Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

The aftermath of the implosion of the earth still haunts the world of crypto, with the stable yield platform now obtainable stablegains being continued for client losses. The applicants allege that the platform channeled client funds to the anchorage protocol without the knowledge or consent of the users.

The platypus, the protocol challenge that has been exploited for more than $8 million, is working on an offsetting plan to recover a portion of the funds.

The bank cogent of Florida offers a participation of 100 million dollars in loans to the trust rwa master participation of makerdao.

Bridge protocols were the main target of achievements last year, representing hundreds of millions of dollars in stolen funds. Bridges without trust can alleviate the problem, allowing transfers between chains without the need for a centralized depository, which could make this a more secure option for interoperability.

After nearly four weeks of bull racing, the challenging market bravely struggles with bears. There were minor price declines and the market as a whole declined slightly as bears took over late in the week.

Yield platform Stablegains sued for promoting UST as a ‘safe’ investment

DeThe Fi Yield Stablegains platform is being sued in a California court for allegedly deceiving investors and not complying with securities laws.

On the eighteenth of February, the plaintiffs, Alec, then Artin Ohanian, filed a complaint with the U.S. District Court for California's Central District, claiming that the closed challenge platform misappropriated all of its clients' funds to the Anchor protocol without their knowledge or consent. The anchoring protocol provides up to 20% efficiency on the stablecoin algorithmique des laboratoires terraformels, terra usd (ust).

The platypus will be working on the compensation package following an $8.5 million attack.

The $8.5 million blitz attack on Platypus was made possible by a code that was in the wrong sequence, according to a post-mortem report by Platypus Omniscia's auditor. The DeFi firm is working on a compensation plan for users’ losses after a flash loan attack drained nearly $8.5 million from the protocol, affecting its stablecoin dollar peg.

In a tweet about February. 18, platypus stated that it was working on a plan to offset the damage and asked users not to realize their losses in the protocol, to say that this would make the management of the problem more difficult for the company. The winding-up of assets is also suspended, in accordance with the protocol.

MakerDAO voting on $100M loan participation with Florida commercial bank

Crypto lending platform MakerDAO is voting on a new proposal to bring another commercial bank into its ecosystem, strengthening the connection between DeFi and traditional finance.

In accordance with the governance forum of makerdao, cogent bank, a commercial bank based in Florida, proposes to participate with 100 million dollars in loans to the rwa participation trust of makerdao.

DeFi security: How trustless bridges can help protect users

Blockchain bridges allow DeFi users to use the same tokens across multiple blockchains. For instance, a merchant may use a USD coin () on ethereum or solana blockchain to interact with the decentralized applications of these networks.

Although these protocols may be suitable for challenge users, they may be exploited by malevolent actors. For example, in the past year, the Wormhole bridge — a popular cross-chain crypto bridge between Solana, Ethereum, Avalanche and others — was hacked, with attackers stealing over $321 million worth of wrapped Ethereum (wETH), the largest hack in DeFi history at the time.

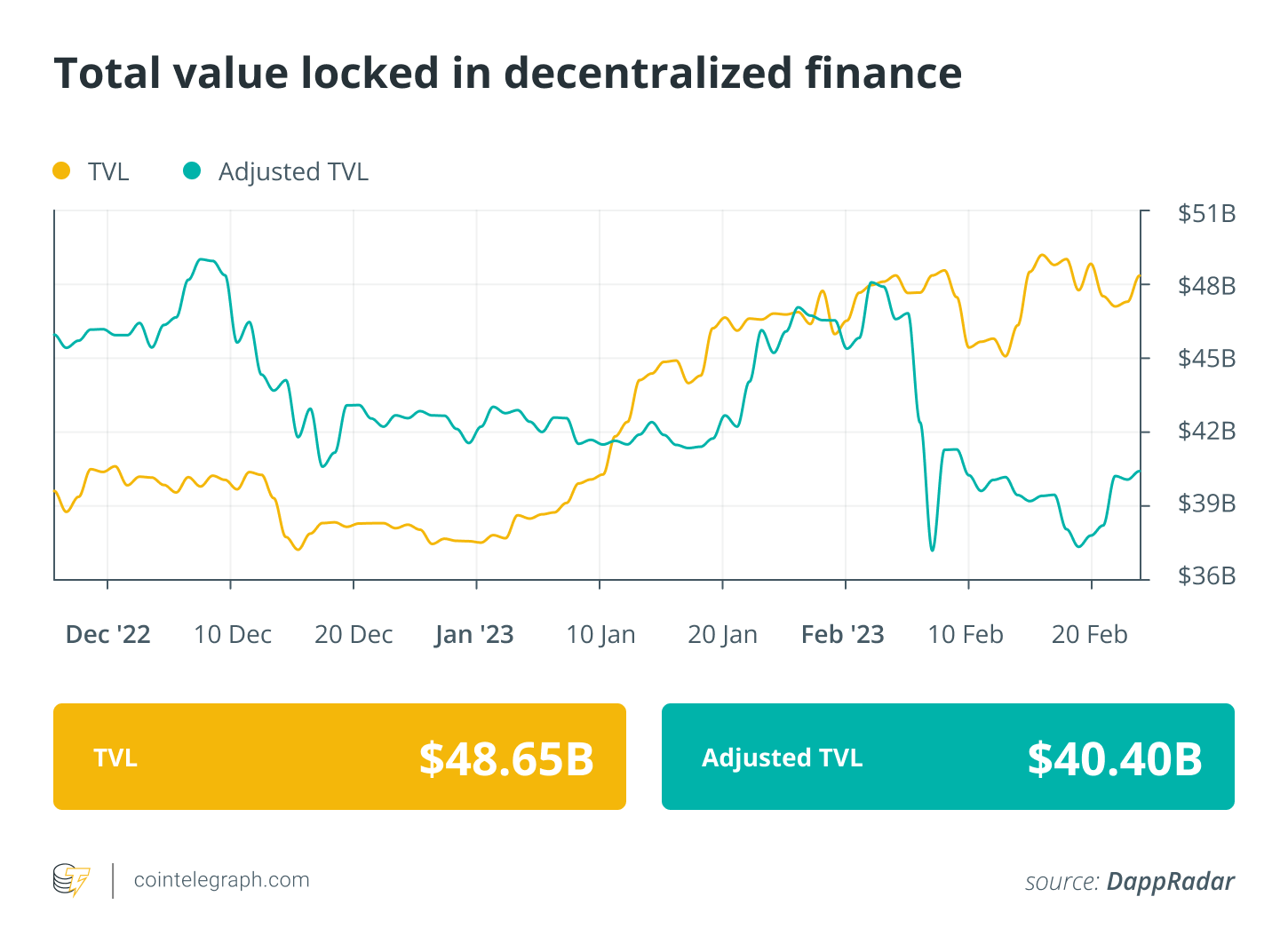

DeFi market overview

The analysis shows that the total market value of the challenge went below $50 billion last week. Both pro and tradingview currency market data show that the top 100 challenge tokens per market cap had a mixed week, with most trading chips in green while a few other were bleeding in red.

Thank you for reading our highlights from this week. Please join us on Friday to learn about this evolving space.

BlocksInform

BlocksInform