Total AUM for cryptocurrency investment products jumped 36.8% in January to $19.7 billion, the largest AUM since May 2022, as investor sentiment picks up.

According to CryptoCompare’s latest Digital Asset Management Review report, bullish sentiment on the market was fueled by a short squeeze that forced short sellers to close their positions and a favorable economic outlook, as shown by the latest Consumer Price Index (CPI) report. This has led to the price of Bitcoin peaking since August 2022, at $23,000.

Despite the recent increase, assets under management for crypto investment products remain considerably weaker than in January 2022. It's because of a difficult year for Bitcoin, the wider cryptocurrency market, and traditional assets. In particular, aum for bitcoin and ethereum products decreased by 38.7% and 39.2%, respectively, relative to January 2022, according to the report.

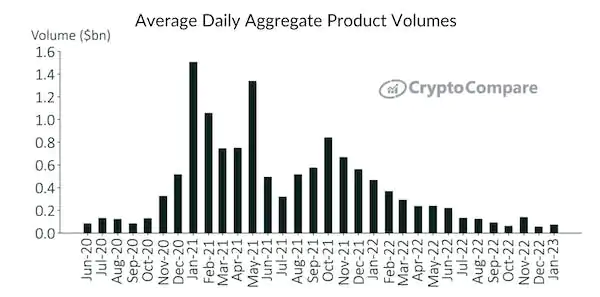

In January, the report adds, the average daily aggregate volume of investment products in cryptocurrencies also increased, with a recovery of 30% to 72.5 million dollars. However, volumes are still down 84.4% from Jan 2022 and down 95.2% from their historic peak in Jan 2021.

However, January accounted for the highest weekly net flows since November 2022, at $36.8 million per week. The upside occurred as the recent bull market "re-established investor confidence in the digital asset market and investment universe."

Last month, Bitcoin commodities short had the highest net flows of $12.0 million, followed by Bitcoin commodities with $7.9 million and Ethereum commodities with $4.9 million, according to the report.

Notably, the U.S. Securities and Exchange Commission (SEC) has recently rejected the ARK 21 Shares Bitcoin ETF proposed by ARK Investment and 21Shares for listing on the CBOE BZX Equities Exchange for the second time. The rejection was due to the argument of the sec according to which the stock market does not respect the norms of the sec to prevent fraud. To date, no spot market Bitcoin ETFs have been approved by the SEC.

BlocksInform

BlocksInform