July’s insights into blockchain gaming and the metaverse depict a landscape brimming with potential and rapid evolution. As investments surge and major players like Google recognize the significance of Web3 gaming, promise transformative shifts in the industry. This report dives deep into the key events, decisions, and data of the past month, painting a picture of a future being actively sculpted at the crossroads of gaming, blockchain, and the expansive metaverse.

Key Takeaways

- Blockchain gaming accounts for 41% of on-chain dapp activity in July with 712,611 dUAW; WAX leads with 300,325 dUAW.

- Genkai NFTs had a trading volume of over $491,000 and a floor price drop to 0.19 ETH, marking a 24% decline from its mint value.

- Arbitrum gaming gains momentum with Mighty Bear Games’ migrating from Polygon and TreasureDAO, recording over $842,000 from 73,580 transactions in a single month.

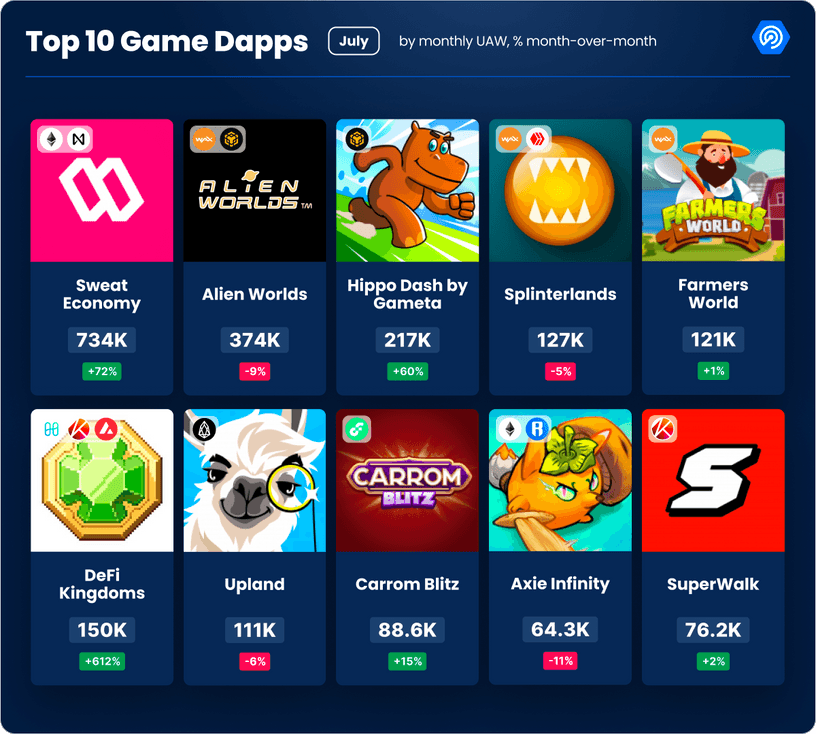

- Sweat Economy became the most played game dapp in July, reaching over 739,000 monthly UAW.

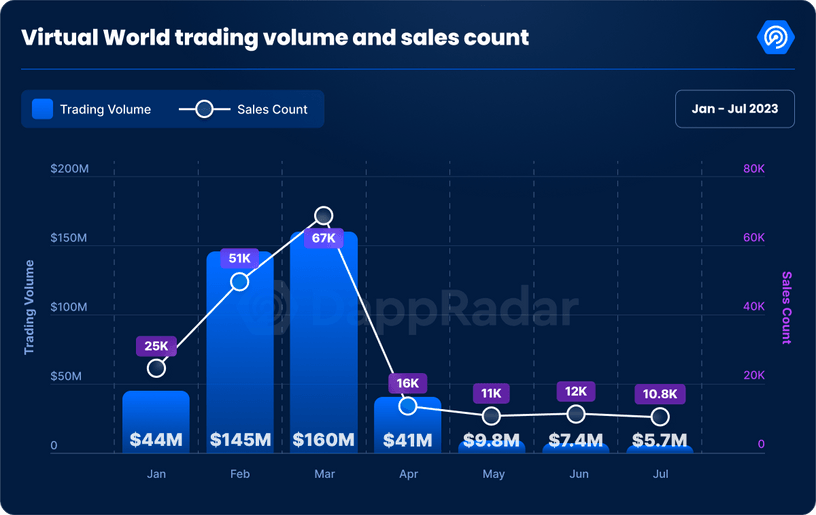

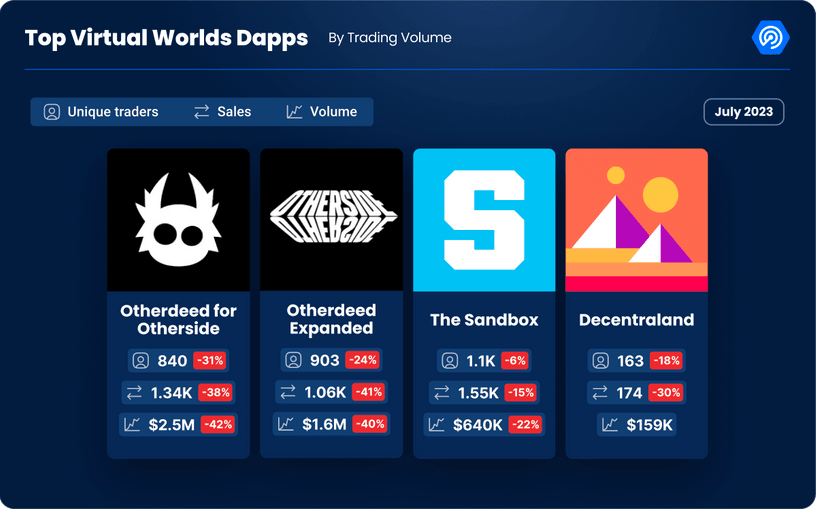

- Metaverse trading volumes hit a year-low in July at $5.6 million from 10,796 land sales.

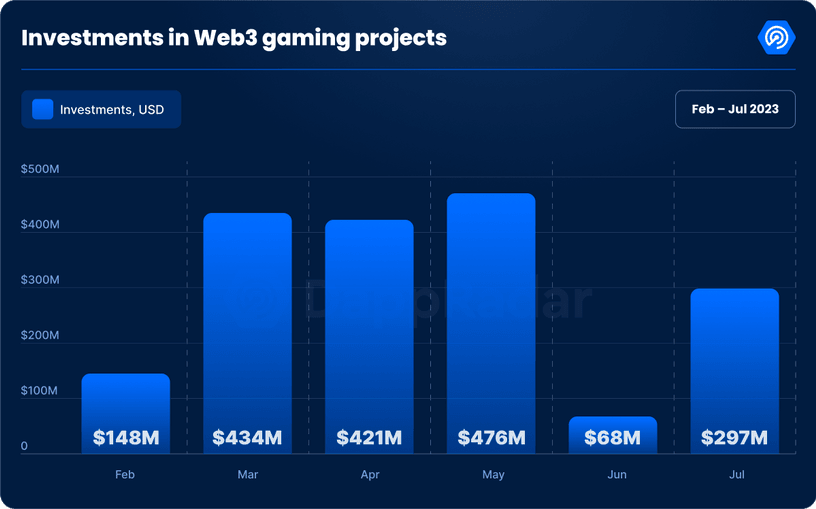

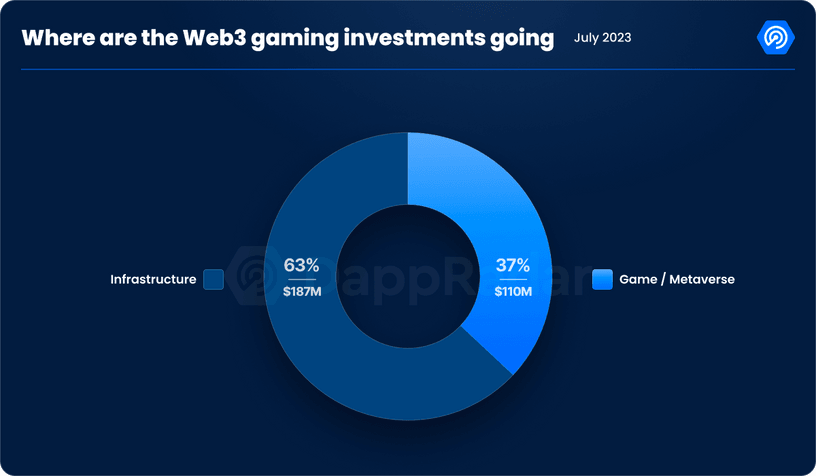

- In July 2023, web3 gaming investments rebounded to $297 million, with 63% funneled into infrastructure.

- Blockchain Gaming Overview

- Ronin & CyberKongz partnership: pioneering Genkai’s NFT and gaming future

- Ethereum L2’s gaming pivot: Arbitrum’s rising stardom

- July’s gaming leaders

- The hype around virtual realms is over?

- Fueling the future: $297M Web3 gaming investments

- Google’s Web3 welcome: unveiling the Play Store’s new playbook

- Conclusion

1. Blockchain Gaming Overview

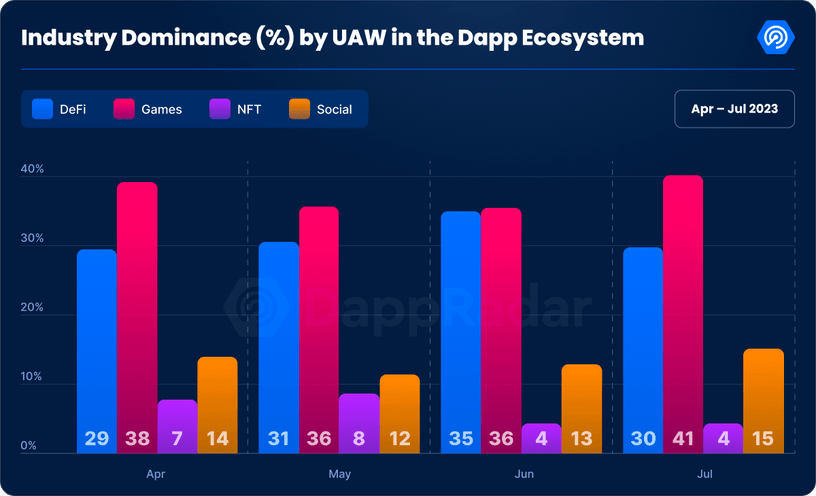

Even with the rising popularity of DeFi in June, especially the buzz around L2 airdrops from the preceding months, blockchain gaming made a noteworthy comeback.

After witnessing a dip in market dominance in June, blockchain gaming swiftly re-established itself as a pivotal player in the dapp domain. Current figures point to a daily unique active wallets (dUAW) count of 712,611 for the sector. This denotes a marginal drop of 0.5% month-on-month, yet it commands a significant 41% of the entire industry’s engagement.

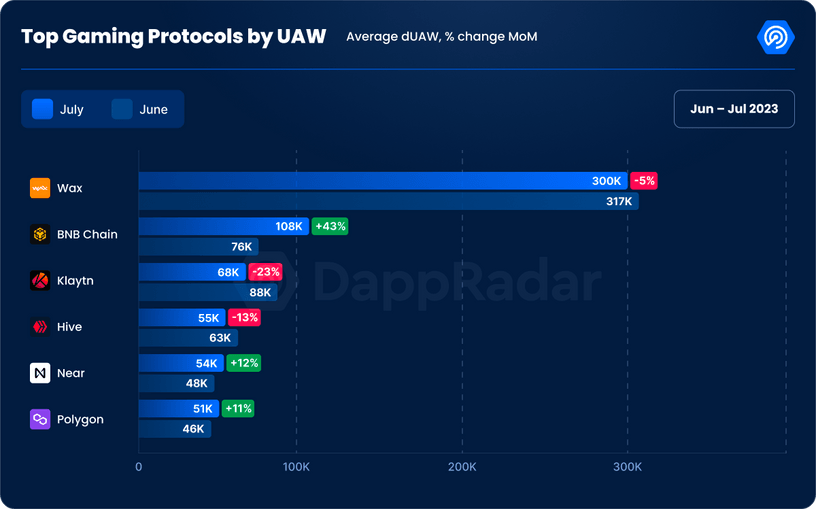

Zooming in on individual blockchain performance, WAX emerges as the reigning champion in the gaming sphere based on UAW metrics. Registering 300,325 dUAW this month, WAX isn’t merely synonymous with the renowned Web3 game, Alien Worlds. It’s also the backdrop for other trending games like Wombat Dungeon Master and Taco.

BNB Chain, meanwhile, has climbed back to secure the second position. This month, it witnessed a surge of 43%, tallying 108,311 dUAW. This uptick is predominantly attributed to gaming hubs such as and Gaimin.

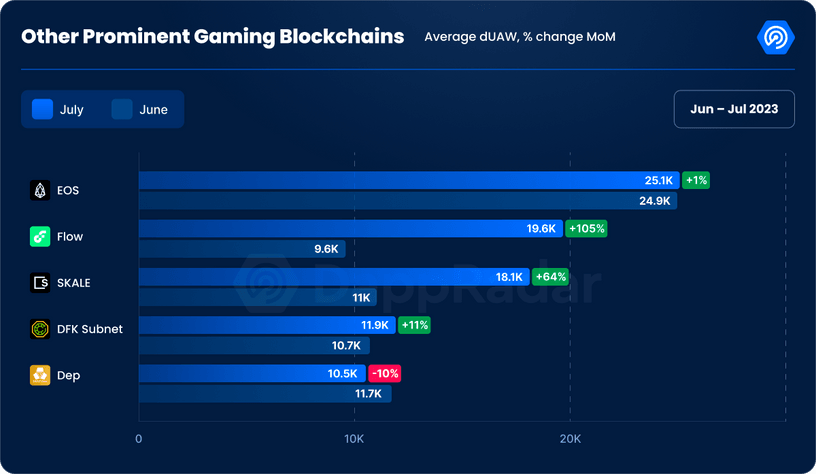

While some top-tier blockchains experienced minor declines this month, newcomers are making their presence felt. Here’s a glimpse:

SKALE, the platform behind games like CryptoBlades and 5TARS, saw a 64% uptick, clocking in 18,133 dUAW. Flow stole the spotlight with an astounding 105% growth, registering 19,621 dUAW.

For an up-to-the-minute, in-depth breakdown of these stats and a closer look at these gaming blockchains, be sure to check out DappRadar’s gaming leaderboard.

2. Ronin & CyberKongz partnership: pioneering Genkai’s NFT and gaming future

Ronin blockchain, predominantly renowned for hosting Axie Infinity, witnessed 97% of its gaming UAW activity in July 2023 solely from this game. However, this dominance might become smaller in the future. Recently, the notable Ethereum-based NFT collection, CyberKongz, unveiled a segment of its upcoming anime-inspired Genkai NFTs on the Sky Mavis blockchain.

Further strengthening the bond with Ronin, CyberKongz plans to transition its “Play & Kollect” on-chain community – a hub where enthusiasts can discover, mint, and collect NFTs – from Polygon over to Ronin. The collaboration will also see them joining hands with Sky Mavis to create a Ronin-based Genkai-themed game.

Diving deeper into the Genkai NFT specifics, there’s an overall supply cap of 20,000 units. From this, 4,000 will find their genesis on Ronin, while the remaining 16,000 NFTs originate from Ethereum. Notably, Ethereum-based assets will benefit from a seamless optional transition to Ronin. Adding a cherry on top for the Axie Mystic community, approximately 1,000 holders will receive a complimentary Genkai airdrop from the 4,000 minted on Ronin.

The curtain for the Genkai NFT mint was raised on 27th July at 4 pm UTC, initially for pre-registered wallets. Following this, a public sale was slated for 8 pm UTC, pending availability. Each mint bore a price tag of 0.25 ETH. Moreover, existing CyberKongz aficionados are in for a treat with a Genkai airdrop, albeit with a 180-day vesting stipulation.

Latest figures depict a trading volume surpassing $491,000 with a base price of 0.19 ETH for the Genkai NFT. This indicates a 24% depreciation from the initial mint price.

In the broader landscape, CyberKongz’s alliance with Ronin not only boosts their outreach to Asian collectors via the Genkai collection but also paints a promising horizon where Ronin diversifies beyond Axie Infinity in the gaming sphere embracing the interoperability ethos.

3. Ethereum L2’s gaming pivot: Arbitrum’s rising stardom

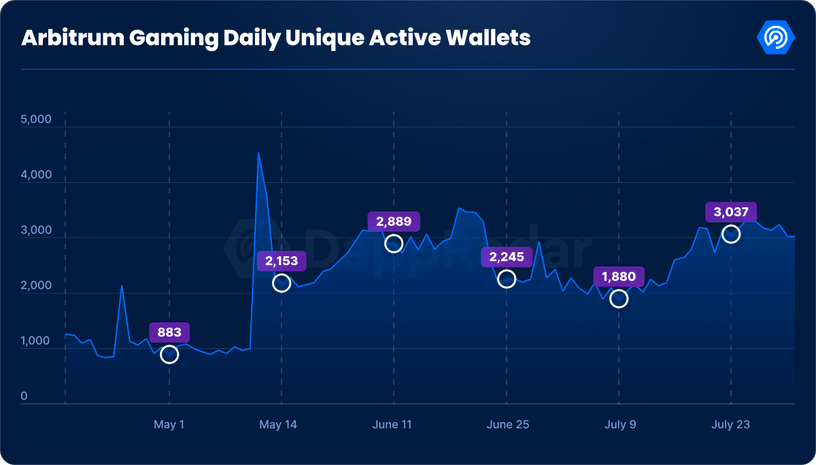

The recent months have unveiled the escalating prominence of Ethereum’s L2 solution, Arbitrum, as a pivotal gaming platform. The spotlight shines brighter with the announcement that Singapore’s gaming giant, Mighty Bear Games, is transitioning its “Mighty Action Heroes” game from Polygon straight to Arbitrum.

Taking its strategic move a notch higher, the company is intertwining with the TreasureDAO gaming universe, while also integrating the MAGIC token. This comes as a significant boost for TreasureDAO, which recently reported a transaction volume surpassing $842,000, accumulated from 73,580 transactions, equating to an average of $11.4 per transaction.

Crafted to offer an engaging and user-friendly battle royale encounter, “Mighty Action Heroes” entered its open beta phase on 14 July, opening doors for gamers to dive in.

Further enriching the Arbitrum ecosystem is the introduction of Arbitrum Nova — a streamlined version tailored for gaming. The realm of gaming on Arbitrum is expanding beyond the confines of the core projects under TreasureDAO’s umbrella. For instance, Pixel Vault’s highly-anticipated “BattlePlan!” game, along with its Reboot protocol, is slated to debut on Arbitrum Nova.

Such transitions bring forth intriguing technical deliberations. Arbitrum employs Optimistic rollups, whereas Polygon and allies like Immutable are staunch proponents of the advanced zk-rollups.

Nevertheless, the swift adoption trajectory of these Ethereum-focused scaling strategies is a boon for the encompassing Ethereum gaming landscape. This momentum positions Ethereum favorably against non-EVM competitors like Solana and Sui, as well as comparatively rigid chains like BNB.

4. July’s gaming leaders

July has seen some intriguing shifts in the world of Web3 gaming, most notably with yet another rise of ‘move-to-earn’ games. At the forefront is Sweat Economy, boasting an impressive 730,000+ monthly UAW (mUAW), signaling the potential resurgence of move-to-earn trends. This sentiment is further solidified with Super Walk, a Klaytn-based fitness social dapp that cracked the top 10 rankings by drawing in over 68,000 for the month.

While there are new entrants shaking things up, we’ve seen a consistent performance from familiar names. Alien Worlds, for instance, has shifted to the second spot, while staples like Splinterlands, Upland, Farmers World, and Axie Infinity retain their esteemed positions. These games have not only established their prowess but have cultivated robust communities that keep them firmly anchored in our rankings.

In the midst of these standings, Carrom Blitz from Joyride Games has recaptured attention, dovetailing with Flow UAW’s rejuvenation, spearheading its resurgence.

On the development side, Upland has been transparent about its aspirations, unveiling its Q3 2023 roadmap. The key takeaways? An ambition for expansive growth, heightened player customization, and amplified opportunities for ownership.

A fascinating observation this month has been the near 1:1 correlation between transactions and UAW for some games, like Hippo Dash, Alien Worlds or Farmers World. The structure of their gameplay might be the key, suggesting that each transaction possibly leads to a wallet’s inception. For those intrigued by this, we recommend our deep dive into this trend in a dedicated educational piece.

5. The hype around virtual realms is over?

June 2023 witnessed a staggering decline in virtual worlds’ performance, as trading volumes dipped to a mere $7.4 million. This descent was mirrored by 12,466 land sales, which averaged out to $594 per transaction. Fast forward to July, the landscape wasn’t any rosier. Trading volumes recorded another year-low of $5.6 million, derived from 10,796 land sales, averaging $523 each.

Clearly, while the fervor for trading metaverse assets seems to be waning, the Q2 metaverse report pinpoints that user engagement and interest in this technology remain resilient.

Delving deeper into the sources of this trading activity, our analysis centered around the top 5 Virtual Worlds NFT collections. As anticipated, Otherdeed for Otherside and Otherdeed Expanded stand unchallenged, representing the lion’s share. Combining their forces, they account for a whopping $4 million, or 72.5% of the total trading volume.

Conversely, The Sandbox leads the pack in trader numbers, boasting over 1,100 traders and 252 UAW in July alone. Elevating its offerings, on 19th July, The Sandbox team unveiled a slew of innovative features, enabling users to craft their personalized gamified experiences. This evolution marks a pivotal move towards intensifying The Sandbox’s decentralization, amplifying the role of user-generated content.

However, this declining trajectory has prompted some metaverse projects to wind up. Perhaps, this mirrors the inherent nature of bear-market cycles, where only the creme-de-la-creme projects thrive.

A case in point is Neopets. The Neopets team recently signaled the termination of their ambitious Neopets Metaverse venture. Originally envisioned as a web3-integrated game, this project will now cease further development. Instead, Neopets is reverting to its foundational web2 blueprint.

Despite unveiling collections like Genesis, Pizzaroo, and Masterpiece, Neopets’ strategic direction remains nebulous, especially concerning their NFT and blockchain aspirations. Their vague assurance of “supporting the community” coupled with mentions of potential perks like physical merchandise or in-game items only amplifies the ambiguity.

Decoding these patterns, where does the metaverse head from here? At DappRadar, our conviction in the metaverse’s potential remains undeterred. In fact, the subsequent section unravels an intriguing investment insight that reaffirms our optimism for this domain.

6. Fueling the future: $297M Web3 gaming investments

June 2023 observed web3 gaming investments plummeting to an annual low at $68 million. It’s crucial to underscore that the overarching market dynamics posed significant hurdles. Notably, June was rife with adversities for several flagship Web3 gaming initiatives, predominantly triggered by the legal entanglements that BINANCE and COINBASE found themselves in, thanks to the SEC.

Nevertheless, July experienced a rebound, registering a robust $297 million. As highlighted throughout this report, the month was marked by strategic partnerships and noteworthy announcements.

A closer examination reveals that infrastructure projects absorbed the lion’s share of the investments at $187 million, making up a hefty 63% of the entire funding pie. Meanwhile, the combined investments towards games and metaverse ventures reached $110 million, accounting for the remaining 37%.

Certain investments stood out for their innovation and promise. Animoca Brands’ investment of $30 million in hi—a firm that made waves in 2022 by unveiling the world’s first NFT avatar-customized debit card—is a case in point. Furthermore, Animoca made headlines again by announcing a novel game with nWay, which kickstarts its first season in collaboration with Yuga Labs. (Find an in-depth review [here](add link).)

Adding to the mix, Inworld AI has secured a whopping $50 million from Lightspeed Venture Partners, catapulting the valuation of this AI-driven game character engine creator to an impressive $500 million.

Yet, two pivotal investments captured the industry’s attention. Valhalla Ventures made waves by initiating a $66 million VC fund focused on deeptech and gaming startups. In tandem, Futureverse, an avant-garde blend of AI and metaverse technology, clinched $54 million in its latest funding round. Aiming to bridge AI with the metaverse, Futureverse seeks to amalgamate 11 metaverse infrastructure and content firms, creating an extensive metaverse ecosystem fueled by digital collectibles. Their ambition doesn’t stop there; with aspirations to pioneer the new horizon of AI gaming, they recently rolled out the AI-centric consumer game, AI League, in collaboration with FIFA for iOS and Android platforms.

This influx of investment is testament to the unyielding faith in the potential of the metaverse and virtual worlds, even amidst observed industry downtrends.

7. Google’s Web3 welcome: unveiling the Play Store’s new playbook

In a groundbreaking move, Google is gearing up to usher web3 gaming into its Play Store later this year.

While this is exciting news, the announcement on their blog brings with it certain stipulations. For starters, developers must be forthright about the incorporation of NFTs within their games. Furthermore, game studios are cautioned against hyping up potential earnings via play or trading, signaling a definitive disapproval of the play-to-earn model. Google has also drawn a line against blending NFTs with gacha-style mechanisms, a move many consider prudent. These policy revisions will be put into play as of December 7, and you can delve into the specifics [here](link to more details).

Casting our minds back to the investment and partnership buzz from the previous year, 2023 is emerging as the year where those seeds are bearing fruit!

It’s invigorating to witness Google Play extend a warm welcome to web3-integrated games and applications. Given the unparalleled reach of the mobile domain, the hitherto obstacles in merging web3 with mobile applications undeniably stifled the sector. Google’s revamped stance is poised to rekindle interest among mobile gaming studios in NFT exploration, infusing fresh enthusiasm and confidence throughout the larger ecosystem to craft outstanding mobile games and apps.

In recent times, there’s been a noticeable pivot, with dominant web2 gaming studios transitioning towards the web3 sphere, as elaborated in our prior gaming report.

Both Apple and Google remain on our watchlist as we keenly await their next moves to address web3 developers’ core challenges. A prime concern is the mandate which requires the use of Apple/Google’s fiat-focused in-app purchase system for all gaming-related transactions, NFT acquisitions, and other content. This presents hurdles in enabling cryptocurrency-based value exchanges or the deployment of noncustodial wallets. We remain hopeful for a more progressive approach in this realm in the upcoming days.

8. Conclusion

July’s deep dive into the world of blockchain gaming and the metaverse revealed undeniable signs of sustained momentum. Despite the cyclical fluctuations and challenges inherent to emerging markets, the considerable investments made this month underscore a prevailing optimism. The surge of investments, combined with Google’s acknowledgment of Web3 gaming, highlights the growing acceptance and integration of blockchain technology into mainstream platforms.

Moreover, with gaming giants like CyberKongz adopting platforms such as Ronin for their latest ventures, it’s evident that blockchain’s foothold in the gaming universe is more than just a fleeting trend—it’s a foundational shift.

As we step into the coming months, it will be crucial to keep an eye on how these investments materialize in terms of product innovation, user engagement, and market growth. But one thing is clear: the intersections of gaming, blockchain, and the metaverse are not just shaping the future; they’re actively building it.

BlocksInform

BlocksInform