This trend is likely to continue as cryptography continues to grow in popularity and general acceptance, and businesses are looking for new ways to protect their finances and improve their performance.

Now, some experts ask if and other cryptocurrencies will be the next addition to the portfolios of central banks.

Time to get rid of Bitcoin's precious metals?

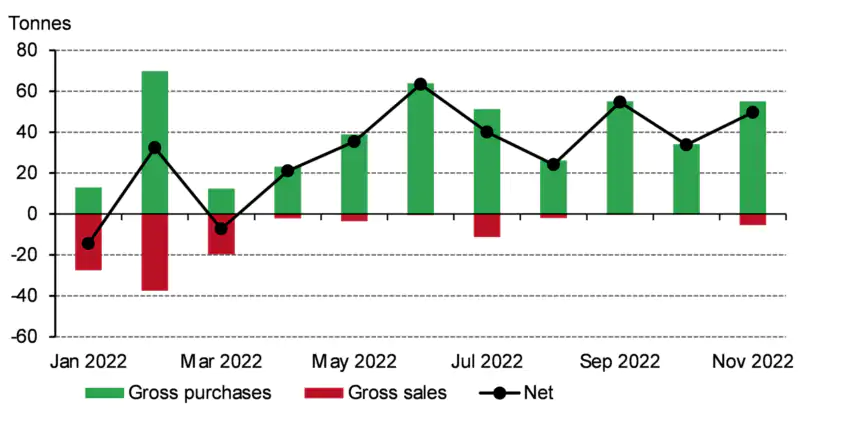

Precious metals have long been considered a safe haven for investors and a hedge against inflation. Consequently, the central banks increased their purchases of gold and money.

"The Central Bank sector was one of the strengths of the gold market in 2022, purchasing 673 net tons between the first and third quarters. For the entire year, central banks are likely to have amassed a high level of gold over several decades in 2022," said Krishan gopaul, Senior Analyst, Emea, Wgc.

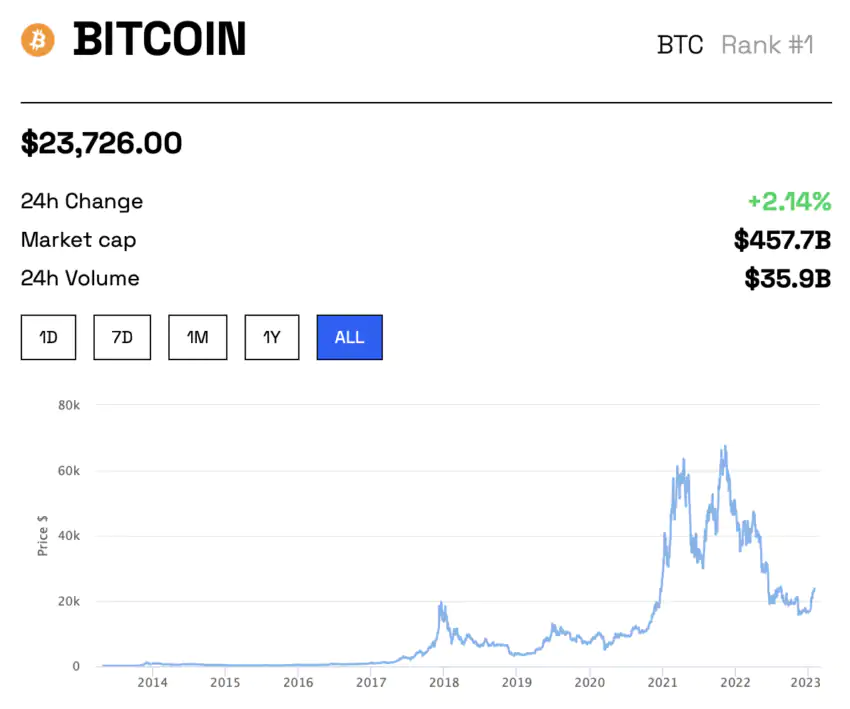

However, the rise of cryptocurrencies has sparked a new debate among economists and financial experts. Bitcoin, especially, has gained widespread attention for its potential as a valuable store, just like gold. It has also seen rapid growth with its value increasing by over 900% in the past five years alone.

Some central banks have already started looking at adding cryptography to their reserves. At the same time, many remain skeptical about the long-term stability and viability of these digital assets. Critics argue that the decentralized and unregulated nature of cryptocurrencies makes them susceptible to manipulation and hacking.

Others, however, view cryptocurrencies as a natural evolution of silver and a potential substitute for traditional fiat currencies. They highlight the growing use of cryptography in day-to-day transactions and the growing number of merchants who accept it as a payment.

Despite the current debate, one thing is certain: the financial world is evolving rapidly. Central banks should consider all options to stay one step ahead of . From precious metals to cryptos to a combination of the two, central banks will need to assess risks and benefits to protect their reserves and ensure financial stability.

If bitcoin will become a regular portion of central bank portfolios remains to be seen. It is clear that the conversation about cryptocurrencies and their role in the financial world will only continue to grow in the coming years.

It is clear that the conversation about cryptocurrencies and their role in the financial world will only continue to grow in the coming years.

This can be seen in particular in the number of listed companies which have added BTC to their balance sheets. Consumer acceptance as Bitcoin continues to gain in popularity and consumer acceptance, an increasing number of listed companies have added cryptography to their balance sheets. As Bitcoin continues to gain in popularity and general acceptance, an increasing number of listed companies have added cryptography to their bottom lines.

One of the first companies to embrace Bitcoin was Tesla, which invested $1.5 billion in the cryptocurrency in February 2021. Since then, other companies such as Square and MicroStrategy have followed suit. Other companies like Square and Microstrategy have followed suit ever since.

The two companies investing billions of dollars in Bitcoin and declaring large returns on their investments. Many experts consider these investments as a sign of the increasing maturity and stability of the cryptocurrency market. Bitcoin was considered a speculative asset for a long time.

However, not everyone is convinced that adding Bitcoin to corporate balance sheets is a wise move. However, not everyone is convinced that adding Bitcoin to the balance sheets of corporations is a wise decision. Some financial experts maintain that cryptocurrencies are still too volatile and unpredictable to be regarded as a safe investment for businesses.

Despite these concerns, more companies seem to be jumping on the Bitcoin bandwagon. They also point out that there is a lack of regulation in the crypto market, which could put businesses at financial and reputational risk.

BlocksInform

BlocksInform