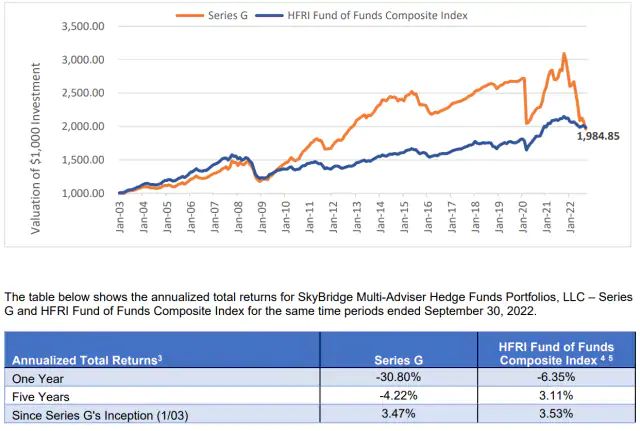

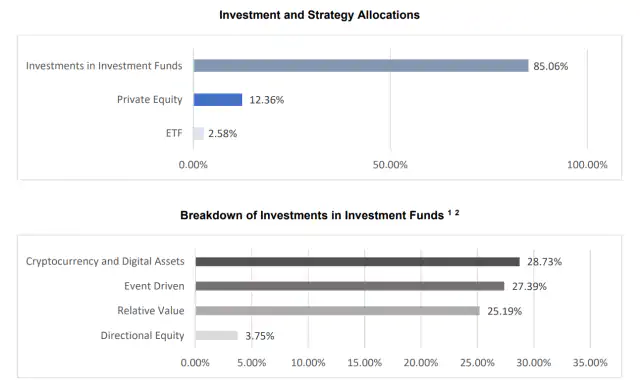

SkyBridge’s 22-year operational performance

A "I encourage people to start investing now." not restricted to Bitcoin' skybridge capital advice to cryptocurrency sskybridge potential investment, a significant risk capital, dropped by 39 percent last year: report first appeared on our new Bitcoin..

Operational performance of 22 years of SkyBridge A. The Bloomberg report of 27 found that the SkyBridge Capital Foundation Fund, a large American hedge fund which is also exposed to crypto assets (VC), Underperformed in 2022 at 39%.

The SkyBridge Multi-Advisor Hedge Fund Portfolios is SkyBridge's core fund that invests in equities, cryptoassets (VC), ETFs, etc.

The investors, which are now limited to half-yearly repurchases, had asked to withdraw 60% of the capital of the fund during the seven. 30 redemption period, but SEC (U.S. Securities and Exchange Commission) filings in January Only 10% were reimbursed, according to the report.

According to the report, only 10% of deposits in January (US securities and foreign exchange fees) were repaid. In addition, the conditions under which the fund will be repurchased will become more stringent in the future.

"we have already accepted 25% cash claims four times a year," but for the repayment period of March 31, we intend to make redemptions of no more than 5 per cent," says the report.

January SEC (US Securities and Exchange Commission) deposits Only 10% were repaid, according to the report.

Source: Skybridge

According to filings with the SEC as of the end of September 2022, the annual return of “SkyBridge Multi-Adviser Hedge Fund Portfolios (Series G)” was negative 30.8% at that time, but the latest reports have widened the loss range further. "We have already accepted 25% cash claims four times per year for the March 31 repayment period, we intend to make redemptions of no more than 5 per cent," says the report.

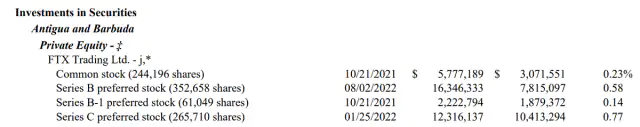

Bloomberg's request for an interview was not acted upon by a SkyBridge representative. In good form as well, in the same document, you can verify the fund's portfolio allocation. "b" labelled investments which may be bought back four times a year have a total capital of 100.9 billion yen, which represents only 60% of the total capital of the fund (101.4 billion yen).

- Brevan Howard Digital Asset Multi-Strategy Fund, LP ClassB: $111,957,910 (14.5 billion yen: virtual currency)

- Multicoin Capital Offshore, SPC: $13,947,121 (1.8 billion yen: virtual currency)

- Furthermore, in the same document, you can verify the fund's portfolio breakdown.

- Soma Offshore Ltd.: $6,488,649 (840 million yen: shares)

- Axonic Credit Opportunities Fund LP: $62,967,374 (8.1 billion yen: event-driven)

- Axonic Credit Opportunities Overseas Fund, Ltd.: $61,991,558 (8.1 billion yen: event-driven)

- Third Point Offshore Fund, Ltd.: $170,111,961 (22 billion yen: event-driven)

- Millennium International, Ltd.: $53,795,491 (6.9 billion yen: investment fund)

- Point72 Capital International, Ltd.: $272,562,330 (35.4 billion yen: investment fund)

Brevan Howard Digital Asset Multi-Strategy Fund, LP Category B: $111,957,910 (14.5 billion yen: VC)Multicoin Capital Offshore, SSC: $13,947,121 (1.8 billion yen: VC) Brevan howard digital global asset fund, lp classb: $111,957,910 (14.5 billion yen: virtual currency) offshore multi-member capital, spc: $13.947.121 (JPY 1.8 billion: virtual currency)coatue offshore fund ltd class m-6: $26.020.176 (JPY 3.3 billion); Stock)soma offshore ltd.: $6,488,649 (JPY 840 million: equities)axonic credit opportunities fund lp: $62,967,374 (JPY 8.1 billion: event-driven)axonic credit opportunities overseas fund, ltd.: $61.991.558 (JPY 8.1bn: event-driven)third point offshore fund, Ltd.: $170.111.961 (22 billion yen: global event-driven)millennium, Ltd.: $53,795,491 (JPY 6.9 billion: mutual funds), Ltd.: $272,562,330 ($35.4 billion: mutual funds)The other issuing companies have separate hold clauses and buyback accounts.

For example, end-Sept 2010, the only investment destination ("d" tag) which can be bought back twice a year was "polychain global ltd: $7,945,257 (100 million yen: virtual currency)".

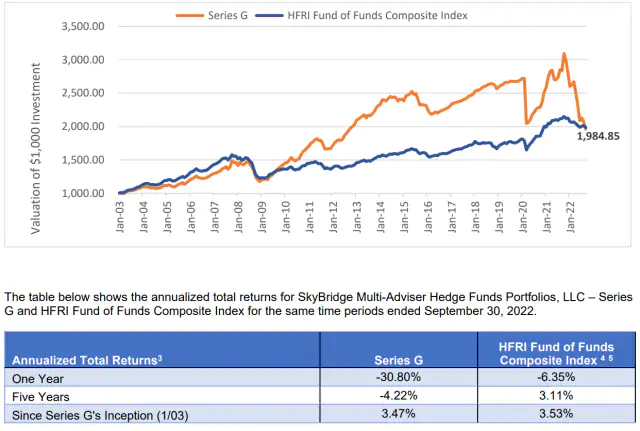

Capital relationship with FTX

Source: Skybridge

The other issuing companies have separate blocking clauses and repurchase accounts.

For example, late September of 2010, the only investment destination ("d" label) that can be exchanged twice a year was "Polychain Global Ltd: $7,945,257 (100 million yen: VC)". Third Point Offshore Fund, Ltd.: $170,111,961 ($22 billion for events)Millennium International, Ltd.: $53,795,491 ($6.9 billion for mutual funds)Point72 Capital International, Ltd.: $272,562,330 ($35.4 billion for mutual funds)according to a second filing at the end of September 2022, skybridge has acquired shares in ftx trading since 2021.

Critical ratio to FTXSource: Skybridge.

According to a SEC deposit at the end of September 2022, SkyBridge has purchased shares of FTX Trading since 2021.

Source: Skybridge

Looking at the breakdown of “investment funds”, which account for 85% of SkyBridge’s main funds, “various virtual currencies” (Bitwise Ethereum Fund, NYDIG Institutional Bitcoin Fund, etc.) account for 28%, and “unlisted virtual currency companies” ( FTX, Genesis Digital Assets, Lightning Labs, etc.) accounted for 14% (as of the end of September 2022).

Antony Scaramucci, founder of SkyBridge, and Sam Bankman-Fried, founder of FTX, are friends. SkyBridge announced that it will purchase virtual currency with a portion of the funds collected ($5.2 billion: $40 million).

Scaramucci remains bullish on cryptocurrencies in an interview with CoinDesk on Jan. Source: skybridgelooking on the breakdown for "mutual funds", that represent 85% of the major skybridge holdings, "diverse virtual coins" (bitwise ethereum fund, nydig fund bitcoin institution, and so on) represent 28%, and "unlisted e-money companies" (ftx, The beginnings of digital assets, lightning labs, and so on) represented 14% (end of September 2022). “I encourage people to invest now.”

‘Besides managing Bitcoin (BTC) and Ethereum (ETH) funds, SkyBridge raised about 900 million yen in April 2010 to launch the Bitcoin mining fund "SkyBridge BTC Mining LP."

SkyBridge, a major US venture capital, fell 39% last year: report appeared first on Our Bitcoin News.

BlocksInform

BlocksInform