Jodie Gunzberg

Jodie Gunzberg, CFA, is the Managing Director of CoinDesk Indices.

Max Good, senior index research analyst at CoinDesk Indices, contributed writing for this report.

Introduction

In December 2021, CoinDesk Indices launched its Digital Asset Classification Standard (DACS) to set the standard for defining the industries of digital assets. Every one of the top 500 digital assets by market capitalization is assigned to an industry, defined by DACS, then at least one industry is assigned to an industry group, and finally, at least one industry group is assigned to a sector.

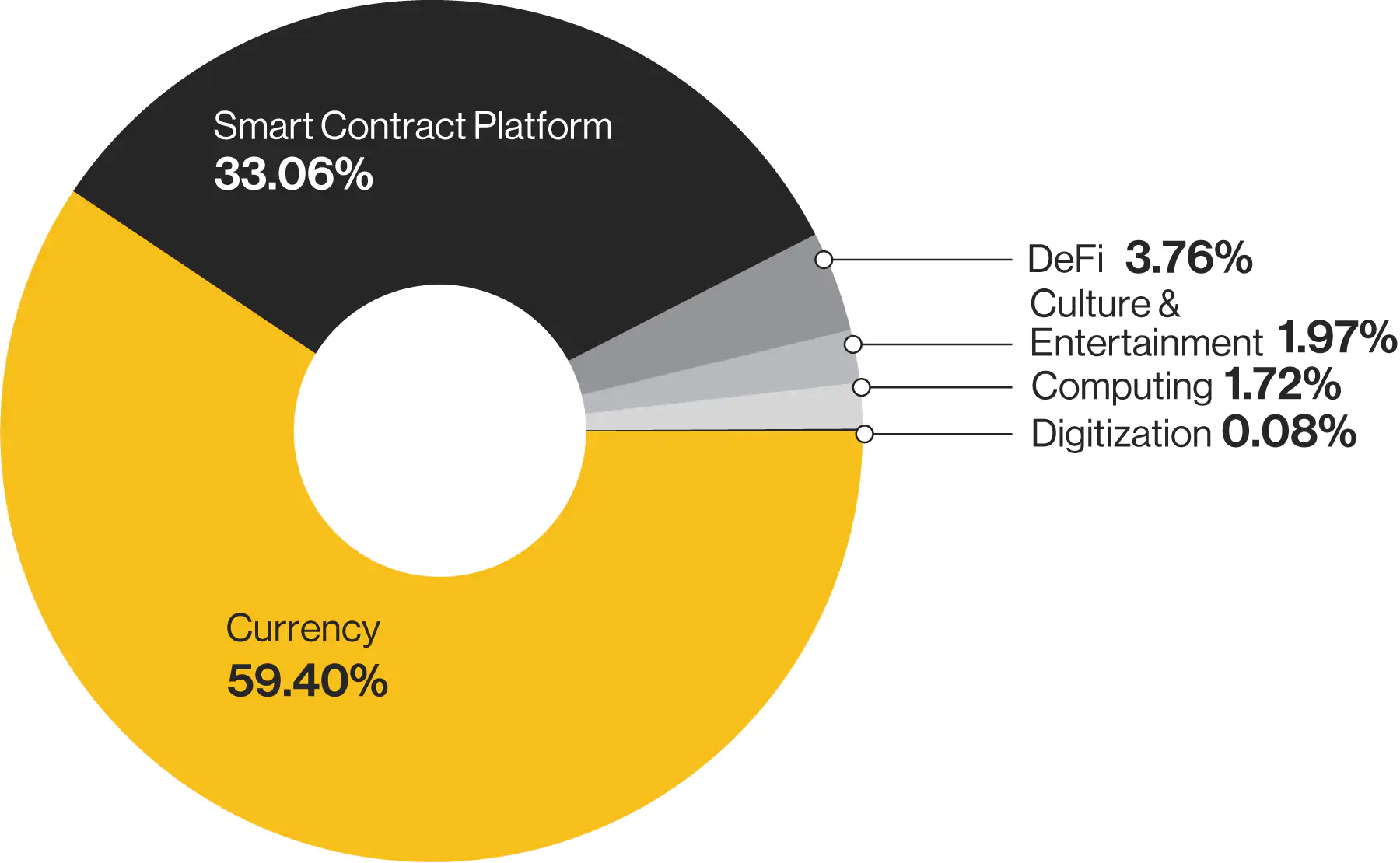

Currently, there are six sectors defined by DACS including Currency, Computing, DeFi (decentralized finance), Digitization, Culture & Entertainment, and Smart Contract Platform. The Smart Contract Platform sector is the second-largest sector in DACS, with 80 assets representing 33.1% of the digital asset market worth approximately $576 billion in market capitalization as of April 2022.

Exhibit 1: CoinDesk Indices DACS

(CoinDesk Indices, May 13, 2022. Market capitalization data is based on 4/30/2022.)

In this paper, we describe the Smart Contract Platform Sector in further detail by discussing its definition, constituents and significance in the broader digital asset space.

Defining the Smart Contract Platform sector

A smart contract platform is a blockchain that provides the fundamental backbone for building decentralized applications (dapps). These dapps run when predetermined conditions are met and are thus paramount to the operation and flourishing of decentralized finance (DeFi) and other blockchain applications. There are two important features that enable a Smart Contract Platform: first, compatibility with developer-friendly programming languages so that they can build custom smart contracts. Second, a consensus mechanism maintained by a network of nodes who periodically validate blocks to ensure transaction finality and the security of the overall network.

DACS Glossary defines the Smart Contract Platform sector as follows:

Smart contracts are computerized blockchain protocols that execute terms of a contract. Smart contracts represent computer codes ensuring that when both parties meet the terms of the contract, they will execute automatically, allowing for trustless peer-to-peer transactions. Smart Contract Platform assets are designed for the building of decentralized applications, layer 2 scaling solutions, decentralized autonomous organizations (DAOs) and other custom protocols. Every platform has a unique open-source user and miner incentive structure that utilizes the BFT (Byzantine Fault Tolerance) consensus mechanism. Every platform utilizes a native token for the payment toward building on the platform, providing liquidity and allowing interoperability between the native token and the newly created tokens built on the platform.

Industry groups inside the Smart Contract Platform sector

The industry groups in the Smart Contract Platform sector depend on whether the asset offers interoperability with other chains. There are two industry groups, Single Chain and Multi-Chain/Parachain, included in the Smart Contract Platform sector.

The Single Chain industry group includes layer 1 blockchain in which all transactions are recorded on the primary distributed ledger. Single Chain allows for layer 2 scaling solutions that remain tied to the primary blockchain for transactional competency.

The Multi-Chain/Parachain industry group includes smart contract platform assets that enable multiple parallel blockchains and cross-chain interoperability. It can be structured with a relay chain that allows slots for external parallel chains, or parachains. The relay chain allows for pooled security and pooled block execution, making it possible for each parachain to be an isolated, independently validated blockchain that can achieve its own levels of scalability.

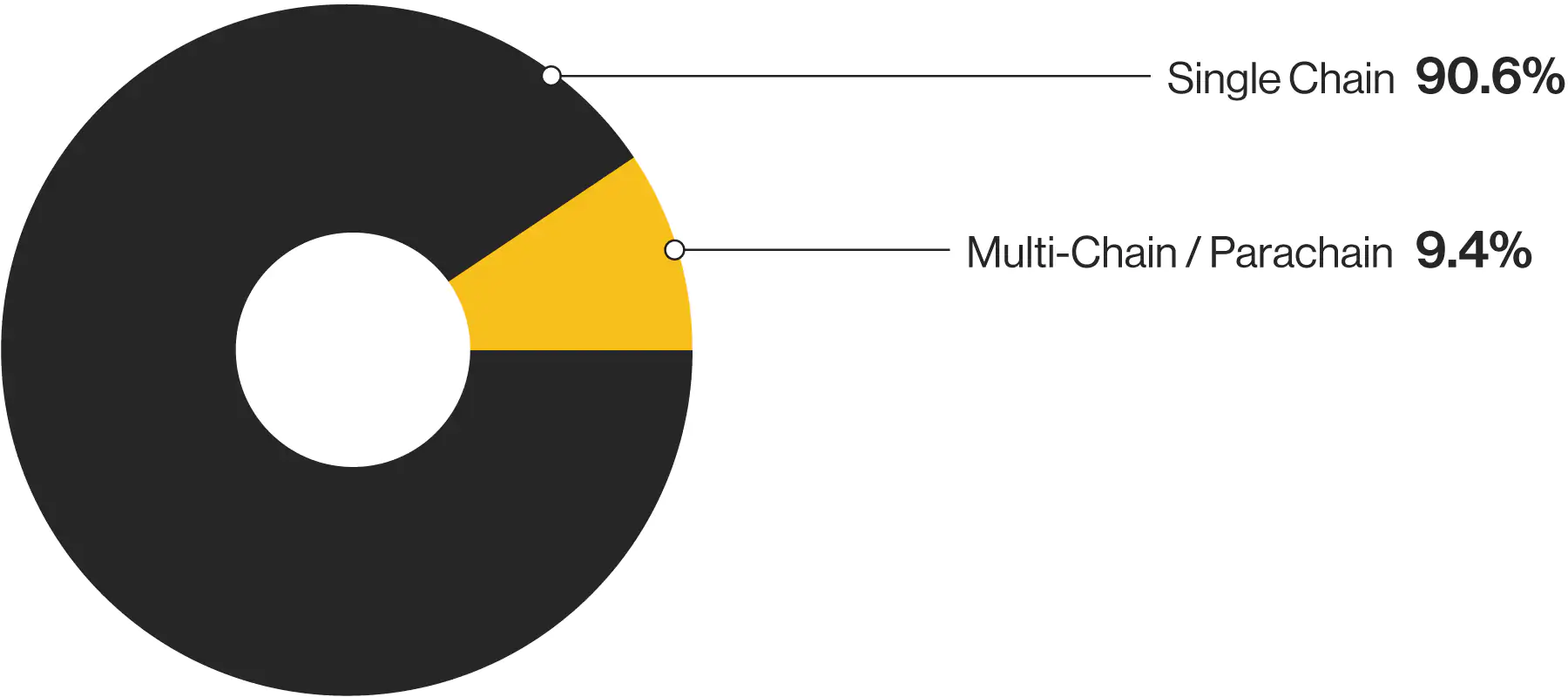

Within the Smart Contract Platform sector, Single Chain is the more developed industry group, comprising nearly 90.6% of the market capitalization, given the dominance of ether. However, there are 30 digital assets in the Multi-Chain/Parachain industry group with rising demand for interoperability.

Exhibit 2: Smart Contract Platform Sector Breakdown by Industry Group

(CoinDesk Indices, May 13, 2022. Market capitalization data is based on 4/30/2022.)

Exhibit 3: Industry Groups Under Smart Contract Platform Sector

Industry Group | Market Capitalization $ | Number of Assets | % of Market Capitalization |

|---|---|---|---|

Single Chain | 522,339,090,986 | 50 | 90.6% |

Multi-Chain/ Parachain | 54,172,131,547 | 30 | 9.4% |

(CoinDesk Indices, May 13, 2022. Market capitalization data is based on 4/30/2022.)

Industries inside the Smart Contract Platform Sector

Within the Smart Contract Platform sector, each industry group currently consists of a single industry to which a digital asset is assigned. Therefore, the industry composition of the sector is the same as the industry group composition. However, as the sector grows, it is possible for additional industries to emerge.

Major assets inside the Smart Contract Platform sector

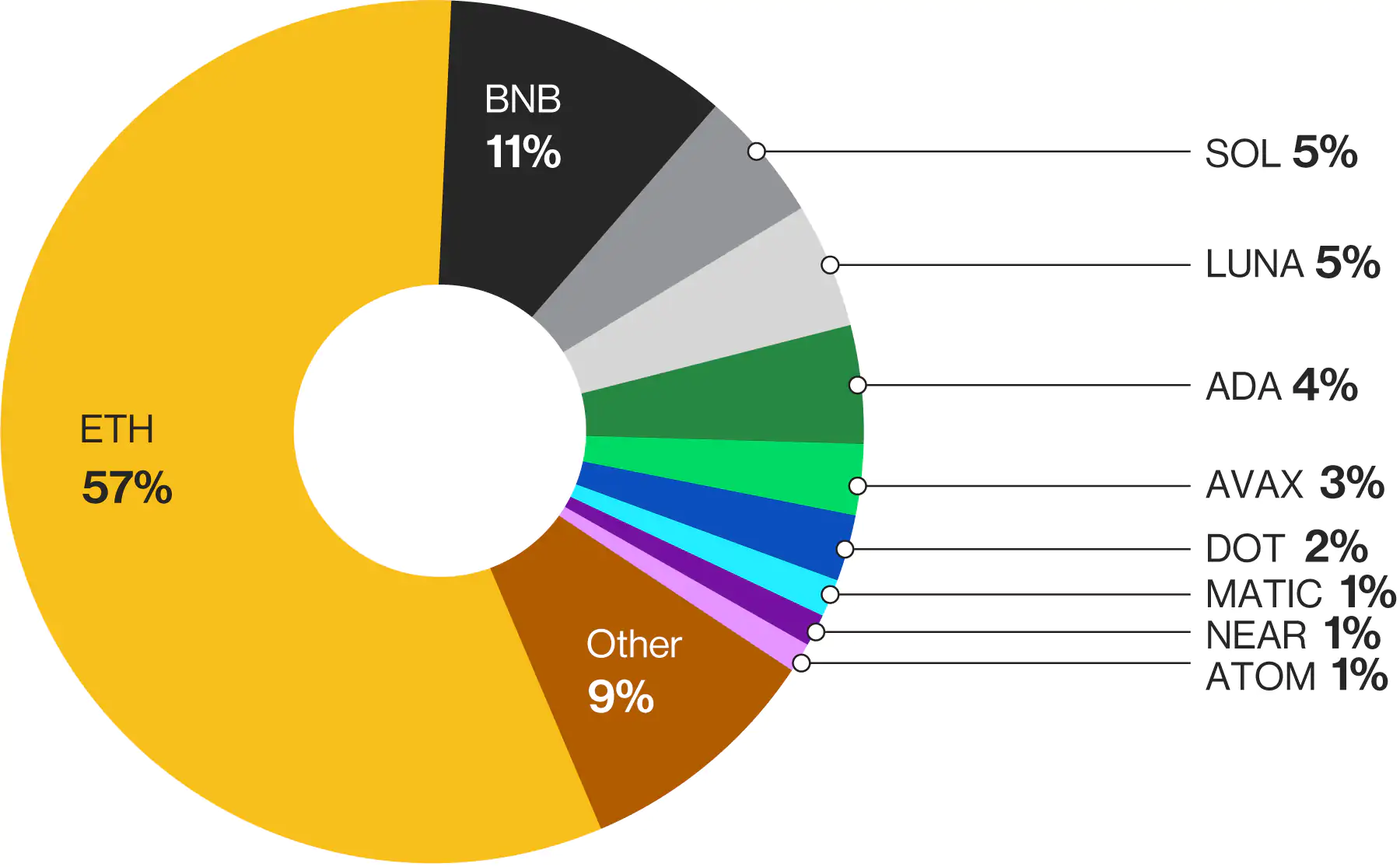

While there are 80 digital assets inside the Smart Contract Platform sector, the sector is highly concentrated with ETH1 representing more than half the sector, and the top 10 assets representing 90.6% of the sector. Within the Single Chain industry, significant assets beyond ETH include ADA and SOL2, each with its own blockchain and dapp ecosystem. DOT3, a layer zero relay chain that serves as a hub for other parachains, and AVAX4, the primary network for a series of subnetworks, are other key assets in the sector included in the Multi-Chain/Parachain industry.

Exhibit 4: Top 10 Assets Inside the DACS Smart Contract Platform Sector

(CoinDesk Indices, May, 13, 2022. Market capitalization data is based on 4/30/2022.)

Conclusion

The Smart Contract Platform sector tends to foster a rich environment for innovation that attracts a high level of development and resources. These platforms leverage network effects, decentralized consensus mechanisms, and compatibility with various programming languages – thus, allowing creative and innovative developers to build protocols for a wide range of purposes such as decentralized exchanges, lending platforms and NFT marketplaces.

Smart Contract Platforms serve as the foundation for the digital economy as the dapps built on these platforms attract millions of users, empowering individuals to take greater ownership over their finances and transactions, thus creating a burgeoning economy with a wide range of opportunities. They also facilitate a positive reinforcement cycle through the network effect. As more dapps are built on the various smart contract platforms, the platform that acts as the transactional base settlement layer for each protocol running on its blockchain benefits from increased revenue and demand, as new users purchase and spend native tokens to gain access to the network.

Relevant Indexes

- CoinDesk Cardano Price Index (ADX)

- CoinDesk EOS Price Index ()

- CoinDesk Ether Classic Price Index ()

- CoinDesk Ether Price Index ()

- CoinDesk Industry Group Select Equal Weight Index (DIGS)

- CoinDesk Large Cap Index (DLCS)

- CoinDesk Smart Contract Platform Select Ex ETH Index (SCPXX)

- CoinDesk Smart Contract Platform Select Index (SCPX)

- CoinDesk Solana Price Index (SLX)

- CoinDesk Tezos Price Index ()

References

Ethereum (Single Chain) – The largest smart contract platform, Ethereum has been fundamental to the enormous growth in the DeFi space over the past few years. Ethereum’s extensive developer resources and its native programming language, Solidity, have enabled developers to build a massively successful ecosystem of dapps such as Aave, Uniswap, and OpenSea. These dapps leverage the security of Ethereum’s decentralized proof-of-work blockchain, as well as the network effect it has cultivated since its launch in 2015. Ethereum plans to switch to a proof-of-stake blockchain sometime in 2022.

(Single Chain) – The self-proclaimed “fastest blockchain in the world,” Solana boasts sub-$0.01 transaction fees and 400-millisecond block times. With extensive smart contract capabilities, Solana has become arguably the second most popular platform for dapp developers and retail users. Solana uses a combination of delegator & validator-backed proof-of-stake consensus, with a novel proof-of-history mechanism to process transactions quickly and with high throughput, while simultaneously securing and decentralizing the network. Solana’s network sports its own rich ecosystem of dapps, including lending protocols, exchanges, and a budding NFT ecosystem.

Polkadot (Parachain) – Polkadot is the central “hub” of a multichain network of heterogeneous blockchains, interconnected via the Polkadot Relay Chain. The key function of Polkadot is to provide interoperability between these blockchains, while ensuring they all benefit from the same security offered by Polkadot’s proof-of-stake consensus mechanism. Polkadot’s Relay Chain also allows transactions on each chain to process in parallel, rather than in sequence, as is the case with typical single-chain smart contract platforms.

Avalanche (Multichain) - Avalanche is a fast and low-fee smart contract platform that combines a rich ecosystem of dapps with the capacity to build and support custom blockchains via subnets. Avalanche employs a validator/delegator proof-of-stake consensus mechanism, which is used to secure and validate all subnets on the network. Avalanche’s Primary Network is a special subnet, which is broken into three separate chains: Exchange (X-Chain), Platform (P-Chain) and Contract (C - Chain).

Disclaimer:

CoinDesk Indices, Inc. (“CDI”) does not sponsor, endorse, sell, promote or manage any investment offered by any third party that seeks to provide an investment return based on the performance of any index.

CDI is neither an investment adviser nor a commodity trading adviser and makes no representation regarding the advisability of making an investment linked to any CDI index. CDI does not act as a fiduciary. A decision to invest in any asset linked to a CDI index should not be made in reliance on any of the statements set forth in this document or elsewhere by CDI.

All content contained or used in any CDI index (the “Content”) is owned by CDI and/or its third-party data providers and licensors, unless stated otherwise by CDI. CDI does not guarantee the accuracy, completeness, timeliness, adequacy, validity or availability of any of the Content. CDI is not responsible for any errors or omissions, regardless of the cause, in the results obtained from the use of any of the Content. CDI does not assume any obligation to update the Content following publication in any form or format.

© 2022 CoinDesk Indices, Inc. All rights reserved.

BlocksInform

BlocksInform