Bitcoin trade price highly above the $20,000 psychological level and shows signs of another upward movement above $21K. Five on-chain indicators also signal that Bitcoin has entered an early bull market

The crypto market recovered slightly after the U.S. DOJ enforcement action against Russian crypto exchange Bitzlato. Crypto twitter blames doj to create a lot of hype around little news that caused the sale of panic throughout the crypto market.

Five On-Chain Indicators Indicate More Upside in Bitcoin Price

According to on-chain data by CryptoQuant, Bitcoin price has entered the early bull market cycle and is likely to move higher with promising momentum in the next few days.

Bitcoin spot moves to derivatives trade have grown as investors have begun to take risks. Dealers typically move their coins to derivatives exchanges to increase their market exposure. It helps them make more money while the market recovers.

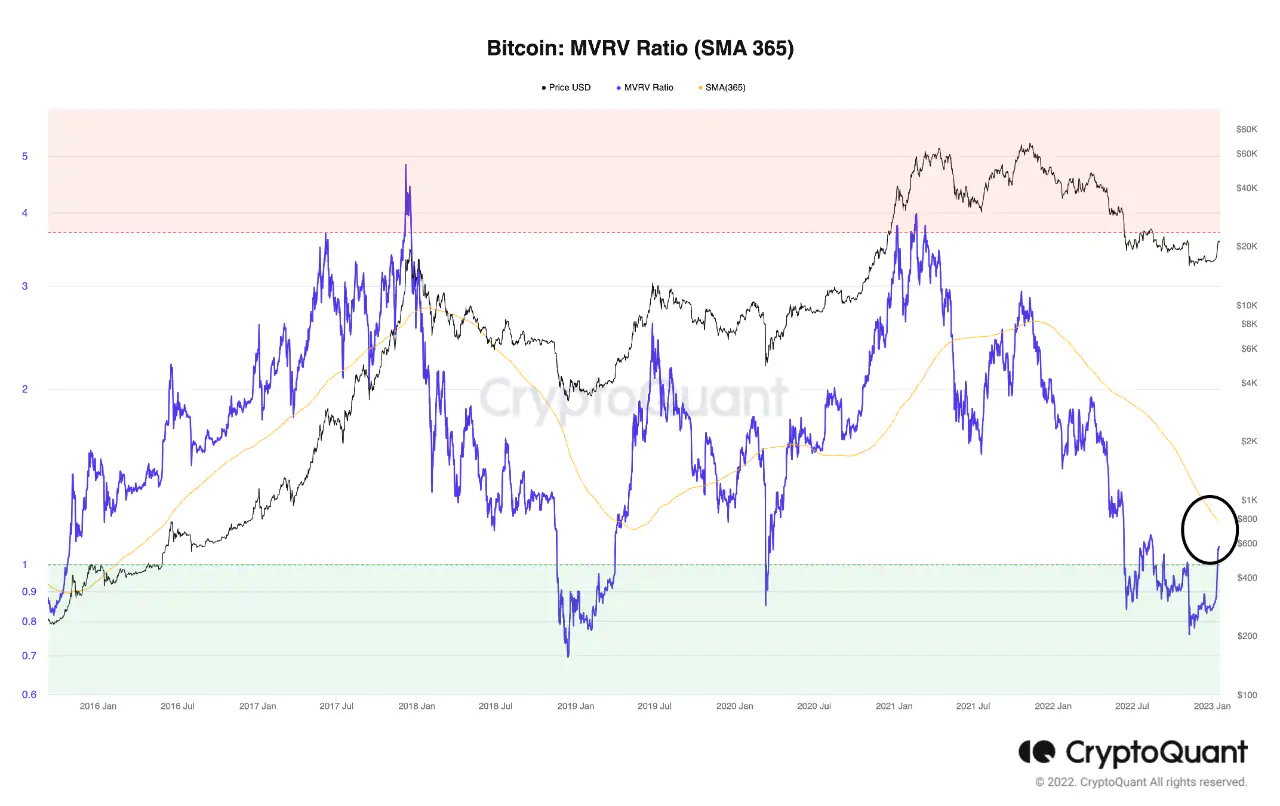

The mvrv ratio indicates whether the price of bitcoin is underestimated or overestimated. It is derived from Bitcoin’s market capitalization (market price) divided by its actual market capitalization. At this time, mvrv is 1.07 and is close to the 365-day moving average (orange line). Thus, it says bitcoin is on the verge of starting a new upward trend.

Third indicator, unrealized net income shows the mean profit margin of bitcoin holders. It is also close to the moving average over 365 days and indicates an early bull cycle.

Puell multiple is the ratio of the daily value in dollars of newly issued bitcoins to their rolling average of a year. Currently, the indicator shows a shift towards a positive trend as the Bitcoin price stands strongly above its moving 365-day average.

Cryptoquant’s p&l index indicator combines the mvrv ratio, net loss not realised, and lth/sth sopr in an indicator of unique bitcoin value. The P&L Index points to an early Bitcoin bull market cycle as the index (dark purple line) looks to cross the 365-day moving average (light purple line)

Also ReadBitcoin Price Really Bottomed? Use These To Confirm Market Bottom

BTC Price Await Upside Momentum

Bitcoin (BTC) price fell nearly 2% in the last 24 hours, with the price currently trading at $20,774. The lowest and highest amounts are $20,541 and $21,564 respectively. In addition, the volume of transactions has increased by 21 per cent over the past 24 hours, indicating an increase in interest.

Traders should watch the USD index (). A drop in the dxy below 102 to present market conditions will confirm a rally in the Bitcoin price.

Also ReadBinance Linked With Exchange Accused Of Money Laundering

- Bitcoin

- Bitcoin on-chain metrics

- Bitcoin Price

BlocksInform

BlocksInform