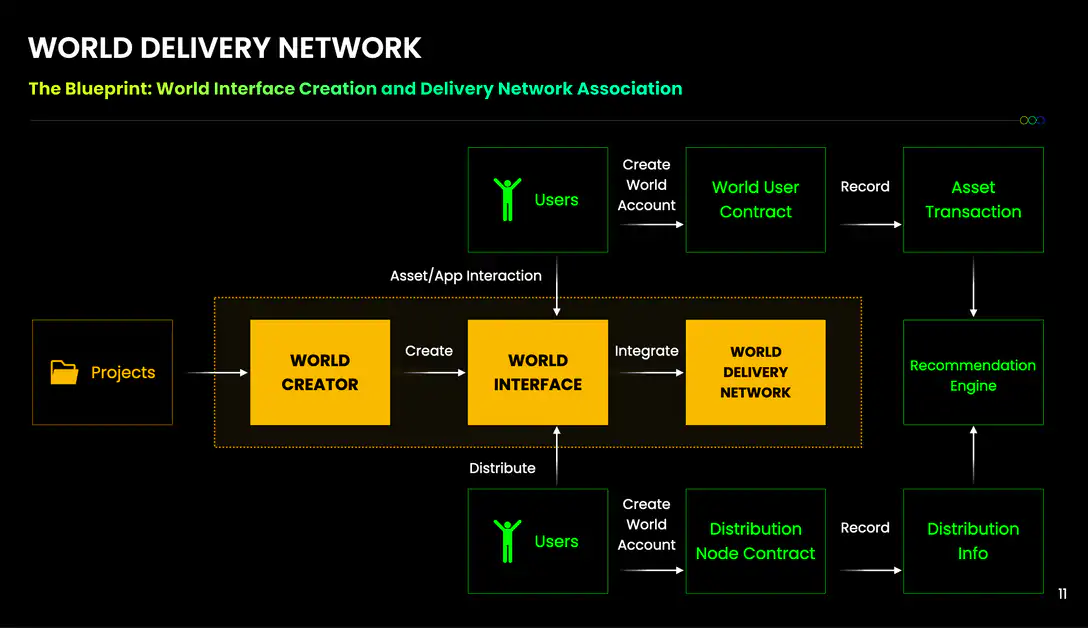

Projects create their settlement interfaces via the Node Creator, through which users directly deposit and purchase assets with the target application.

The key innovation of World Store lies in the underlying transaction engine, which shifts user transactions from fiat currency towards the target asset, associating each transaction record with the Asset Delivery Network to recommend interfaces and assets to end users. World Store leverages ID/address mapping and transaction history to recommend the most relevant assets.

By building on these components, World Store represents both the natural progression of applications away from centralized distribution and an optimization of asset delivery and settlement flows.

Global Asset Checkout: World Settlement Layer

- World Settlement Layer tackles multi-chain and multi-EVM asset settlement, with the World Settlement layer supporting networks like Rollups, L1s, and L2s.

Asset Delivery Network: World Delivery Network

- World Delivery Network empowers projects to create checkout interfaces and become delivery nodes, allowing all users to transact with their assets with lower fees and friction. Delivery Node Contract and World User Contract can record associated transaction data and contributions, providing projects oversight tools to view and manage user data.

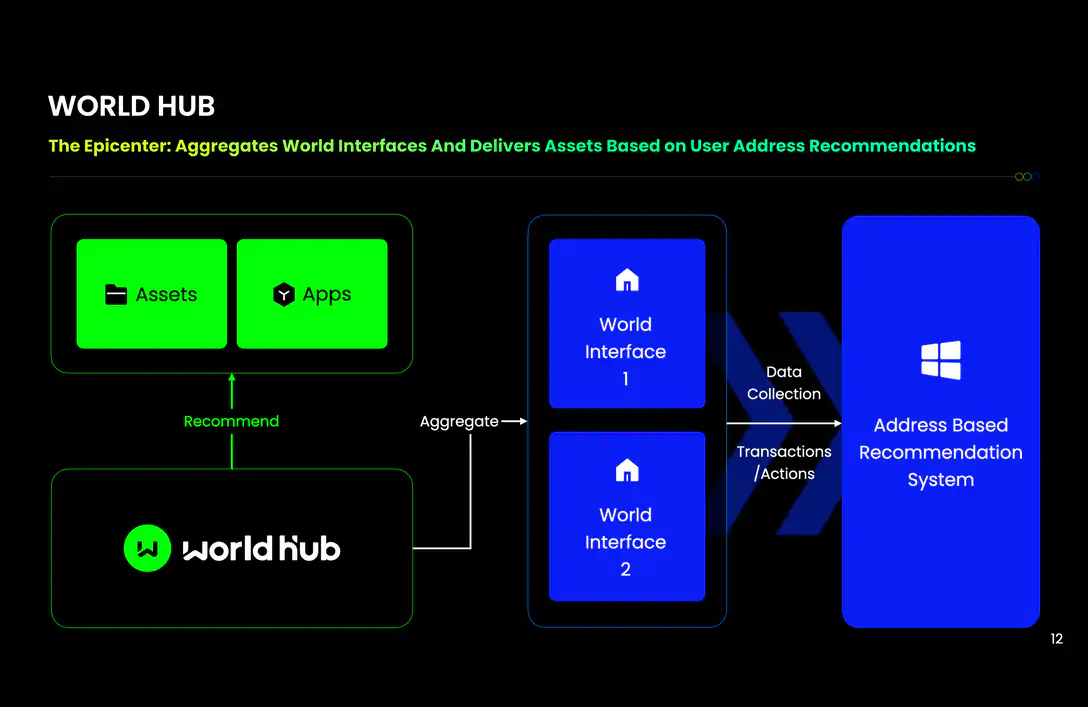

User-Facing Hub: World Hub

- World Hub aggregates partners’ on-chain assets and recommended those assets and dApps based on user transaction history.

Projects can analyze target user asset allocation patterns through World Store to identify relevant yet unreached users. This bypasses restrictions and fees traditional Web2 platforms impose on crypto apps while aggregating higher value, precisely targeted users for blockchain ecosystems.

Asset-To-Asset Recommendation

A New Paradigm: At the World Store, each transaction isn’t a mere value transfer. It’s an information unit, a pulse, that feeds into our recommendation system. Users aren’t just making a trade or purchase; they’re subtly expressing preferences, defining their digital identity one transaction at a time

In any blockchain system, transactions serve as the foundational unit of work. This parallels the way user actions like likes, clicks, scrolls, and views underpin web2 products. Take a social media platform as an example. Users like photos, scroll through feeds, and watch videos. On an e-commerce site, user purchase histories of related items contribute to the creation of product recommendations.

In web2, these actions are meticulously logged and often channeled into recommendation engines with user permission. User interactions are stored in a centralized database, allowing the system to track interests by assessing how users interact with various product features. Tools such as Kafka have enabled this deep data integration and understanding. However, financial transactions and possessions are difficult data to track normally.

Transitioning to Web3, every user action is intrinsically tied to an address. Addresses interfacing with World Store should offer a comprehensive transaction history from their inception, not just recent activities. User transactions encompass actions like transfers, listings, sales, signatures, and a myriad of other interactions. By tapping into on-chain transaction data, it becomes feasible to drive this data into recommendation engines.

Such an algorithm would scrutinize an address’s recent transaction history, map it to certain device IDs and for each transaction, highlight related assets (i.e. what are trades that correlate with other trades). This approach aims to optimize associated asset purchases, thereby boosting asset delivery. It is more similar in essence to Amazon’s Collaborative Filtering where each item provides a sense of correlation towards another item. Each asset, when associated with user address & device data, can be recommended precisely to its end trader/buyer.

World Store’s flywheel effect on Public Chains

World Store supports mainstream public chain projects like Sui, Aptos and Solana by providing a universal deposit center and aggregated page. The World Settlement layer simultaneously supports Rollups, L1 and L2. On this aggregated page, target assets can be precisely recommended to specific users through on-chain recommendation systems. This provides both a traffic flywheel while reducing the friction for users to purchase assets, with World Store offering the following services to public chain ecosystems:

- World Store can direct traffic to pages and allow users to register by logging in with native wallets of each public chain ecosystem, directing segmented traffic to different ecosystems to provide external Web2 traffic supply.

- After registering, users can purchase other tokens through World Store’s Cross-Chain DEX Aggregator from the target chain, directly streaming assets into each ecosystem’s asset procurement. Users can also purchase NFTs on the target chain through our NFT Checkout after registration, enabling the purchase of asset contents in any form within public chain ecosystems.

- For users without liquidity after registration, World Store supports On-ramp for users across countries to directly purchase assets on the target chain with fiat currency.

World Store’s traffic flywheel: The Last Mile Solution

The method of attracting Web2 traffic and user growth was to open up the offline market of the mobile internet through massive coupons and relevant discount incentives. The last mile for Web3 requires providing airdrop expectations to attract a large number of users, while retaining and converting users through product functionality. To that end, World Store has launched and offers an integrated points system and referral mechanism.

The Anatomy of World Store

Central to our vision, the World Store is comprised of three primary components:

World Settlement Layer

World Delivery Network

The World Hub

Closing words

Reflecting on the early days of the mobile app epoch, the significance of adapting and innovating becomes clear. Long before the iPhone’s reign, apps were already prevalent. Yet, it wasn’t until the convergence of visionary hardware and an intuitive marketplace (the iOS AppStore) that they truly flourished. Equally, in-app purchases saw light only when mobile payment mechanisms matured around 2012, before which we saw only one-time game payments.

As Web3 unveils new frontiers, the lessons from the past remain salient. We need to rethink the way decentralized applications are launched and focus on the asset flow between content and assets. Our endeavor is to liberate applications from the confines of the App Store and Google Pay, to democratize virtual worlds unfettered by geographical or blockchain-specific limitations. As the first light of a new era dawns, we invite you to join our journey, forging worlds that resonate as much more than games.

BlocksInform

BlocksInform