Okx has $7.5 billion in reserves, and those reserves don't contain his indigenous token, according to a proof of reserves released by the stock market on Thursday.

This is the third evidence of reservations that Okx has published.

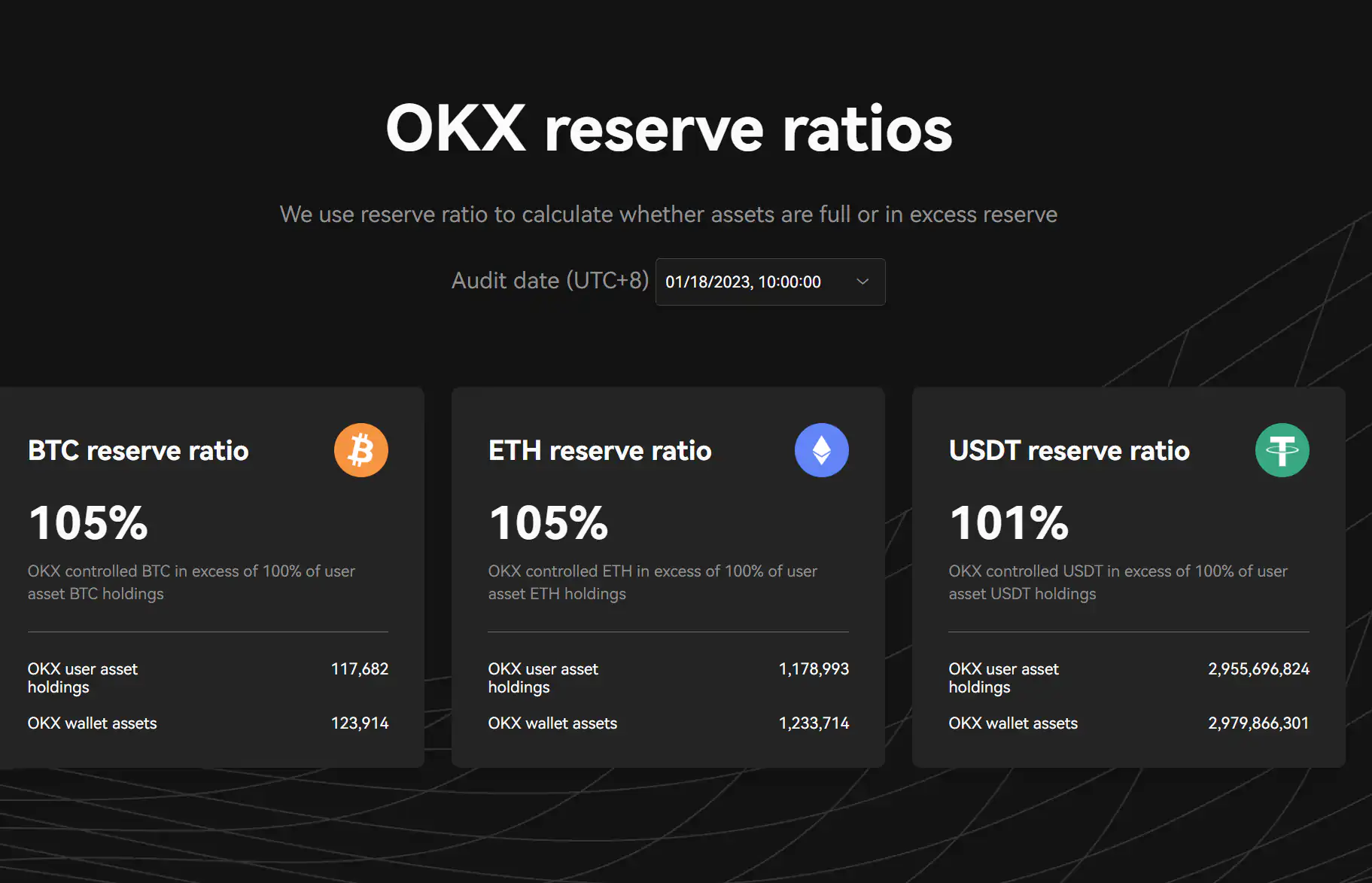

OKX Proof of Reserves for January 2023 (OKX)

The report shows that the exchange is overcollateralized with a reserve ratio of 105% for bitcoin (BTC), 105% for ether (ETH), and 101% for USDT.

OKX publishing the exact asset mix comes as a response to an CryptoQuant developing a metric to measure the CryptoQuant defines it as the dependency of an exchange on its native chip.cleanliness” of reserves. Okx proof of reserves for January 2023 (okx)the report shows that the exchange is overcollaterized with a reserve ratio of 105 per cent for bitcoin (btc), 105 per cent for ether (eth), and 101% for usdt.okx publish the precise composition of the asset comes in response to a cryptoquant developing a metric to measure the "cleanliness" of the reserves. Cryptoquant defines it as an exchange dependent on its native token. Crypto data indicates that okx reserves are 100 percent clean.

Binance, on the other hand, is 87 percent clean, bitfinex is 70 percent clean, and huobi is 60 percent clean. Personally, I believe that everyone will learn tons of things in the next six months or year. Further, towards the end of December, the United States Securities and Exchange Commission stated in a complaint against Alameda's former leader, Caroline Ellison, that FTT, and as a result of other trading chips, are investment agreements and therefore a guarantee.We are all going to learn from each other and ask the hard questions - hopefully most venues have good intentions.”

Personally, I believe that everyone will learn a great deal in the next six months to a year. Our Indigenous token has always been designed to engage our most active clients and give them a way to apply for discounts with the platform activity."we are all going to learn from each other and ask the hard questions - hopefully most venues have good intentions.”rafique says that okx plans to publish its proof-of-reserves report every month.

"We will all learn from each other and ask the difficult questions - with a bit of luck, most places have good intentions."

Rafique says OKX plans to release its Evidence of Concern report on a monthly basis. As CoinDesk reported in November, a material portion of Alameda’s balance sheet was made up of FTT - a synthetic creation of FTX. As indicated in November, an important part of the alameda balance sheet consisted of ftt - a synthetic creation of ftx.

Further, in late December, the U.S. Securities and Exchange Commission said in a complaint against former Alameda executive Caroline Ellison that FTT, and by virtue of the fact other exchange tokens, are investment contracts and thus a security. Further, towards the end of December, the Securities and Exchange Commission of the United States declared in a complaint against Caroline Ellison's former executive that ftt, and as a result of other trading chips, are investment agreements and therefore a guarantee.

Ellison does not challenge the sec's claims in its overall guilty plea and co-operates with prosecutors.

In that lawsuit, the second pointed out that ftx intended to use the ftt sales funds to create, promote, and run the FTX operation, in order to make a "investment" with profit potential. "We never used a native chip to fund the business," Rafique told Coindesk. Our native token was always designed to engage our most active customers and give them a way to seek discounts through activity on the platform.”

We never used an Indigenous chip to fund the business," Rafique told CoinDesk.

While other exchanges have launched their own stablecoins - and with this has come its own set of problems - Rafique says that’s not on the agenda for OKX.

Our native token was always designed to engage our most active customers and give them a way to seek discounts through activity on the platform.”separation between coin and exchange"The Indigenous token has never been an important part of our company or cash flow. "We do not believe that a trading platform, centralised or decentralized, has business, launching their own asset that is traded, even a stable asset that people settle into," said Rafique. "There are a lot of conflicts. That takes us back to our aboriginal chip philosophy.”

Investing with fiat

OKX does operate a venture fund called OKX Ventures, but as Rafique explained, this firm has a separate balance sheet and an executive team that manages it.

'Investment with fiatokx does not operate a venture fund called okx ventures.

We don't build our business around an indigenous chip offer."Investment with fiatOKX operates a venture capital fund called OKX Ventures.

BlocksInform

BlocksInform