2024 kicks off in the shadow of the approaching Bitcoin halving, casting a wave of optimism across the Web3 industry. With on-chain metrics signaling a positive trend, the start of the year, despite its highs and lows, sketches an intriguing outline for what’s ahead. Dive into our report to unravel the nuances of this promising year in the dapp industry.

Key Takeaways

- Daily Unique Active Wallets (dUAW) have reached a new all-time high of 5.3 million, the highest since 2022. Social dapps witnessed a 262% surge, nearing 1 million in dUAW. Meanwhile, on-chain gaming continues to lead, maintaining a dominant 28% share in the dapp industry.

- The Total Value Locked (TVL) in the DeFi sector has increased by 7% reaching $110 billion, the highest since 2022.

- NFT trading volume reaches $1.5 billion, with 903,479 unique traders.

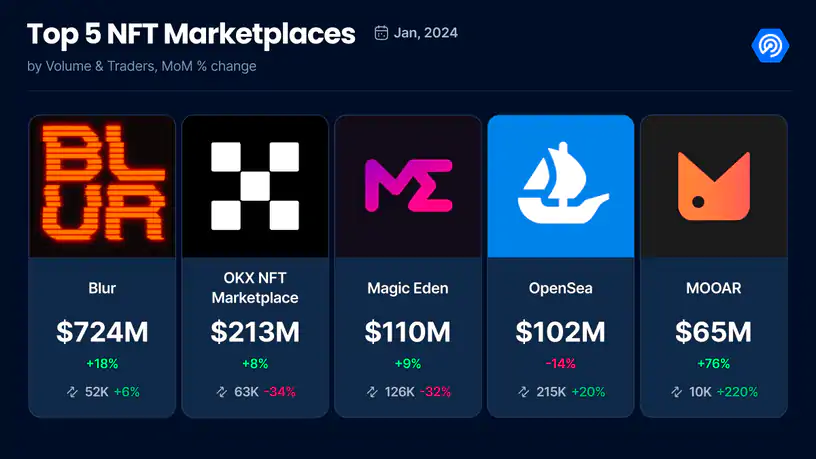

- Blur leads NFT trading volumes with a 47% market share but accounts for only 4% of sales, indicating a focus on high-value NFTs at an average price of $3,260. In contrast, OpenSea, with a 6.6% share in trading volume, dominates 14% of NFT sales, featuring the lowest average price at $136.

- $41 million in crypto assets were lost due to hackers exploiting smart contracts and duping investors.

- Dapp Industry Overview

- KAI-CHING retains its spot as the top dapp by UAW

- DeFi’s TVL reaches $110 billion, Ethereum holds 68% share

- NFT trading rose to $1.5 billion

- Blur leads NFT Market with 47% trading volume, only 4% sales share

- Blockchain gaming holds 28% dominance over the dapp industry

- $41 million lost due to exploits and hacks

- Closing Words

1. Dapp Industry Overview

The dapp industry has demonstrated a solid start in the early part of this year, marked by a notable achievement of 5.3 million daily Unique Active Wallets (dUAW). This figure, an 18% increase from the previous month, sets a new high point since 2022, signifying a sustained upward momentum. With the upcoming Bitcoin halving event, there’s increasing anticipation about the potential of a forthcoming bull market in the industry.

Focusing on specific industry segments, gaming remains at the forefront with a steady 1.5 million dUAW, maintaining its previous month’s level. Similarly, the DeFi sector also shows consistent performance, maintaining its 1 million dUAW figure from the last month.

In the NFT space, there’s a noticeable growth, with a 4% increase this month, reaching 697,959 dUAW. The Social dapp sector is also making a significant resurgence, as it kicks off the month with an impressive 868,091 dUAW, a substantial 262% increase, largely driven by platforms like CARV and Dmail Network.

When it comes to blockchain networks, is leading the pack with the most UAW, closely tailed by BNB Chain.

For those seeking in-depth analysis on blockchain performance, our comprehensive chains rankings provide extensive and detailed insights.

2. KAI-CHING retains its spot as the top dapp by UAW

In this segment, we delve into the top 10 dapps by Unique Active Wallets (UAW) for the month, offering insights into current trends and potential shifts in the rankings as the year progresses.

A notable observation is the continued dominance of KAI-CHING, which retains its position as the leading dapp in the Web3 sector, closely followed by . A significant development is the emergence of Sleepless AI, a new gaming platform that has quickly captured the interest of the Web3 community, ascending rapidly to third place since its launch. Additionally, the presence of Play Ember, another gaming studio, and Joyride Games’ Flow-based classic, Trickshot Blitz, in the rankings underscores the growing prominence of Web3 gaming.

This trend suggests a burgeoning phase of adoption and indicates that Web3 gaming is not only thriving but also shaping the future landscape of digital interaction and entertainment.

3. DeFi’s TVL reaches $110 billion, Ethereum holds 68% share

The Total Value Locked (TVL) in the DeFi sector has had an auspicious start in 2024, reaching an impressive $110 billion. This figure not only surpasses any peak recorded in 2023 but also indicates a resurgence in the market.

This surge in DeFi’s TVL is partly attributed to growing optimism about the onset of a new bull market, which has sparked an uptick in overall token prices. A continuing trend from 2023, which persists into 2024, is the launch of new chains offering airdrops, fueling the narrative around airdrop hunting in the X ecosystem. This phenomenon contributes significantly to the heightened activity in the DeFi landscape.

An analysis of the top 10 chains by TVL reveals that only three have experienced growth over the past month.

Ethereum maintains its dominance in the DeFi sector, holding 68% of the TVL, followed by Tron with a 7% share. A notable milestone for Ethereum this month is the implementation of its largest upgrade since early 2023, on two of the three test networks. This upgrade, part of the “Dencun” project, introduces the “proto-danksharding” feature, a step forward in reducing transaction costs for layer-2 blockchains and making data storage more affordable through new “blobs” for data. As the number of layer-2 chains built on Ethereum rapidly expands, this upgrade is pivotal for the ecosystem’s growth. The final test of Dencun on Ethereum’s Holesky testnet is scheduled for February 7, paving the way for its subsequent activation on the main blockchain.

This development is significant, as it enhances the relevance and discoverability of Layer-2 solutions.

For detailed metrics and further information on DeFi data, please visit our DeFi Rankings.

4. NFT trading rose to $1.5 billion

The NFT market has been showing signs of revival in recent months, and this trend continued into this month with a recorded trading volume of $1.5 billion. This represents a 16% decline from the previous month. In terms of sales, there were 5 million NFT transactions, a modest 3% decrease from the last month.

Additionally, we monitored the unique traders, identifying new wallets that engaged in NFT trading this month. January saw 903,479 unique traders, a slight drop of 2.9% compared to the previous month.

A key highlight is the collections driving the most trading volume. Topping the list is Azuki, which experienced a surge in floor price following rumors of a partnership with Weeb3 Foundation, jumping from 6.06 ETH to 7.96 ETH in a single day. Despite the buzz, no official announcement has been made regarding this rumored collaboration.

Next, we have a notable entry from Polygon, Gas Hero, a social MMO game launched on January 3rd by Find Satoshi Lab. This collection has made a significant impact on our rankings.

On the Solana front, STEPN has made a notable return. This month, STEPN unlocked a substantial 79.2 million GMT tokens, which could influence the token’s market dynamics. Out of these, 55.3 million GMT were distributed to 45 unique addresses.

An intriguing development is the emergence of a Bitcoin-based NFT collection, NodeMonkes. This collection of 10,000 unique images inscribed on the Bitcoin blockchain in February 2023 gained prominence when 8,000 inscriptions were auctioned on December 21, 2023. Since its launch, NodeMonkes Ordinals has generated significant interest, amassing over 500 BTC in trading volume in just four days and currently reaching around 1,400 BTC ($55.6 million).

The project gained traction by issuing 400 honorary inscriptions to celebrate Web3 figures and producing original, easily recognizable art. The collection’s rarity can be sorted on the project’s website.

This diversity in the NFT marketplace, moving away from domination by the same prominent collections, is a positive indication of the sector’s growing versatility and appeal.

5. Blur leads NFT Market with 47% trading volume, only 4% sales share

In the landscape of NFT marketplaces, there have been some notable shifts this month. OpenSea, a long-standing leader in the space, has experienced a downturn, being overtaken by Magic Eden in terms of trading volume. Additionally, there have been speculations about OpenSea’s potential sale, as suggested by various X posts.

A closer look at the metrics reveals that Blur has claimed the top spot in trading volume, commanding a 47% share in the NFT industry, yet only accounting for 4% of NFT sales. This indicates that Blur is predominantly used for trading high-value NFT collections, with the average price of an NFT on the platform being $3,260, marking an 11% increase from the previous month.

OpenSea, despite its reduced market share of 6.6% in trading volume – the lowest recorded by the platform – still maintains a significant presence in terms of NFT sales, holding a 14% dominance. Interestingly, OPENSEA features the lowest average NFT price on the list, at $136.

For those looking for more detailed insights and metrics, our NFT Marketplace provide comprehensive data and analysis. This resource can be invaluable for drawing conclusions and understanding the evolving dynamics of the NFT marketplace as we move through 2024.

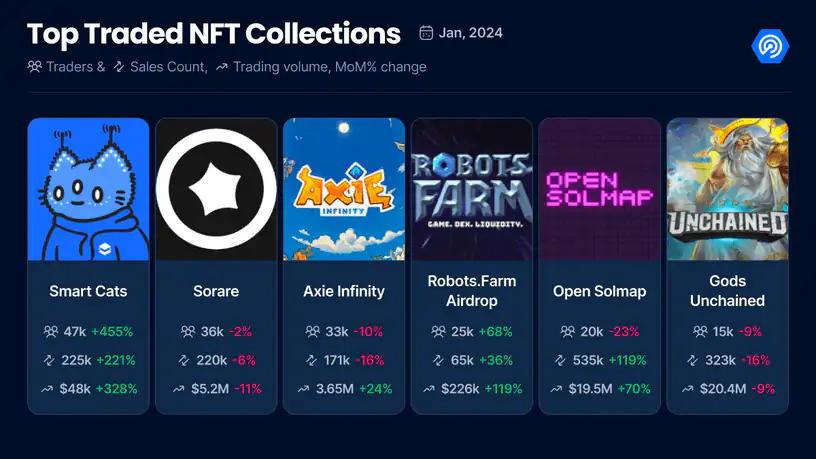

6. Blockchain gaming holds 28% dominance over the dapp industry

Blockchain gaming has emerged as a pivotal force in the decentralized application (dapp) industry as we enter this year. It has significantly influenced the dapp sector, accounting for 1.5 million daily Unique Active Wallets (dUAW), which equates to a 28% dominance over the entire dapp industry. For a retrospective look at this sector’s performance in 2023, our yearly gaming report provides extensive insights.

While a detailed analysis of blockchain gaming will be covered in our upcoming gaming-specific report, it’s important to note a significant trend observed in recent months. Notably, four out of the six most-traded NFT collections are associated with blockchain games. This intersection of NFTs and gaming is a strategic and growing integration, highlighting the increasingly intertwined nature of these sectors.

For those interested in exploring these trends in greater depth, our comprehensive gaming report, which is scheduled for release next week, will offer detailed insights. If you are accessing this after February 8, we encourage you to visit our reports page to access in-depth analyses and observations of the evolving blockchain gaming landscape.

7. $41 million lost due to exploits and hacks

As we step into the new year, the blockchain industry continues to face challenges with exploits and hacks. In January, the industry suffered a significant loss of $41 million due to these incidents, marking a substantial 180% increase from January of the previous year. While this is not the optimistic start we hoped for in 2024, it’s worth noting that this figure represents a 67% decrease from the losses incurred in the previous month.

Among the most notable incidents, the Animoca Brands’ GAMEE token hack stands out. On January 22, 2024, the GAMEE token on the Polygon chain fell victim to an exploit stemming from unauthorized GitLab access and a compromised deployer key. The attacker infiltrated the GitLab repository, obtained the private key, and exploited a flaw in the recoverERC721s() function, leading to the theft of 600 million GMEE tokens. At the time of the theft, these tokens were valued at approximately $16.3 million according to the polygonscan explorer.

Another significant event was a massive phishing attack on January 23. In this instance, four attackers targeted users on both the BINANCE Smart Chain and Ethereum networks. They created malicious contracts and transactions, successfully siphoning a total of $12.9 million from their victims.

This serves as a stark reminder of the importance of security in the digital asset space. The key takeaway for users is to remain vigilant and understand that the security of their keys is paramount to safeguarding their assets.

8. Closing words

As we conclude our overview of the dapp industry, it’s evident that this dynamic sector is on the brink of a new wave of adoption. Surpassing the milestone of 5 million dUAW is a testament to the industry’s growing influence and potential. This significant number not only reflects the current health of the industry but also hints at its promising future.

Gaming continues to be a powerhouse within the dapp landscape. Its consistent strength and appeal have been pivotal in driving adoption in the past years – 2022, 2023, and now it seems poised to play a similar role in 2024. The gaming vertical has proven to be more than a trend; it’s a driving force that continually shapes and energizes the dapp ecosystem.

Meanwhile, the social vertical has made an impressive start this year, suggesting that this sector will likely maintain its upward trajectory. The integration of decentralized applications into social platforms is not just a fleeting trend but a significant shift in how we interact and engage in the digital realm.

In my opinion, the dapp industry’s growth and diversification are clear indicators of its maturation and resilience. The increasing daily UAW is a clear signal that the dapp industry is not only thriving but also evolving to meet the changing needs and expectations of its users. As we move forward, I anticipate that this industry will continue to innovate and expand, drawing in more users and solidifying its position as a key player in the broader landscape of technology and digital interaction.

BlocksInform

BlocksInform