Chainlink’s (LINK) price felt the bullishness of the Bitcoin halving event more than BTC itself, which was visible in its 20% rally.

The altcoin, however, is now facing a crucial barrier, which has been a challenge in the past.

Chainlink Investors Might Move to Sell

As Chainlink’s price rose, LINK investors regained their profits, which might be a key factor driving them to sell. The recent correction brought the total LINK supply in profit down from 84% to 70%.

This 14% supply represents nearly 82.18 million LINK worth nearly $1.3 billion. All of this supply has once again returned to its original state before the decline. In the past two days, the profitable supply rose by 13% to reach 84% at the time of writing.

While this is a good thing, it is also a potential trigger for selling, as investors want to secure their gains to prevent losses from another decline. This would drive Chainlink’s price lower.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

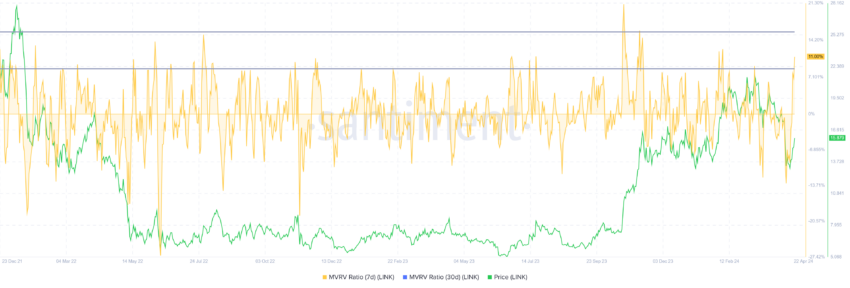

The Market Value substantiates this sentiment to the Realized Value (MVRV) ratio. The MVRV ratio tracks investor gains/losses. Chainlink’s 7-day MVRV of 11% suggests profit, possibly prompting sales. Historically, BTC corrects at MVRV levels of 8% to 15%, labeling it a danger zone.

In the short-term timeframe, this area has repeatedly witnessed declines, which is the expected outcome for LINK

LINK Price Prediction: Beating the Barrier

Chainlink’s price was noted to rally by 20% over the weekend, bringing the digital asset to trade at $15.8. Right under this point is a barrier that LINK has attempted to sustain multiple times and failed in the past.

Even though The altcoin manages to close above it, it falls back down from the $15.6 resistance to test the support at $14.6 and $13.4. If LINK holders move to sell this time, the potential decline will result in a test of the latter support level should the former break.

However, if the resistance of $15.6 is successfully breached and flipped into support, recovery is possible.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

The next critical resistance lies at $18, and Chainlink’s price would make it there should it breach $17. Once the latter is flipped into support, the altcoin would invalidate the bearish thesis and rally towards $18.

BlocksInform

BlocksInform