Read More: Influx of Bitcoin Gemini further exchanges fell to about six years lower, cryptoquant data shows. FIX (Jan 30, 6:26 GMT):

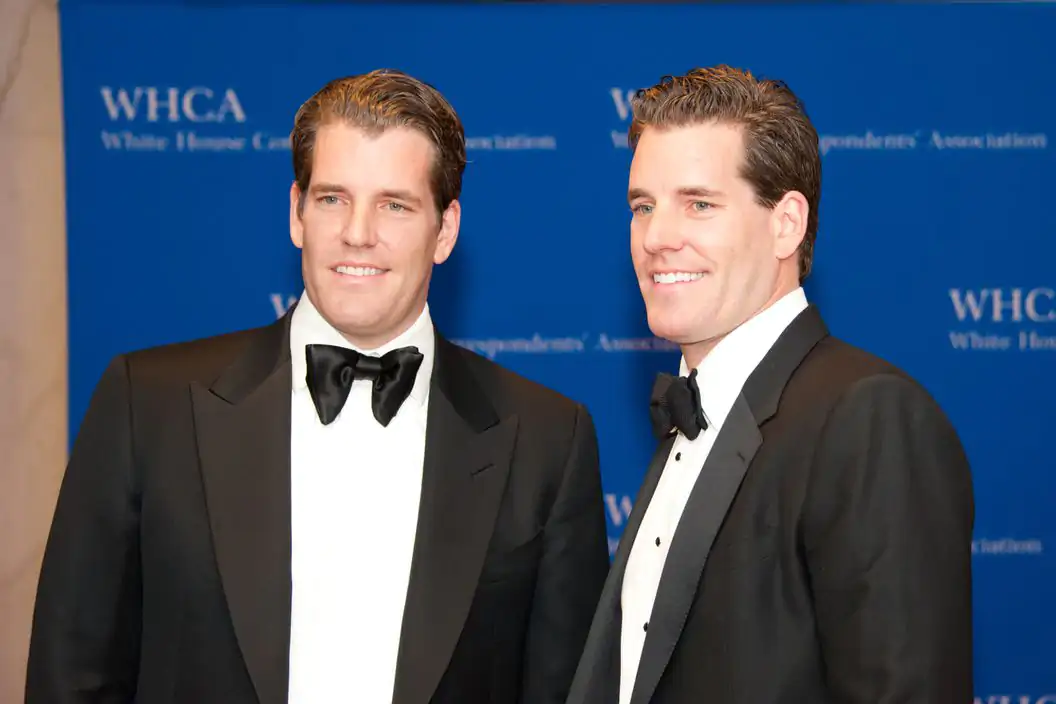

Cryptocurrency exchange Gemini reportedly implied to customers that their assets in its interesting-bearing Earn product were safe because they were backed by the Federal Deposit Insurance Corp (FDIC), Axios reported on Monday.

According to the report, Gemini's discussions with clients made reference to the fdic.

Seems to relate to the company's deposits with other banks rather than its own products, a distinction that clients do not seem to understand.

It is unlawful for a financial practice to suggest that an uninsured product is insured by the FDIC.

The New York Department of Financial Services (nydfs) is investigating gemini, the axios report says.

The New York Department of Financial Services (nydfs) is investigating gemini, the axios report says.

The exchange halted withdrawals from its Earn product in November last year amid the fallout from the collapse of fellow exchange FTX.

Gemini did not reply to CoinDesk's request for a formal comment on this subject at the time of the press. The New York Department of Financial Services (NYDFS) surveys Gemini, according to the Axios report.around $900 million is estimated to be frozen on the platform as a result. Gemini blamed the stoppage of a freeze similar to the genesis crypto-lender now in bankruptcy, where gemini invested the funds of its customers.

Genesis and coindesk are both owned by the crypto conglomerate's digital money cluster.

BlocksInform

BlocksInform