Doing that in a regulated way may not be easy.

Switzerland is very accommodative and it can be very difficult to compete otherwise.

On numerous stock tokenization attempts however, this one seems to be the most professional to date.

The process is the same for usdc and usdt, but through actions and by an entity that claims to be totally regulated in Europe." permissionless tokenized securities are here thanks to backed finance," explains sebastien derivatives, an active-passive administrator for makerdao.

Sustained funding launched at the beginning of 2021 with a start-up cycle of gnoses, semantic projects and strategic technologies.

They are based in Zug and indicate that they were approved in Liechtenstein by fma from 9 May 2022, and in Switzerland through bx swiss ag from 23 May 2022. The token is legally considered a certificate.

The broker and custodian is Maerki Baumann & Co according to their terms, while the tokenizer is Backed Finance.

Backed Finance was launched at the beginning of 2021 with a wave of launches of Gnosis, Semantic Ventures and Stratos technologies.

They are based in Zug and claim that FMA approved them in Liechtenstein on 9 May 2022, and Switzerland by BX Swiss AG with effect from 23 May 2022.

The token is legally referred to as a certificate.

For each bCSPX, they buy one CSPX share from a regulated depositary.

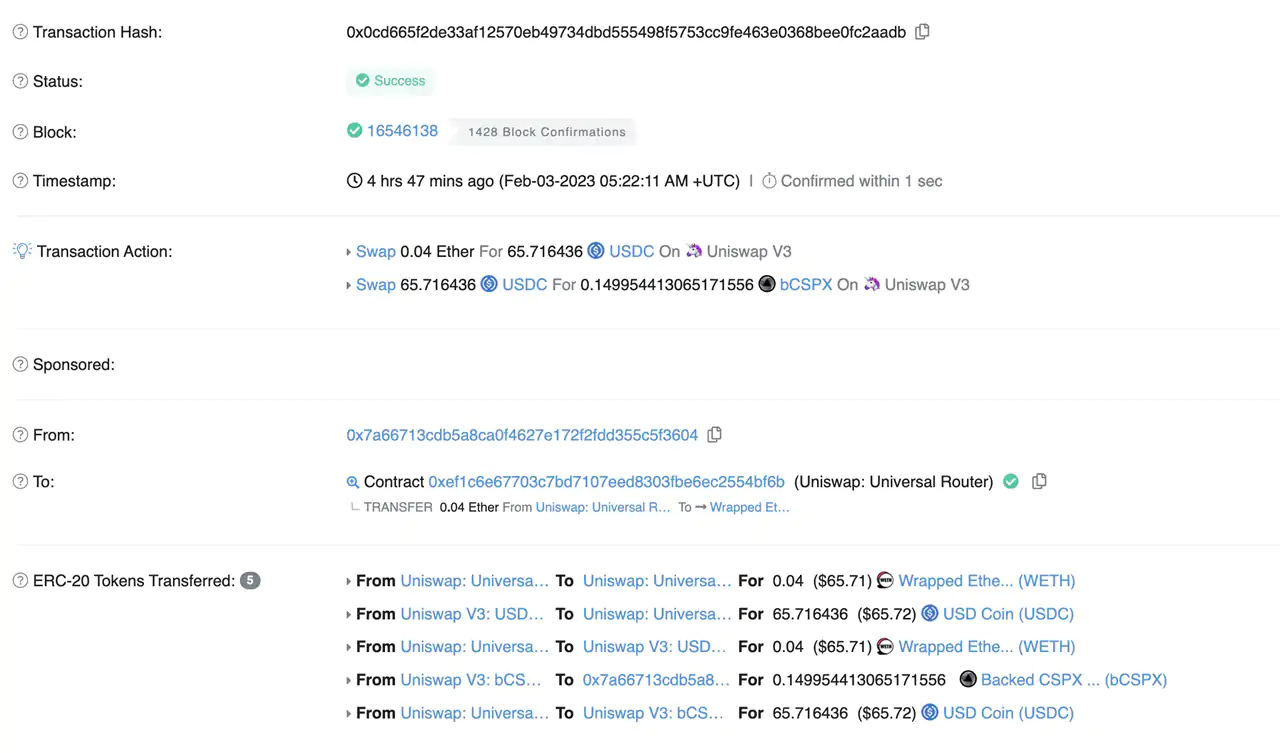

We have a simple swap here from tokenized dollars to the tokenized ETF on Uniswap, showing a familiar sight of what is in effect a bridging of two different markets.

An ETF-backed trade, Jan 2023We have a simple exchange here between tokenized dollars and tokenized etf on uniswap, a familiar view of what is actually a bridge between two separate markets. Backed is committed to achieving these benefits in a secure and transparent manner, and Chainlink Proof of Reserve is a foundational tool that will help deliver unparalleled transparency to our customers."

The token part is on the blockchain, so the evidence of reservations on this aspect is native, with this ETF in very familiar search on the ethereum blockchain.

"loan Google chips on the composite, use apple as a warranty to the dai manufacturer, ETF inclusion in an annual strategy, and create new test-based challenge derivatives, among innumerable other options." yet the token doesn't see a lot of use, In part perhaps because much of this more challenging integration has not entirely taken place.

Without such integration, investors may question why have it in a symbolic form rather than as a share through a broker like their other shares. 'Users will be able to build new assets into their challenge strategy,' says Backed.

"Lend Google chips to Compound, use Apple as a guarantee for DAI Maker, include ETFs in a Yearn strategy, and create new Tesla-based challenge derivatives among countless other options." Besides, if you got eth, buy this etf would be just a click away without needing to register with a mint broker.to or swap the token you need to pass through kyc, However, it is available free of charge in secondary markets such as uniswap.

Only 100 were hit, but the bootstrapping is very hard.

This may be partly because some people fear that although this is regulated in Europe, the United States Securities and Exchange Commission (US Securities and Exchange Commission) does not share the same view.

Again, an intelligent contract is decentralized and there are many challenges now dapps, some of which do not care about sec because they are not based in us.

So it could be an increased demand, And that may be partly because there's not a lot of support out there, perhaps relying on word of mouth, which is likely no longer a viable strategy now that the crypto market has grown significantly.

And a more fundamental issue could be that securing funds in crypto space is fairly easy.

It was much more difficult and that can have created a mental firewall of sorts where crypto funds are left in crypto space for crypto.

The value proposition for something like usdc is obvious that you're looking for a relatively stable unit of account in crypto financing.

But for example, we do not testrun bcspx because we do not want to transform our eth into s.

You could put money into the system for this single tokenised ETF, the ETF being very popular since it has $55 billion in assets under management.

Yet an intelligent contract is decentralized and there are a lot of challenges at the moment, some of which don't care about the SEC because they're not based in the United States.

Moreover, it would be interesting to see adoption for stocks such as coin or mstr that are more linked to cryptography.

Bonds are also quite difficult to obtain, even through brokers, so they could generate more interest, maybe even to compete with monetized dollars or be used as a substitute. Make this project interesting with potential use cases in particular if you can't access the stock market because you're not in us or in Europe.

Furthermore, it is not easy to borrow stocks from brokers, which is a simple challenge.

So the demand could go up, because this is a brand-new project that was implemented primarily in the bear period.

Also, it would be interesting to see adoption for stocks such as COIN or MSTR that are more linked to cryptography.

BlocksInform

BlocksInform