Sage D. Young

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, As well as BTC, ETH, LINK, AAVE, PEOPLE, DOGE, OS, and HTR.

Privacy Pools, an open-source research project and forked successor of coin mixer Tornado Cash, was deployed on the testnet of layer 2 scaling system Optimism this past weekend.

Like Tornado Cash, Privacy Pools allows users to make anonymous transactions, but the defining difference between the two privacy tools stems from how Privacy Pools uses zero-knowledge proofs to prove that funds in the anonymous transactions are not connected to criminal activity.

In August 2022, Tornado Cash, a popular privacy tool on the Ethereum blockchain that pools transactions to obfuscate senders and recipients, was sanctioned by the U.S. Treasury Department’s Office of Foreign Asset Control (OFAC) for its role in North Korea’s money-laundering operations. In the same week, Tornado Cash’s web developer, Alexey Pertsev, was arrested.

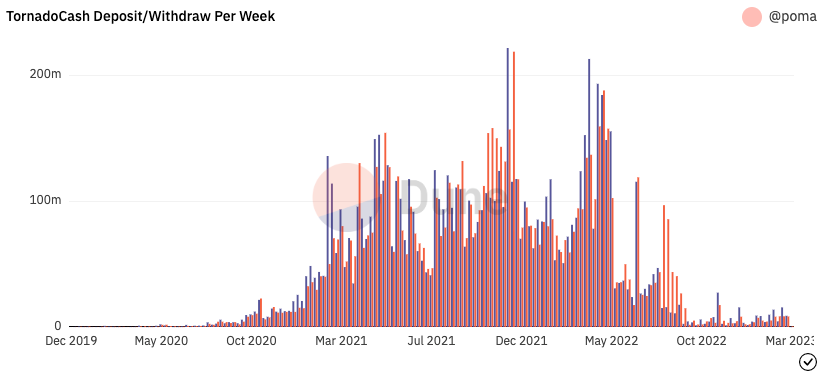

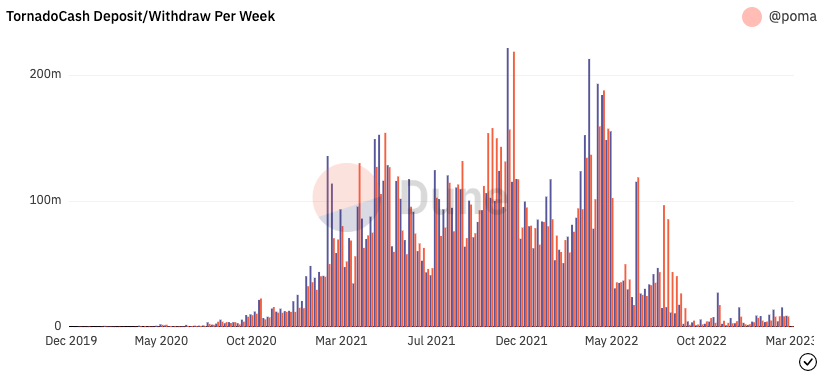

While OFAC sanctioned Tornado Cash, making it illegal for U.S. citizens to use the coin mixer, Tornado Cash has averaged $7.87 million in deposits and $5.97 in withdrawals per week in 2023, “on track to anonymize ~$250M in 2023,” tweeted Ameen Soleimani, a developer for Privacy Pools.

(Poma/Dune Analytics)

Privacy Pools improves on what Tornado Cash couldn’t do: It allows users to prove their funds are not associated with criminal activity such as North Korea’s $625 million hack on play-to-earn gaming giant, Axie Infinity.

How Privacy Pools works

According to the protocol’s Github technical documents, “Users can voluntarily remove themselves from an anonymity set containing stolen or laundered funds … This design aims to be a crypto-native solution that allows the community to defend against hackers abusing the anonymity of honest users without requiring blanket regulation or sacrificing on crypto ideals.”

With Privacy Pools, users deposit their funds into a common pool and withdraw their funds into a new wallet address that is untraceable and unlinkable to any prior transaction history, using zero-knowledge proofs that allow for information to be verified, such as a transaction on a blockchain, without leaking specific details of the transaction.

As more people choose to opt out of anonymity sets that contain stolen or laundered funds, the number of sets available for hackers and malicious actors to use shrinks. As such, the protocol gives users “the option to help regulators isolate funds, without revealing their entire transaction history,” added Soleimani.

Privacy Pools is in its “version zero” with future iterations to come. The protocol is still experimental code and has not been audited. Soleimani said, “This is an opportunity to prove the ingenuity of the crypto community to self-regulate and to showcase the awesome power of zero-knowledge proofs.”

$22,425.82

$22,425.82 $1,569.17

$1,569.17 BNB$287.78

BNB$287.78 XRP$0.37096432

XRP$0.37096432 $11.26

$11.26DISCLOSURE

Please note that our privacy policyterms of usecookiesdo not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Sage D. Young

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, PEOPLE, DOGE, OS, and HTR.

Sage D. Young

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, PEOPLE, DOGE, OS, and HTR.

BlocksInform

BlocksInform