BlockFi sells mortgage obligations.

It was disclosed on 24 that BlockFi, a crypto asset lending company (virtual currency) that is going bankrupt, is in the process of selling 20 billion yen (160 million dollars) in debt securities.

The tender deadline, which started at the end of 2022, is set for 24 January, reported Bloomberg on Wednesday, quoting an anonymous source.

All such loans are designed for Bitcoin (BTC) miners and supported by a total of 68,000 extraction machines. Some are under-guaranteed as the price of mining equipment declines.

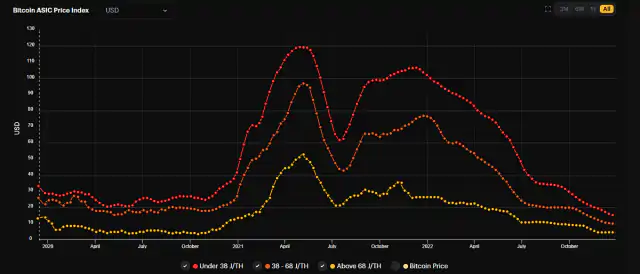

ASIC price index

The average price of Bitcoin mining equipment (ASIC) is falling by 80 per cent annually, according to market data. The main factors are the fall in the price of bitcoin and the rise in electricity costs, like uneconomic miners and debt consolidation lenders put a lot of their mining machines for sale.

Blockfi filed in bankruptcy pursuant to Chapter 11 of the United States Bankruptcy Code in November 2022. Depending on the deposit, there are over 100,000 creditors and between $1 billion and $10 billion in assets and liabilities.

Chapter 11 will continue to function and reduce the debt and so on, and rebuild the business. However, in certain cases, the debtor company's assets are sold to a third party in order to maximize collection from the creditor. If so, it will be sold to the highest bidder and the funds will be distributed to creditors.

BlockFi has contacted 106 potential bidders since December and expects to seek Tribunal approval on the tendering process on January 30.

Are bitcoin miners giving themselves up now?Consider industry trends and impact on BTC price

Distressed investment progresses in the industry

In 2022, there were a series of deleveraging (reduction of excessive debt) events in the cryptocurrency market, such as the Terra (LUNA) shock in May and the FTX shock in November. There is a view that these have brought about the forced liquidation of debts by money lenders who have lent funds to miners, adding additional downward pressure to the price of Bitcoin.

Ethan Vera, co-founder of Luxor Technologies, an American mining company, estimated total loans guaranteed by mining machinery to be in the amount of? $520B ($4B) in June 2022

The major lenders who accept mining machines as security are the digital galaxy, an investment firm in cryptocurrency, nydig, a cryptocurrency investment company in the USA, celsius network, foundry networks, a dcg mining company, an investment firm in cryptocurrency, and Shanghai. ‘s virtual currency lending platform Babel Finance.

Of these, Celsius stopped withdrawing customer funds in June due to a chain of defaults that occurred in the virtual currency market after the collapse of the former Terra ecosystem in May 2022. In July, chapter 11 went under in the U.S.

In June 2022, Babel Finance stopped withdrawing funds from its clients, citing that it was "confronted with liquidity pressures" in the context of a series of defaults by some industry giants. It subsequently came to light that the company was seeking hundreds of millions of dollars in loans and equity investments as part of a bailout.

Under these circumstances, there is a growing need for "troubled investment" to buy the assets of companies that fail at low prices. Jihan wu, co-founder of bitmain, a leading manufacturer of bitcoin extraction machinery, launched a fund of approximately 36.1 billion yen (250 million dollars) in September 2010.

The founder of Bitmain will create a $300 million fund for the purchase of questionable assets.

In November, Foundry Digital announced its intention to acquire the facilities of the failed U.S. mining company Compute North. Compute North applied for bankruptcy protection under Chapter 11 (Chapter 11) in Sept 2022. There are approximately 200 creditors and $500 million in total liabilities (approximately $70 billion).

DCG’s Subsidiary to Acquire Compute North

Cryptocurrency exchange FTX, which filed for bankruptcy last November, said about 117 entities were interested in bidding on four businesses it was considering selling.

Over 100 organisations interested in bidding on the sale of FTX business, including the exchange of Japanese cryptocurrencies.

BlockFi to sell 20 billion yen worth of bitcoin mining machine-backed loan appeared first on Our Bitcoin News.

BlocksInform

BlocksInform