Court Greenlights Court Greenlights He has contenders who are trying to buy all or part of the company.fi Plan to reimburse creditors with Crypto Mining Sale appeared first on Coinpedia Fintech NewsThe qualifying bidders must submit their bids to the court by March 2 and the representatives of the creditor have until March 16 to oppose the sale of the assets to them.Fi, a cryptocurrency swap, filed for chapter 11 bankruptcy on November 28.fi’s Plan To Repay Creditors With Crypto Mining Sale appeared first on Coinpedia Fintech News

BlockFi, a cryptocurrency exchange, filed for Chapter 11 bankruptcy on November 28. Blockfi has fallen victim to the spread caused by the collapse of FTX. The collapse of the three-arrow crypto hedge fund in June coincided with a liquidity problem on the New Jersey Stock Exchange, which marked the beginning of the problems. In the June crisis, former FTX CEO Sam Bankman-Fried offered a liferaft.

He rapidly deflated when FTX collapsed.

Blocki wins approval to auction assets

BlockFi has won approval from a New Jersey bankruptcy court to begin auctioning off its bitcoin mining assets. Blocki wins the auction approval of blockfi assets won the approval of a bankrupt court in New Jersey to start the auction of its Bitcoin mining assets. He has contenders who seek to buy all or part of the company. In a document filed earlier this month, the company stated that it had contacted 106 potential buyers with respect to the purchase of all or part of the business. Blockfi petition says it hopes to receive bids by February 20 and to close the auction a week later.

The company will then submit the sale motion to the court no later than March 1st for any agreement reached by the company. The court agreed that the purpose of the sale of the assets is to maximize the collection and "achievable value" of the corporation.

With the approval of the Court, more offers for crypto-extracting blockfi assets would have to enter. According to the document, "all qualified offers" had to be sent before the 20 February deadline to the parties listed in the submission procedures.

With court approval, more bids for the BlockFi crypto mineral assets should enter.

Why does the offer matter so much to the blockfi?

According to the newspaper, BlockFi’s lawyer, Francis Petrie, told the court that the business has already received offers for various assets and expects more to come.

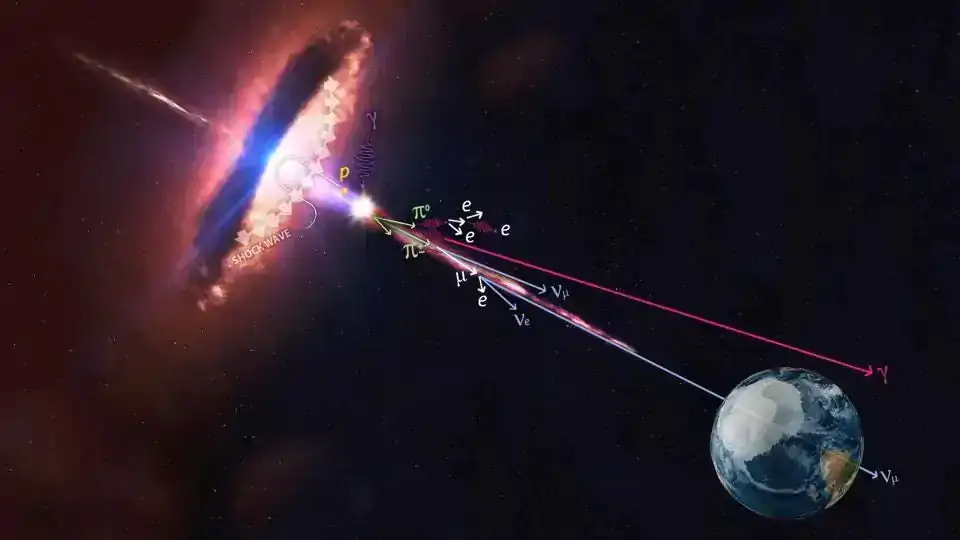

Fi's tight timeline is an attempt to secure bids as early as possible to take advantage of current market conditions, that saw most of the cryptocurrencies increase after months of trading aside. The paper said, blockfi’s lawyer, francis petrie, says to the court that the company has already received bids on various assets and expects others to be submitted on January 24, This was uncovered in bankruptcy proceedings, blockfi has been selling $160 million in secured loans through more than 68,000 Bitcoin mining platforms.

Given the state of the market for cryptocurrencies, some loans were already in default when blockfi started the process of selling them last year. Taking into account the state of the cryptocurrency market, some loans were already in default when BlockFi started the process of selling them last year.

BlocksInform

BlocksInform