BlockFi can auction off mining assets to take advantage of favourable market conditions, according to the rules of an American bankruptcy judge.

BlockFi’s assets have courted significant interest given crypto market volatility, necessitating an expedient response, BlockFi’s lawyer Francis Petrie told bankruptcy judge Michael Kaplan.

BlockFi Wants to Exploit Upsurge in Mining

According to Petrie, interested parties can bid for the assets up to Feb. 20, 2023, with the auction following roughly a week later. Blockfi will seek court approval for any large offer of the auction. All assets that are not retained will be part of the company's restructuring plans for a quick recovery from bankruptcy, Petrie.

The auction plans come roughly a week after BlockFi it would sell $160 million in loans collateralized by mining equipment as part of ongoing Chapter 11 bankruptcy proceedings. It allegedly sold its own crypto assets for $239 million after going bankrupt in November 2022.

The auction is also taking place at a time when the mining industry is becoming more and more prosperous, dipped in a broadly bearish market, notwithstanding a recent rebound in the price of bitcoin since early 2023. The rise in the price of bitcoin has raised miners' incomes and seen miners bring more machines online.

The smelter is leading the worldwide resurgence of hashrates.

Mining companies borrowed a lot to finance their expansion through the 2017 and 2022 bull markets. However, the drop in Bitcoin prices and rising energy costs have reduced the liquidity required to pay off these debts. As a result, many highly indebted crypto companies have sold or returned their mining equipment to repay loans.

The New York Digital Currency Group acquired mining platforms owned by Greenidge Generation Holdings in order to reduce its debts from 57 to 68 million dollars. By contrast, Sydney-based Miner Iris Energy closed a significant portion of its mining operations as a result of a $108 million loan default. The scientific mining giant has recently closed platforms owned by a Celsius bankrupt lender after the lender did not pay for the increase in energy costs as part of an accommodation agreement. Others, such as digital mining, died by converting the modified banknotes into shares.

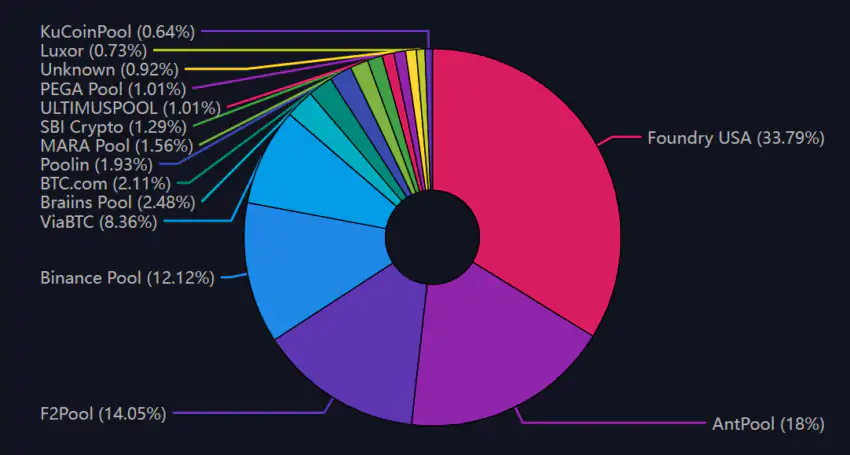

Despite the surrender, mining hash has increased to around 290 exahashes per second, according to blockchain.com. Most of the mining power in the last week came from the world’s largest mining pools, such as Foundry USAAntPool, which collectively account for 64% of the current global hashrate. A mining pool consists of a group of miners who earn revenues based on their contribution to the hashrate of the pool, independently of the fact that the pool checks a Bitcoin transaction block.

According to mempool data, Foundry USA alone accounts for over 90 exahashes per second, with AntPool coming in second with 47.1 exahashes per second. Foundry is a member of the Digital Currency Group, a leading crypto company whose subsidiaries include failed lender Genesis Global Capital and digital asset manager Grayscale Investments.

BlocksInform

BlocksInform