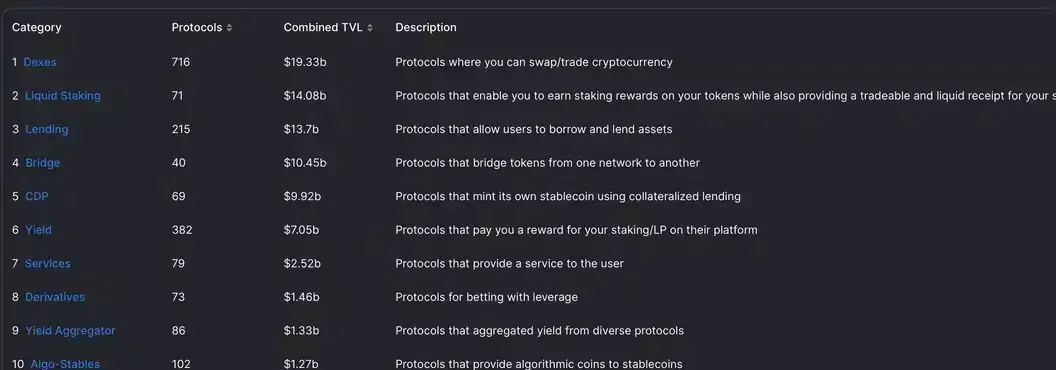

Liquid staking, which allows users to earn rewards for locking cryptocurrency in a blockchain network while retaining the liquidity of the locked funds, is now bigger than decentralized lending and borrowing.

The total value of crypto assets deposited in liquid staking protocols was $14.1 billion as of European hours on Monday, making it the second-largest crypto market sector, according to data source DeFi Llama. The total fixed value in the Challenge Lending and Borrowing Protocols was $13.7 billion, the third largest, while decentralized exchanges, with $19.4 billion in deposits, were ranked first.

The upcoming upgrade from Ethereum to Shanghai, that will allow punters to withdraw the aether (eth) they staked and rewards accrued for the first time, galvanized the interest of investors in liquid staking. Liquid staking is the most successful crypto industry this year, with Total Locked Value (TVL) growth close to 60%.

$23,423

$23,423 $1,640.11

$1,640.11 BNB$305.12

BNB$305.12 XRP$0.37291616

XRP$0.37291616 $12.46

$12.46"It [the upgrade] will innovate the current space by allowing for healthy competition between liquid staking solutions, will strengthen ETH's position by providing yield from staking/unstaking, and will give users the security of maintaining sovereignty over their assets," Messari CEO Ryan Selkis said in a newsletter published Friday.

The availability of withdrawals should improve overall liquidity. Since December 2020, over 16.5 million terminals have been staked in the Ethereum beacon chain, 42% of which have been locked by liquid staking protocols, primarily lido.

Users of liquid staking protocols such as lido are provided with derived tokens such as Pegged Ether (steth) on a 1:1 basis. These derived tokens are of user interest and can be used to generate additional performance across challenge protocols. The governance of the ldo token lido rose by 220% this year, outperforming the leaders of the bitcoin and ether industry by an enormous margin. Governance tokens of Lido's rivals Rocket Pool and Frax have also surged, according to CoinDesk data.

The increased popularity of liquid staking versus decentralized loans may also be attributed to the difference in performance between the two sectors.

Lido, who controls more than 75% of the market for liquid milestones, provides a 4.8% annualized percentage return (APR) on the ether invested, Six percent on the staked solana and six and a half percent on the Polygon MATIC token. It is higher than the rates available to lend the best stablecoins usdt, usdc et dai on the giant aave challenge.

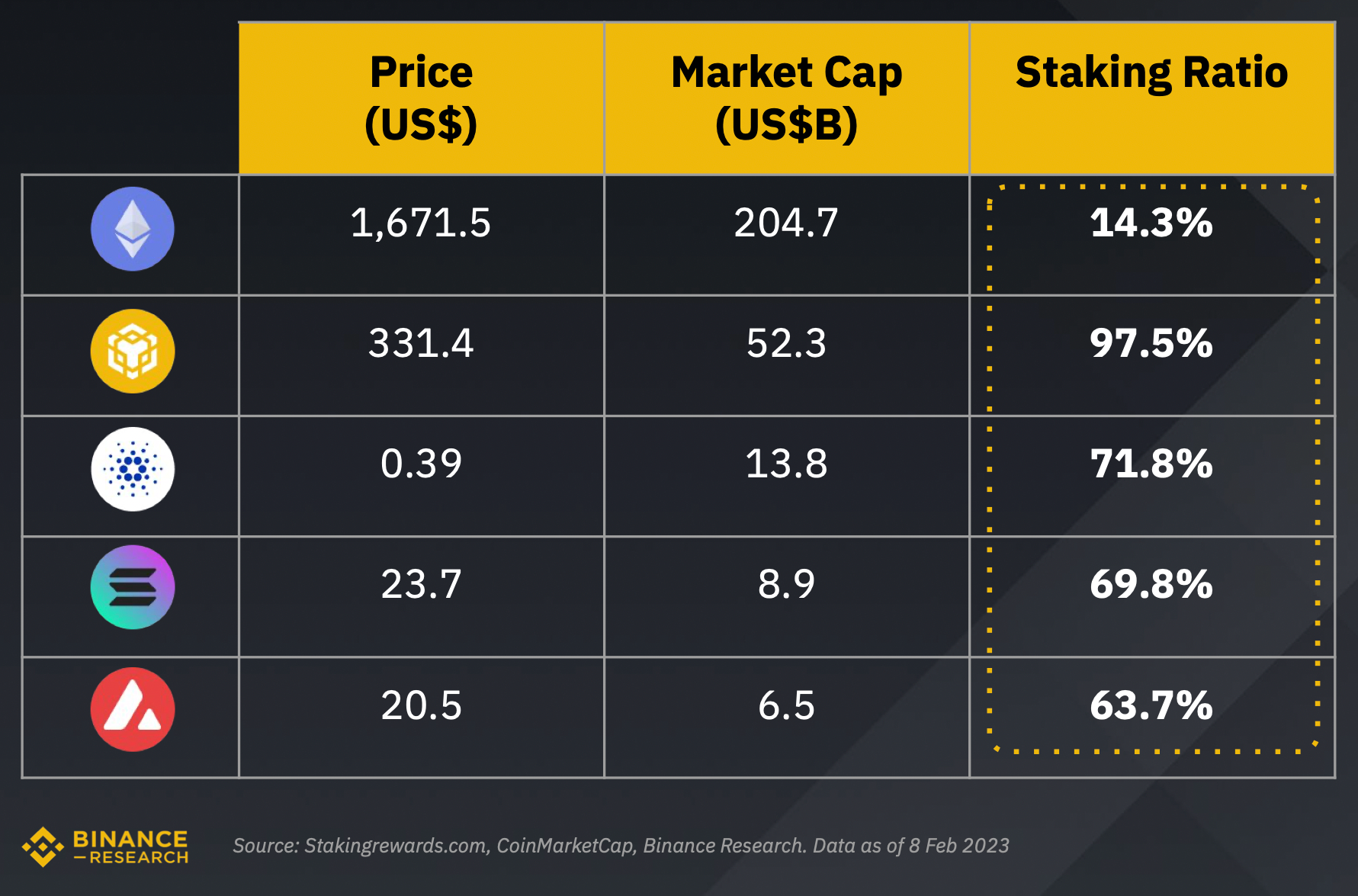

Liquid staking is expected to grow further, as the ETH staking ratio, which measures the percentage of the cryptocurrency's supply staked, is significantly lower than other layer 1 cryptocurrencies.

'Only 14% of eth is currently staked against 58%, the average for the 1-piece layer, markus thielen, head of matrixport research and strategy, said Coindesk. Its probable focus on staking will continue to grow."

The shielding ratio of ether is significantly lower than its. competitors. (Binance Research) (Binance Research)

Binance Research recently voiced a similar opinion, forecasting more inflow of money into staking protocols after the Shanghai upgrade.

"It could be argued that many groups of individuals had been waiting for Shanghai to stake their ETH, as withdrawals will remove the liquidity risk and uncertainty of an previously undefined lock-up period," BINANCE Research said in a report early this month.

$23,423

$23,423 $1,640.11

$1,640.11 BNB$305.12

BNB$305.12 XRP$0.37291616

XRP$0.37291616 $12.46

$12.46DISCLOSURE

Please note that our privacy policyterms of usecookiesdo not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk reporters are not permitted to buy titles on DCG.

BlocksInform

BlocksInform